█ FreedX Grid Backtest is an open-source tool that offers accurate GRID calculations for GRID trading strategies. This advanced tool allows users to backtest GRID trading parameters with precision, accurately reflecting exchange functionalities. We are committed to enhancing trading strategies through precise backtesting solutions and address the issue of...

This indicator is called "Multi Bollinger Bands with Over Zone". The indicator uses linear regression to calculate the regression line and standard deviation to calculate the upper and lower deviation lines. It also plots filled areas between the deviation lines to highlight overbought and oversold zones. The indicator has several customizable inputs, including...

Draws the best support and resistance lines. How it works: 1) Tries every possible line through lows, highs, opens, closes 2) Finds the total hit counts given the confidence interval as input to the candlesticks 3) Calculates the strength of every line according to hit count, total volumes on hits, and timestamps 4) Eliminates similar lines, confidence interval...

best indicator for momentom and movement in btcusdt 15 min just harkat above 1 indicates movment in market in bearish or bullish trend

█ OVERVIEW Double Tap is a pattern recognition script aimed at detecting Double Tops and Double Bottoms. Double Tap can be applied to the broker emulator to observe historical results, run as a trading bot for live trade alerts in real time with entry signals, take profit, and stop orders, or to simply detect patterns. █ CONCEPTS How Is A Pattern...

Library "BjCandlePatterns" Patterns is a Japanese candlestick pattern recognition Library for developers. Functions here within detect viable setups in a variety of popular patterns. Please note some patterns are without filters such as comparisons to average candle sizing, or trend detection to allow the author more freedom. doji(dojiSize, dojiWickSize) ...

Key Levels Aims to capture 3 of the most significant points in price action Breakouts False Breakouts (Traps) Back Checks These 3 points alone, if properly identified, can be some of the most significant points of movement in the price history of an asset and bring significant gains to traders, if capitalized on. Here are a few examples of these...

One Time Trade Risk Management Incorporating the new interactive feature, this script is meant as a one time trailing stop for the active trader to manage positional risk of an ongoing trade. As a crypto trader or Fx trader, many may find themselves in a position late into the evening, or perhaps daily life is calling while a trade progresses in their favor....

Bjorgum 3Commas Bot A strategy in a box to get you started today With 3rd party API providers growing in popularity, many are turning to automating their strategies on their favorite assets. With so many options and layers of customization possible, TradingView offers a place no better for young or even experienced coders to build a platform from to meet...

Scope: Up to 3 MA's can be applied at the users discretion Choose between 10 different average types including favorites from the Bjorgum series from HEMA to Reversal T3's Each MA can be independently set Go Multi-timeframe! Any MA can be set to any timeframe of reference you choose (ex. using 3 different timeframes of...

Bjorgum Reversal Bj Reversal uses Tilson moving averages to identify trend changes Bars change to yellow as bar close crosses the Tilson moving averages. Blue or red is confirmed as the two Tilson averages themselves cross. Reversal is great for pinpointing trend change often giving the absolute best entry or exit Its sensitive nature can mean more false...

This Custom Klinger Oscillator allows you to change the time frames for the Force Volume and Signal calculations to use instead of it's default values. Although the default Fibonacci values ( 34, 55 and 13 ) provide exceptional signals, you can now explore using lower Fibonacci numbers and get faster signals for your own adventures in the market. This indicator...

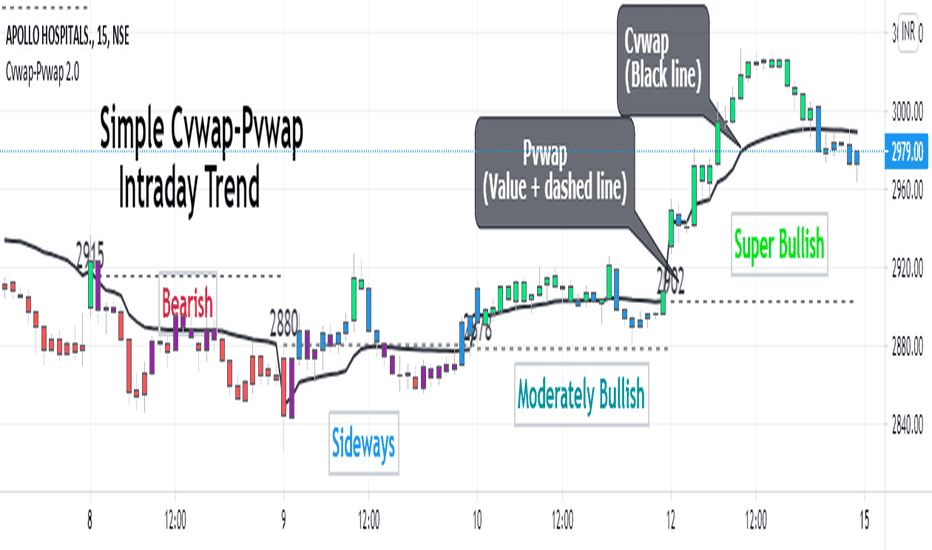

A simple vwap based Intraday trend indicator. Volume-Weighted Average Price (VWAP) - the average price weighted by volume, starts when trading opens and ends when it closes. This can help institutions buy or sell in large orders, without disturbing the market. After buying or selling, institutions compare instrument price to closing VWAP values at end of the...

Hello Traders !! This is a simple super trend based MAST trend. By default the supertrend is 10 period with 3 ATR multiplier. A moving average is used to benefit from the pullback entries. Bullish Pullback : Price above Supertrend & below MA Bullish: Price above Supertrend and above MA Bearish pullback : Price below Supertrend & above MA Bearish :...

RSI output signals are displayed with color change to reflect the plotted value. This makes evaluating RSI conditions require but a glance. RSI momentum buy signals are given on the cross of the 50 level, whereas sell signals are given on a fall below. Default values a 5 period RSI which gives more timely entrances and exits for swing traders. This can be...

-This script utilizes simple color changes of the TSI output signals to aid in interpretation of the classic TSI indicator. -Crosses of the TSI value line and signal line are a bullish or bearish indication. TSI value line is colored green or yellow to help identify that the TSI value line is either dropping or rising, while over or under the signal line. -This...

This my new solid strategy: if you belive that "TREND IS YOUR FRIEND" this is for you! I have tested with many pairs and at many timeframes and have profit with just minor changes in settings. I suggest to use it for intraday trading . VERY IMPORTANT NOTE: this is a trend following strategy, so the target is to stay in the trade as much as possible. If your...

Hello traders This is a Pine adaptation of this FXCM LUA indicator Seems to be made mostly for tick data (< 1 min timeframe) and advanced scalpers Always interesting to see that Pinescript is much easier than most of other trading programming languages out there :) PS You might like checking the data window panel from TradingView and mouseover your cursor...

![[SK] Custom Klinger Oscillator BTCUSD: [SK] Custom Klinger Oscillator](https://s3.tradingview.com/n/Nc6WVqgv_mid.png)