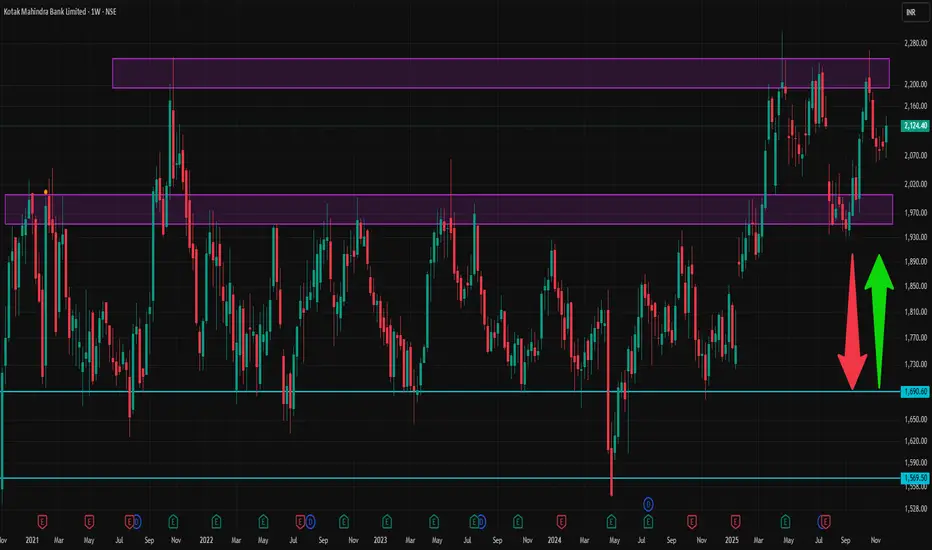

✅ Current snapshot

Latest share price ≈ ₹ 2,124.40 on NSE/BSE

52-week high ~ ₹ 2,301.90, 52-week low ~ ₹ 1,723.75.

Key fundamentals: P/E ~ 22–23, Book Value ~ ₹ 844, PB ~ 2.5–2.7, dividend yield modest.

⚠️ What could upset the short-term view

Broader market weakness (macro-economic, interest-rate moves, global cues) could drag down banking stocks including Kotak.

Negative corporate/asset-quality news or sector-specific headwinds could hamper even good fundamentals.

Volatility: as with any financial-sector stock, sentiment can swing quickly based on news flow (regulatory announcements, RBI policies, etc.).

Latest share price ≈ ₹ 2,124.40 on NSE/BSE

52-week high ~ ₹ 2,301.90, 52-week low ~ ₹ 1,723.75.

Key fundamentals: P/E ~ 22–23, Book Value ~ ₹ 844, PB ~ 2.5–2.7, dividend yield modest.

⚠️ What could upset the short-term view

Broader market weakness (macro-economic, interest-rate moves, global cues) could drag down banking stocks including Kotak.

Negative corporate/asset-quality news or sector-specific headwinds could hamper even good fundamentals.

Volatility: as with any financial-sector stock, sentiment can swing quickly based on news flow (regulatory announcements, RBI policies, etc.).

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。