Current Market Structure:

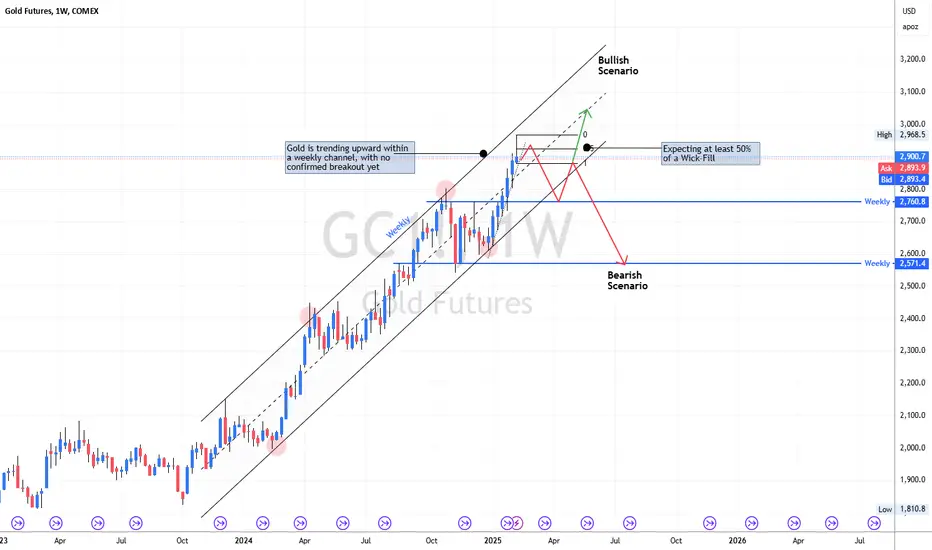

Gold is trending upward within a well-defined weekly ascending channel and has not broken out yet.

The market is currently near the upper boundary of the channel, meaning a breakout or a potential rejection could occur.

Expected Movement This Week:

⚠️ Risk Disclaimer:

Trading involves significant risk and can result in substantial losses. Past performance is not indicative of future results. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making any trading decisions.

Gold is trending upward within a well-defined weekly ascending channel and has not broken out yet.

The market is currently near the upper boundary of the channel, meaning a breakout or a potential rejection could occur.

Expected Movement This Week:

- Bullish Scenario (Higher Probability If Momentum Holds):

- A clean breakout above the channel resistance would signal continued bullish momentum.

- The price could consolidate briefly at the breakout level before pushing higher toward $3,000+.

- If a pullback happens after breaking out, we expect a retest of previous resistance (now support) before continuing upward.

- Confirmation: Strong bullish candles with increasing volume.

- Bearish Scenario (If Gold Fails to Break Above Resistance):

- If gold fails to break out and rejects from the upper boundary, a correction is likely.

- The first key downside target is around $2,760 (weekly level), aligning with previous structure.

- A deeper decline could lead to $2,571, which is another weekly support zone.

- Confirmation: A strong rejection wick, bearish engulfing pattern, or increased selling pressure.

⚠️ Risk Disclaimer:

Trading involves significant risk and can result in substantial losses. Past performance is not indicative of future results. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making any trading decisions.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。