INVITE-ONLY SCRIPT

Power Law Volatility by G. Santostasi

Introduction

This TradingView indicator is designed to provide a comprehensive analysis of Bitcoin's price movements using the concept of power laws. The indicator leverages the mathematical properties of power laws to predict returns and highlight significant deviations from expected trends. By applying the power law model to Bitcoin's price data, we aim to capture the diminishing returns over time and provide valuable insights to traders and analysts.

Theoretical Foundation

The foundation of this indicator is based on the power law, which describes a relationship between two quantities where one quantity varies as a power of another. Specifically, in the context of Bitcoin prices, we observe that returns follow a power law relationship with time.

Mathematically, if the power law holds true, the price P at time 𝑡 can be expressed as:

log(𝑃)=𝑚log(𝑡)+c where m is the slope of the power law and c is the y-intercept.

To understand the returns, we consider two points in time,

𝑡1and 𝑡2, with corresponding prices 𝑃 and 𝑃2. The returns can be derived as follows:

log(𝑃2)−log(𝑃1)=𝑚(log(𝑡2)−log(𝑡1))

This simplifies to:

log(𝑃2/𝑃1)=𝑚log(𝑡2/𝑡1)

For daily data, we let 𝑡2=𝑡1+1resulting in:

log(𝑅)=𝑚log(𝑡+1/𝑡)

where 𝑅 represents the returns, 𝑡 is the number of days from the Genesis Block, and

𝑚 is the slope of the power law.

Observations and Data Analysis

Using historical Bitcoin price data, we observe that returns decrease over time, which is indicative of diminishing returns. To validate this observation, we averaged real returns over a two-month period and compared them with the theoretical results derived from the power law:

𝑚log(𝑡2/𝑡1)

The comparison shows that the averaged real returns align closely with the theoretical predictions, reinforcing the validity of the power law model.

This alignment indicates that the power law is not merely an arbitrary straight line but a model that accurately captures the decay of returns over time. The scaling property of the power law holds at all scales, providing a robust framework for analyzing Bitcoin's price dynamics.

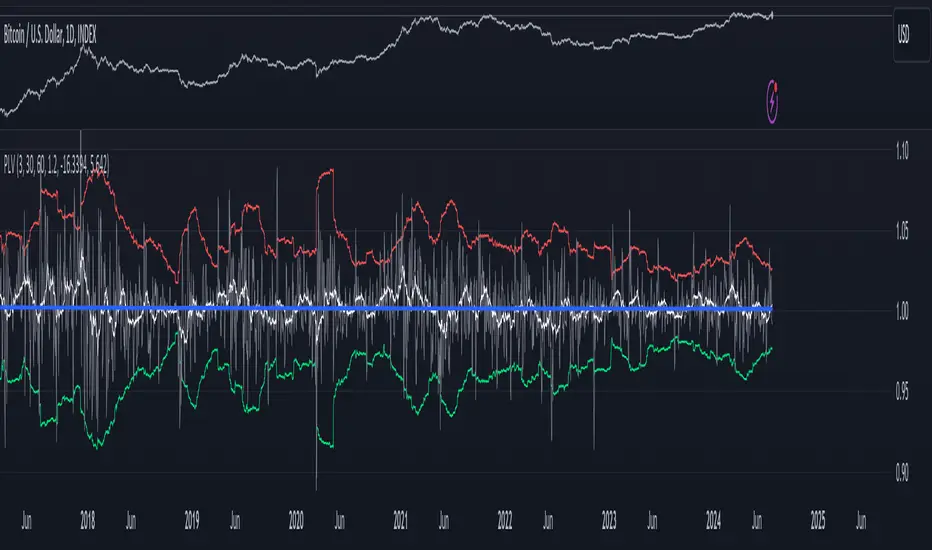

Indicator Components

The indicator comprises several components to visualize the power law's implications and provide actionable insights:

Theoretical Power Law Trend:

Plots the theoretical result from the power law model.

Shows the expected returns based on the power law relationship.

Real Returns:

Plots the real returns averaged over a user-defined Simple Moving Average (SMA) or Exponential Moving Average (EMA).

Provides a comparison between actual market performance and theoretical predictions.

When the real volatility is above the theoretical one derived from the power law the indicator identifies times when the price is overvalued.

Standard Deviations:

Calculates standard deviations on a moving window basis.

Plots deviations from the theoretical power law trend, highlighting significant discrepancies.

Color-Coded Thresholds:

Highlights points that deviate significantly from the expected trend.

Red indicates returns above the upper threshold (indicating potential overperformance or overvaluation).

Green indicates returns below the lower threshold (indicating potential underperformance or undervaluation).

Practical Usage

Traders and analysts can use this indicator to:

Identify periods where Bitcoin's returns deviate significantly from the expected power law trend.

Make informed trading decisions based on the likelihood of mean reversion to the theoretical trend.

Understand the long-term diminishing returns trend and adjust investment strategies accordingly.

Conclusion

This TradingView indicator leverages the power law to provide a detailed and theoretically grounded analysis of Bitcoin's price movements. By comparing real returns with theoretical predictions, the indicator offers valuable insights into market behavior and highlights significant deviations. The use of color-coded thresholds further enhances the utility of the indicator, making it an essential tool for traders and analysts seeking to understand and capitalize on Bitcoin's price dynamics

This TradingView indicator is designed to provide a comprehensive analysis of Bitcoin's price movements using the concept of power laws. The indicator leverages the mathematical properties of power laws to predict returns and highlight significant deviations from expected trends. By applying the power law model to Bitcoin's price data, we aim to capture the diminishing returns over time and provide valuable insights to traders and analysts.

Theoretical Foundation

The foundation of this indicator is based on the power law, which describes a relationship between two quantities where one quantity varies as a power of another. Specifically, in the context of Bitcoin prices, we observe that returns follow a power law relationship with time.

Mathematically, if the power law holds true, the price P at time 𝑡 can be expressed as:

log(𝑃)=𝑚log(𝑡)+c where m is the slope of the power law and c is the y-intercept.

To understand the returns, we consider two points in time,

𝑡1and 𝑡2, with corresponding prices 𝑃 and 𝑃2. The returns can be derived as follows:

log(𝑃2)−log(𝑃1)=𝑚(log(𝑡2)−log(𝑡1))

This simplifies to:

log(𝑃2/𝑃1)=𝑚log(𝑡2/𝑡1)

For daily data, we let 𝑡2=𝑡1+1resulting in:

log(𝑅)=𝑚log(𝑡+1/𝑡)

where 𝑅 represents the returns, 𝑡 is the number of days from the Genesis Block, and

𝑚 is the slope of the power law.

Observations and Data Analysis

Using historical Bitcoin price data, we observe that returns decrease over time, which is indicative of diminishing returns. To validate this observation, we averaged real returns over a two-month period and compared them with the theoretical results derived from the power law:

𝑚log(𝑡2/𝑡1)

The comparison shows that the averaged real returns align closely with the theoretical predictions, reinforcing the validity of the power law model.

This alignment indicates that the power law is not merely an arbitrary straight line but a model that accurately captures the decay of returns over time. The scaling property of the power law holds at all scales, providing a robust framework for analyzing Bitcoin's price dynamics.

Indicator Components

The indicator comprises several components to visualize the power law's implications and provide actionable insights:

Theoretical Power Law Trend:

Plots the theoretical result from the power law model.

Shows the expected returns based on the power law relationship.

Real Returns:

Plots the real returns averaged over a user-defined Simple Moving Average (SMA) or Exponential Moving Average (EMA).

Provides a comparison between actual market performance and theoretical predictions.

When the real volatility is above the theoretical one derived from the power law the indicator identifies times when the price is overvalued.

Standard Deviations:

Calculates standard deviations on a moving window basis.

Plots deviations from the theoretical power law trend, highlighting significant discrepancies.

Color-Coded Thresholds:

Highlights points that deviate significantly from the expected trend.

Red indicates returns above the upper threshold (indicating potential overperformance or overvaluation).

Green indicates returns below the lower threshold (indicating potential underperformance or undervaluation).

Practical Usage

Traders and analysts can use this indicator to:

Identify periods where Bitcoin's returns deviate significantly from the expected power law trend.

Make informed trading decisions based on the likelihood of mean reversion to the theoretical trend.

Understand the long-term diminishing returns trend and adjust investment strategies accordingly.

Conclusion

This TradingView indicator leverages the power law to provide a detailed and theoretically grounded analysis of Bitcoin's price movements. By comparing real returns with theoretical predictions, the indicator offers valuable insights into market behavior and highlights significant deviations. The use of color-coded thresholds further enhances the utility of the indicator, making it an essential tool for traders and analysts seeking to understand and capitalize on Bitcoin's price dynamics

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系Quantonomyfund。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To access the indicator please read instructions here:

https://bitposeidon.com/power-law-indicators

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系Quantonomyfund。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To access the indicator please read instructions here:

https://bitposeidon.com/power-law-indicators

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。