Hola Divinis En una villa nació, fue deseo de Dios Crecer y sobrevivir a la humilde expresión Enfrentar la adversidad Con afán de ganarse a cada paso la vida En un potrero forjó una zurda inmortal Con experiencia, sedienta ambición de llegar De cebollita, soñaba jugar un Mundial Y consagrarse en Primera Tal vez jugando pudiera a su familia ayudar En una villa...

The most common way to use the RSI to spot a good buy opportunity is to check for values lower than 30. Unfortunately, the RSI can remain in oversold territory for long periods, and that could leave you trapped in a trade in loss. It would be appropriate to wait for a confirmation of the trend reversal. In the example above I use a short-term Moving Average (in...

This script help traders to catch bullish and bearish momentum. It creates an alert for 40 altcoins based on the MACD cross over and cross under. The MACD input are adjustable in the settings and you can choose your favorite assets. Simply add this indicator to the chart wait that if finish to load and then create an alert on the time frame of your...

KRAKEN:LINKUSD This is one of the best strategies that can be used to get familiar with technical indicators and start to include them in your rules on Coinrule . ENTRY 1. This trading system uses the RSI (Relative Strength Index) to anticipate good points to enter positions. RSI is a technical indicator frequently used in trading. It works by measuring...

This is inspired by some online free webinars. Didn't pay for the strategy/ course. I just figured it out myself. So there might be problem with this strategy. Theory: It is based on something called cointegrated. Cointegration means the difference between 2 securities are stable in long term. When the difference is bigger / smaller than normal, then there is...

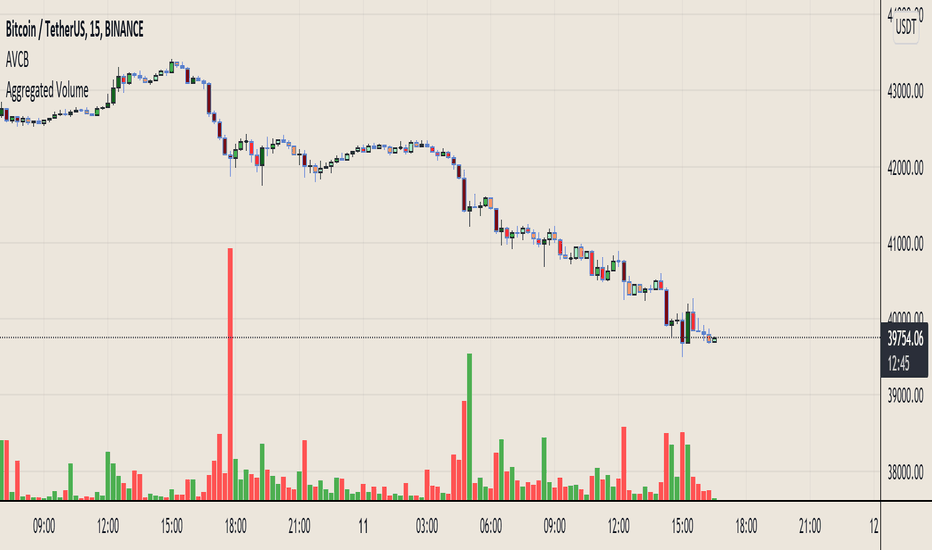

Modified & Updated script from MARKET VOLUME by Ricardo M Arjona @XeL_Arjona that Includes Aggregated Volume Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the aggregation option, which...

Modified & Updated script from MARKET VOLUME by Ricardo M Arjona @XeL_Arjona that Includes Aggregated Volume , Delta Buy/Sell Pressure Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the...

Modified version of Kivanc's Volume Based Colored Bars that colors the bars with Aggregated Volume Data. Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the aggregation option, which...

This study is a functional enhancement to conventionally used Ichimoku Clouds . It uses particular effective adaptive parameters (Relative Volume Strength Index (MZ RVSI ), Volatility and Chikou Backward Trend Filter) to adapt dynamic lengths for Kijun-sen, Tenkan-sen, Senkou-span and Chikou . This study uses complete available Ichimoku...

I just test&learn pine script... Damn, what should I write here? So... Its just a differense between the logarithms of two prices of different periods (You can set the period you want)... And it looks really nice... Ahem... I hope, you enjoy this piece of... Have a nice day, my dear.

Modified Version of In-Built Money Flow Index Indicator. Aggregated Volume is used for it's calculation + a couple of other features. Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the...

Modified Version of In-Built Chaikin Money Flow Indicator. Aggregated Volume is used for it's calculation + a couple of other features. Aggregation code originally from Crypt0rus ***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually*** ***The indicator can be used with specific symbol data only by disabling the...

On Balance Volume calculated with aggregated and normalized volume data and a few other features: Aggregation code originally from Crypt0rus Candle Plotting code from LonesomeTheBlue ***The indicator can be used for any coin/symbol to aggregate volume, but it has to be set up manually*** As normal OBV, this indicator can be used to find divergences and to have...

This indicator shows market structure. The standard method of using Williams Highs and Lows as pivots, is something of an approximation. What's original here is that we follow rules to confirm Local Highs and Local Lows, and strictly enforce that a Low can only follow a confirmed High and vice-versa. -- Highs and Lows To confirm a candle as a Local High, you need...

Hello World It’s no secret that trading sessions play a massive role in market movement and liquidity. We can clearly see in the image about how important identifying international trading hours are for a trader. The Asian session starts around 1am GMT and often has a bearish bias through this session lasting for a few hours, after which Frankfurt and London...

This Indicator enhances functionality of Chikou-Span from Ichimoku Cloud using a simple trend filter. Methodology Chikou is basically close value of ticker offset to close and it is a good for indicating if close value has crossed potential Support/Resistance zone from past. Chikou is usually used with 26 period. Chikou filter uses a lookback length...

An alternative way to look at the Ichimoku Cloud with various modes: Distance to Center: the various lines of the Ichimoku system are displayed as the distance to the center of the cloud in percentage terms. 0 is the center of the cloud. Distance to Edge: lines are displayed as the distance to the closest edge of the cloud in percentage terms. values inside...

HISTORY AND CREDITS Used by John Carter in his indicator’s toolbox. The ATR channels or the Keltner Channels represent the railroads or the natural movement of stocks. WHAT IT DOES Movements between the the The first multiplier lines (white) represent standard movement for the timeframe you are trading. Movements between the second multiplier (green/red...

![[TTI] ATR channels GOOGL: [TTI] ATR channels](https://s3.tradingview.com/k/kUiAg989_mid.png)