Central Pivot Range is a trend and volatility forecasting tool. It is calculated from previous session's (day, week, or month) high, low, close values. It works on the idea that every trading session must be the result of its previous trading session. Pivot, top pivot and bottom pivot values form the CPR. If the CPR for each trading session is getting higher...

This indicator is designed for scalping purposes. Users have the option to input the desired source and enable or disable the following indicators: Multiple EMA (Exponential moving average) Simultaneously displays multiple moving averages to quickly identify shifts in momentum and obtain confirmation from slower-moving averages. By default, the EMA display...

Waddah Attar Weekly Camarilla Pivots is an indicator built by Ahmad Waddah Attar that draws weekly Camarilla over lower timeframes. What are Camarilla pivots? Camarilla Pivot Points is a math-based price action analysis tool that generates potential intraday support and resistance levels. Similar to classic pivot points, it uses the previous day's high...

A slimmed down/cleaner version of the "Pivot Points Standard" indicator. This is for Camarilla pivots only. The S and R pivots are renamed to L/H and the colors of pivot 1 and 2 are faded out by default since those pivots are less used in the Camarilla trading system. They can also be disabled of course.

This indicator plots 20 Camarilla pivot points above and below the pivot based on the selected time frame. This is useful when price goes between the standard 3 and 4 pivots and above 4. Note that the normal 4 pivot point is labeled as 6 in this indicator. You can change the color of each set of pivots so you can mark the standard Camarilla pivots if you wish. The...

The basic idea of the ‘Dynamic Pivot Box’ is to show only the Pivots that are closer to the Price. This is, the nearest pivots acting as support and resistance; thus hiding all other pivots which are further away from the price and also hiding the pivots from previous periods… Pivots will be hidden until price breaks out from the current box and moves to the...

This multi pivot indicator allows you to plot and overlay different types of pivot points: -Fibonacci -Floor Traders -Camarilla In addition to this, you can plot pivots from two different timeframes of your choice, for example the daily & weekly pivots, monthly & yearly, etc. -You can select the linestyle, width and color of each pivot type for easy...

This indicator is based on the Pivot study. Traders will be able to plot CPR, Standard floor pivots as well as Camarilla Pivots on multiple timeframes. Why pivots from multiple timeframes are relevant and included in this one indicator? We can analyse pivots on multiple timeframes for different trading setups. As in, Daily floor pivots are best suited for...

This script is created primarily for Intraday trading but can also be used for short and long term trading. This is a combination of Central Pivot Range (CPR), Moving Averages and Camarilla Pivot levels (with inner levels). This helps you to combine the strategies of CPR and Moving Averages to identify the best trading opportunities with greater edge. Central...

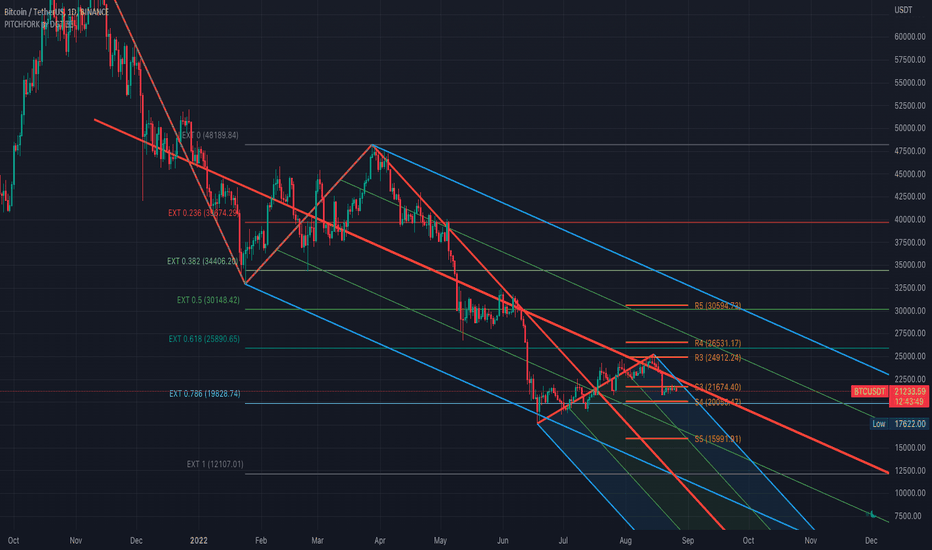

Pitchfork is a technical indicator for a quick and easy way for traders to identify possible levels of support and resistance of an asset's price. It is presents and based on the idea that the market is geometric and cyclical in nature Developed by Alan Andrews, so sometimes called Andrews’ Pitchfork It is created by placing three points at the end of...

Basic script to screen up to 10 tickers with regards to their central pivot range and camarilla pivots. Same color layout as the Danarilla script (). The colors in the screener mean the following: Blue : bar close price is > H4 or < L4 Red : bar close price is < H3 and > CPR top Fuchsia : bar close price is < CPR top and > CPR bottom Green : bar...

Lately, there are a plethora of Pivot scripts on TV, I'll be adding one more :3 This is a combination that I use for my personal use so I've coded accordingly. Its the best combination of the regular pivot, woodie pivot, fib, and cams, in my humble opinion. Also added previous day high and low as those are the key levels for intraday traders. Also, this is a...

All in one pivot points of combined D, W, M CPR, Camarilla & Value area. Inspired by Pivotboss book.

Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using the previous...

Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using the previous...

Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using the previous...

Pivot point studies highlight prices considered to be a likely turning point when looking at values from a previous period, whether it be daily, weekly, quarterly or annual. Each pivot point study has its own characteristics on how these points are calculated. Red color = Sell Green color = Buy WARNING: - For purpose educate only - This script to...

Pivot point studies highlight prices considered to be a likely turning point when looking at values from a previous period, whether it be daily, weekly, quarterly or annual. Each pivot point study has its own characteristics on how these points are calculated. Red color = Sell Green color = Buy WARNING: - For purpose educate only - This script to...

![Waddah Attar Weekly Camarilla Pivots [Loxx] EURUSD: Waddah Attar Weekly Camarilla Pivots [Loxx]](https://s3.tradingview.com/r/rZs49rdi_mid.png)