OPEN-SOURCE SCRIPT

已更新 Volume Zone Oscillator by [VanHelsig]

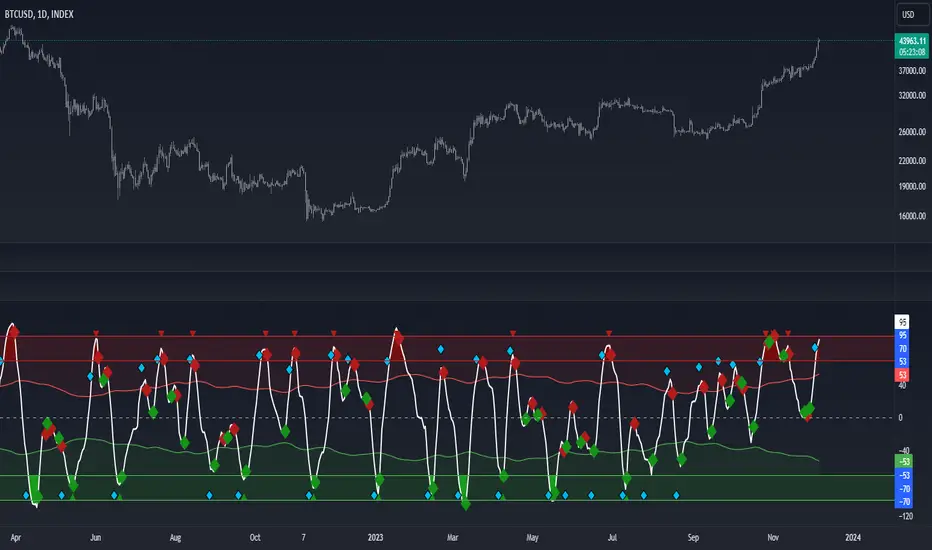

Volume Zone Oscillator

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

版本注释

Updated calculations and backtested. 版本注释

-版本注释

BackTest BTC Index (BackTest of local buys and local sells) BackTest ETH Index

https://www.tradingview.com/x/Dxb8cWuv/

版本注释

Organazide code, changed default inputs开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。