INVITE-ONLY SCRIPT

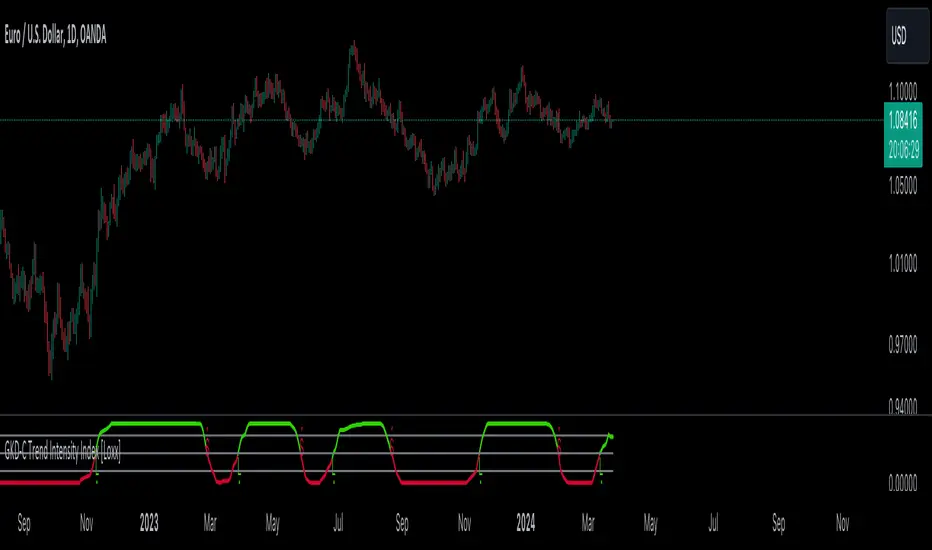

已更新 GKD-C Trend Intensity Index [Loxx]

Giga Kaleidoscope Trend Intensity Index is a Confirmation module included in Loxx's "Giga Kaleidoscope Modularized Trading System".

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is an NNFX algorithmic trading strategy?

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ Trend Intensity Index

What is Trend Intensity Index?

The Trend Intensity Index (TTI) indicator can help determine the strength of the current market trend. The TII range is between 0 and 100, where typically a value above 50 is a bullish trend, and a value below 50 is a bearish trend.

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Additional features will be added in future releases.

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is an NNFX algorithmic trading strategy?

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

- Backtest: Strategy with 1-3 take profits, trailing stop loss, multiple types of PnL volatility, and 2 backtesting styles

- Baseline: Hull Moving Average as shown on the chart above

- Volatility/Volume: Volatility Ratio as shown on the chart above

- Confirmation 1: Trend Intensity Index as shown on the chart above

- Confirmation 2: Williams Percent Range

- Continuation: Fisher Transform

- Exit: Rex Oscillator

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ Trend Intensity Index

What is Trend Intensity Index?

The Trend Intensity Index (TTI) indicator can help determine the strength of the current market trend. The TII range is between 0 and 100, where typically a value above 50 is a bullish trend, and a value below 50 is a bearish trend.

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Additional features will be added in future releases.

版本注释

Updated plot labels. 版本注释

Added the ability to run a backtest on this indicator without adding the other components of the GKD system. This adds a setting "Solo Confirmation Simple" which is now separate from "Simple Confirmation Complex". 版本注释

Upgraded to relax signal rules. This only applies to the Full GKD systems. All settings for signals are controlled by the Confirmation 2 indicator. So this means when you build a Full GKD system, the C2 indicator controls the relaxation of all signals including the Continuation indicator that you are required to add on top of the C2 indicator the full GKD system.Added the following signal types:

Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

1-Candle Rule Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close or Short: close > close)

2. GKD-B Volatility/Volume agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

Added the following backtest options

-Super Complex allows for the creation of a GKD system without Confirmation 2 indicator. This backtest type requires the addition of a GKD-C Confirmation indicator

-Stacked allows for the creation of infinitely stackable GKD-C indicators. This is useful for combining two GKD-C indicators to test their synergy together before using these indicators in a full GKD system.

Updated Requirements

Inputs

Confirmation 1: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Continuation: GKD-C Confirmation indicator

Solo Confirmation Simple: GKD-B Baseline

Solo Confirmation Complex: GKD-V Volatility / Volume indicator

Solo Confirmation Super Complex: GKD-V Volatility / Volume indicator

Stacked 1: None

Stacked 2+: GKD-C Stacked 1

Outputs

Confirmation 1: GKD-C Confirmation 2 indicator

Confirmation 2: GKD-C Continuation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest

Solo Confirmation Complex: GKD-BT Backtest or GKD-E Exit indicator

Solo Confirmation Super Complex: GKD-C Continuation indicator

Stacked 1: GKD-C Stacked 2+

Stacked 2+: GKD-C Stacked 2+ or GKD-BT Backtest

Additional features will be added in future releases.

版本注释

Added volatility signals to continuation signal qualifiers. Added Confirmation 1 + Confirmation 2 backtesting. This allows you to backtest C1 with C2 indicators together without setting up the full GKD system. In the GKD system, the C2 indicator acts as a minor trend filter while the C1 indicator delivers the actual signals and entries. This new backtest allows you to test the entries and signals from the C1 indicator while using the C2 indicator as the macrotrend filter.

版本注释

Updated for new GKD backtests.版本注释

Additions and Subtractions:-All signal logic has been transferred to the new GKD-BT Backtests. You can access these backtests using the links provided below:

GKD-BT Giga Confirmation Stack Backtest:

![GKD-BT Giga Confirmation Stack Backtest [Loxx]](https://s3.tradingview.com/u/UkVUjO7c_mid.png)

GKD-BT Giga Stacks Backtest:

![GKD-BT Giga Stacks Backtest [Loxx]](https://s3.tradingview.com/0/0L1bTVBC_mid.png)

GKD-BT Full Giga Kaleidoscope Backtest:

![GKD-BT Full Giga Kaleidoscope Backtest [Loxx]](https://s3.tradingview.com/n/NP3VQKIX_mid.png)

GKD-BT Solo Confirmation Super Complex Backtest:

![GKD-BT Solo Confirmation Super Complex Backtest [Loxx]](https://s3.tradingview.com/o/o3a9L51S_mid.png)

GKD-BT Solo Confirmation Complex Backtest:

![GKD-BT Solo Confirmation Complex Backtest [Loxx]](https://s3.tradingview.com/n/NUnXZDbn_mid.png)

GKD-BT Solo Confirmation Simple Backtest:

![GKD-BT Solo Confirmation Simple Backtest [Loxx]](https://s3.tradingview.com/p/piMjJcbx_mid.png)

-Removed all Confirmation Type options except for "Confirmation" and "Continuation." The "Continuation" type is only used in GKD-BT Solo Confirmation Super Complex Backtest and GKD-BT Full Giga Kaleidoscope Backtest when selecting a Confirmation indicator.

-Added new signal plots based on the selected Confirmation Type. For the "Confirmation" type, only initial Longs and Shorts will be displayed on the indicator. For the "Continuation" type, both initial and continuation signals will be displayed. In both cases, if multiple signal types are present (e.g., middle cross, signal cross), these signals can be controlled using the "Signal Type" option.

-Implemented code optimizations to enhance the rendering speed of signals.

-Streamlined the export process by generating only a single value for export to other indicators or backtests. This exported value is named "Input into NEW GKD-BT Backtest."

版本注释

Updated for multi-ticker GKD. 版本注释

Updated for GKD optimizer. 版本注释

Updated to add zero-line crosses and added MA Period. 仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系loxx。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator is only available to ALGX Trading VIP group members. For instructions on how to access, send me a private message here on TradingView or message me using the contact information listed in my TradingView profile.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系loxx。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator is only available to ALGX Trading VIP group members. For instructions on how to access, send me a private message here on TradingView or message me using the contact information listed in my TradingView profile.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。