OPEN-SOURCE SCRIPT

已更新 FACTOR MONITOR

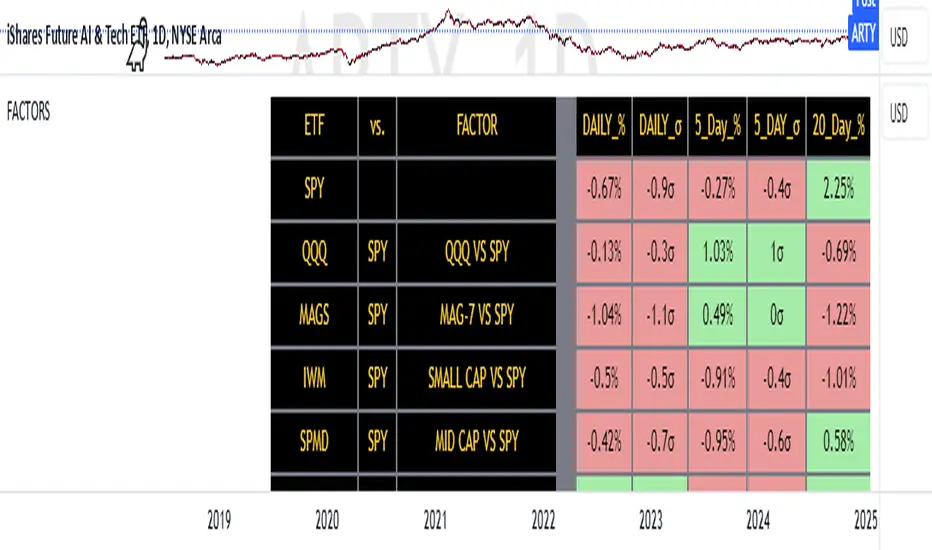

The Factor Monitor is a comprehensive designed to track relative strength and standard deviation movements across multiple market segments and investment factors. The indicator calculates and displays normalized percentage moves and their statistical significance (measured in standard deviations) across daily, 5-day, and 20-day periods, providing a multi-timeframe view of market dynamics.

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

版本注释

Just changed colors around to make more readable版本注释

Updated MAGS exchange开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。