OPEN-SOURCE SCRIPT

已更新 momentum indicator

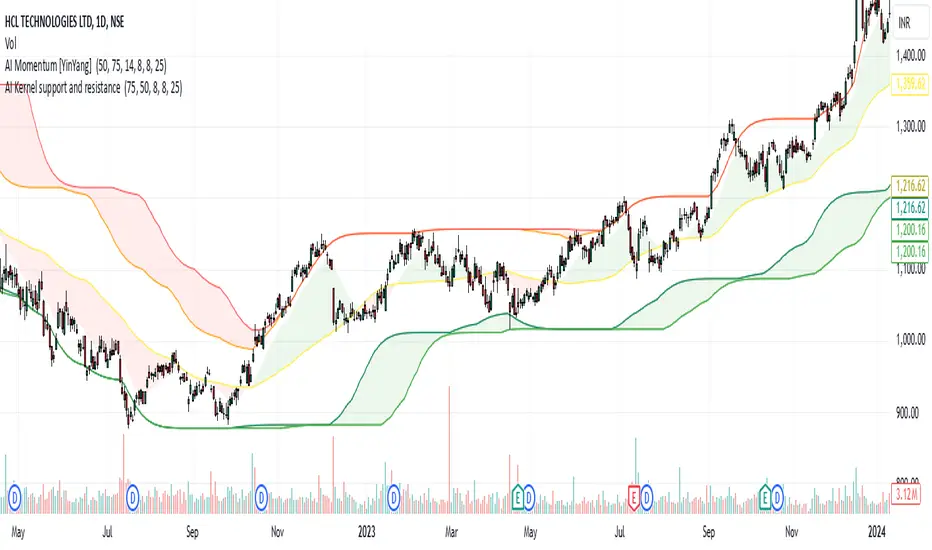

The Rational Quadratic Smoother uses the Rational Quadratic Kernel to create a non-repainting, adaptive smoothing of price data. This method provides a balance between long-term trends and short-term movements by adjusting the weight of distant data points using a kernel function. Traders can use this indicator to:

Smooth price data for better trend identification.

Filter out noise without introducing lag.

Combine it with other indicators for advanced strategies.

Key Features:

Adjustable Lookback Period: Controls the range of data points considered.

Relative Weighting: Fine-tunes the influence of long-term vs. short-term data.

Customizable smoothing to fit different trading styles (scalping, swing trading, etc.).

Smooth price data for better trend identification.

Filter out noise without introducing lag.

Combine it with other indicators for advanced strategies.

Key Features:

Adjustable Lookback Period: Controls the range of data points considered.

Relative Weighting: Fine-tunes the influence of long-term vs. short-term data.

Customizable smoothing to fit different trading styles (scalping, swing trading, etc.).

版本注释

Rational Quadratic-based AI IndicatorThe Rational Quadratic-based AI Indicator is a sophisticated tool designed to assess market trends and signals by leveraging the Rational Quadratic Kernel. This indicator integrates the principles of machine learning and kernel methods, utilizing a non-linear approach to model complex data relationships in financial markets. By applying the Rational Quadratic kernel function, the indicator can effectively capture long-range dependencies and non-stationary data patterns that simpler models might miss.

Key Features:

Rational Quadratic Kernel: The indicator uses the Rational Quadratic Kernel, known for its flexibility in fitting a variety of data types. It excels in situations where data relationships are not easily captured by traditional linear models.

Market Signal Generation: By analyzing market data with kernel-induced feature spaces, the indicator can generate powerful buy or sell signals based on its ability to model complex relationships.

Robustness: It offers high adaptability to different market conditions, as the Rational Quadratic Kernel can handle data with varying degrees of smoothness and noise.

AI-Powered Learning: The indicator incorporates AI principles for predictive learning, enabling it to adjust and refine its predictions based on incoming market data.

Credit:

This indicator was developed with the usage of the KernelFunctions library by JDehorty, which provides a robust set of tools for applying kernel methods in machine learning and statistical analysis. The Rational Quadratic Kernel implementation within KernelFunctions plays a critical role in enhancing the indicator’s ability to capture the intricacies of market dynamics.

For more details on KernelFunctions by JDehorty, please visit the official repository or documentation.

版本注释

Rational Quadratic-based AI IndicatorThe Rational Quadratic-based AI Indicator is a sophisticated tool designed to assess market trends and signals by leveraging the Rational Quadratic Kernel. This indicator integrates the principles of machine learning and kernel methods, utilizing a non-linear approach to model complex data relationships in financial markets. By applying the Rational Quadratic kernel function, the indicator can effectively capture long-range dependencies and non-stationary data patterns that simpler models might miss.

Key Features:

Rational Quadratic Kernel: The indicator uses the Rational Quadratic Kernel, known for its flexibility in fitting a variety of data types. It excels in situations where data relationships are not easily captured by traditional linear models.

Market Signal Generation: By analyzing market data with kernel-induced feature spaces, the indicator can generate powerful buy or sell signals based on its ability to model complex relationships.

Robustness: It offers high adaptability to different market conditions, as the Rational Quadratic Kernel can handle data with varying degrees of smoothness and noise.

Ith elps identify dynamic support and resistance

AI-Powered Learning: The indicator incorporates AI principles for predictive learning, enabling it to adjust and refine its predictions based on incoming market data.

Credit:

This indicator was developed with the usage of the KernelFunctions library by JDehorty, which provides a robust set of tools for applying kernel methods in machine learning and statistical analysis. The Rational Quadratic Kernel implementation within KernelFunctions plays a critical role in enhancing the indicator’s ability to capture the intricacies of market dynamics.

For more details on KernelFunctions by JDehorty, please visit the official repository or documentation.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。