OPEN-SOURCE SCRIPT

BETA (against any benchmark index - defaulted to NSE:NIFTY)

Beta value of a stock relative to benchmark index. Thanks to Ricardo Santos for the original script. This script is adapted from it.

To understand beta, refer Investopedia link: investopedia.com/terms/b/beta.asp

A beta value of 1 means the stock is directly correlated to benchmark index - volatility would be same as overall market.

Beta value less than 1 and greater than 0 means the stock is less volatile than the market.

Beta value more than 1 would mean the stock is more volatile than the market.

A beta value of 1.2 would roughly translate to the stock being 20% more volatile than the overall market.

A negative beta value indicates the stock is inversely correlated to market.

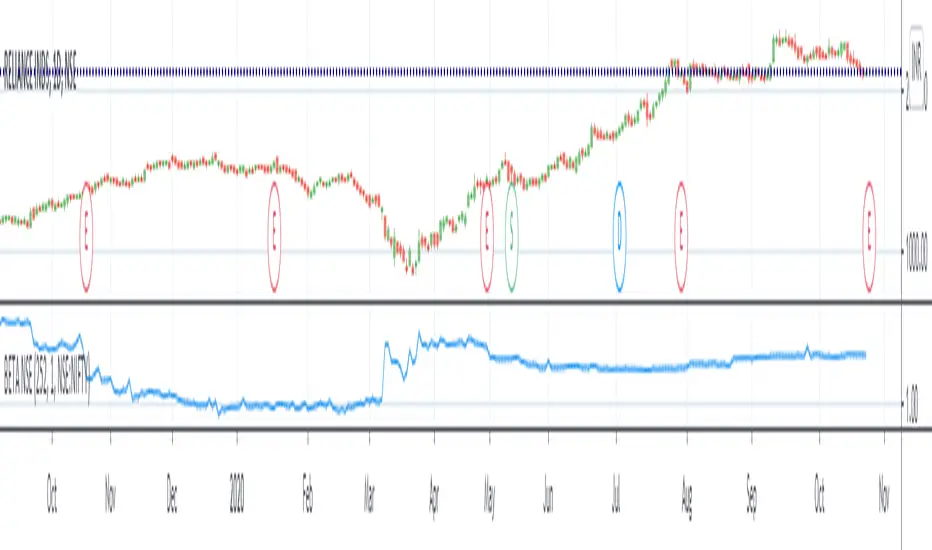

In the example chart, you can see the Beta value change in NSE:RELIANCE with respect to NSE:NIFTY.

To understand beta, refer Investopedia link: investopedia.com/terms/b/beta.asp

A beta value of 1 means the stock is directly correlated to benchmark index - volatility would be same as overall market.

Beta value less than 1 and greater than 0 means the stock is less volatile than the market.

Beta value more than 1 would mean the stock is more volatile than the market.

A beta value of 1.2 would roughly translate to the stock being 20% more volatile than the overall market.

A negative beta value indicates the stock is inversely correlated to market.

In the example chart, you can see the Beta value change in NSE:RELIANCE with respect to NSE:NIFTY.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。