OPEN-SOURCE SCRIPT

Proxy Financial Stress Index Strategy

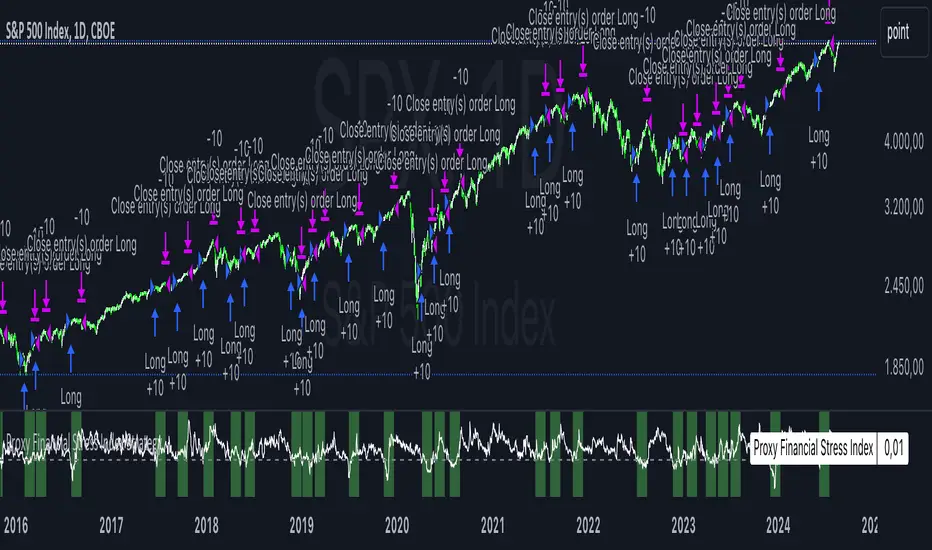

This strategy is based on a Proxy Financial Stress Index constructed using several key financial indicators. The strategy goes long when the financial stress index crosses below a user-defined threshold, signaling a potential reduction in market stress. Once a position is opened, it is held for a predetermined number of bars (periods), after which it is automatically closed.

The financial stress index is composed of several normalized indicators, each representing different market aspects:

VIX - Market volatility.

US 10-Year Treasury Yield - Bond market.

Dollar Index (DXY) - Currency market.

S&P 500 Index - Stock market.

EUR/USD - Currency exchange rate.

High-Yield Corporate Bond ETF (HYG) - Corporate bond market.

Each component is normalized using a Z-score (based on the user-defined moving average and standard deviation lengths) and weighted according to user inputs. The aggregated index reflects overall market stress.

The strategy enters a long position when the stress index crosses below a specified threshold from above, indicating reduced financial stress. The position is held for a defined holding period before being closed automatically.

Scientific References:

The concept of a financial stress index is derived from research that combines multiple financial variables to measure systemic risks in the financial markets. Key research includes:

The Financial Stress Index developed by various Federal Reserve banks, including the Cleveland Financial Stress Index (CFSI)

Bank of America Merrill Lynch Option Volatility Estimate (MOVE) Index as a measure of interest rate volatility, which correlates with financial stress

These indices are widely used in economic research to gauge financial instability and help in policy decisions. They track real-time fluctuations in various markets and are often used to anticipate economic downturns or periods of high financial risk.

The financial stress index is composed of several normalized indicators, each representing different market aspects:

VIX - Market volatility.

US 10-Year Treasury Yield - Bond market.

Dollar Index (DXY) - Currency market.

S&P 500 Index - Stock market.

EUR/USD - Currency exchange rate.

High-Yield Corporate Bond ETF (HYG) - Corporate bond market.

Each component is normalized using a Z-score (based on the user-defined moving average and standard deviation lengths) and weighted according to user inputs. The aggregated index reflects overall market stress.

The strategy enters a long position when the stress index crosses below a specified threshold from above, indicating reduced financial stress. The position is held for a defined holding period before being closed automatically.

Scientific References:

The concept of a financial stress index is derived from research that combines multiple financial variables to measure systemic risks in the financial markets. Key research includes:

The Financial Stress Index developed by various Federal Reserve banks, including the Cleveland Financial Stress Index (CFSI)

Bank of America Merrill Lynch Option Volatility Estimate (MOVE) Index as a measure of interest rate volatility, which correlates with financial stress

These indices are widely used in economic research to gauge financial instability and help in policy decisions. They track real-time fluctuations in various markets and are often used to anticipate economic downturns or periods of high financial risk.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Where others speculate, we systematize.

edgetools.org

edgetools.org

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Where others speculate, we systematize.

edgetools.org

edgetools.org

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。