OPEN-SOURCE SCRIPT

已更新 Liquidity Indicator

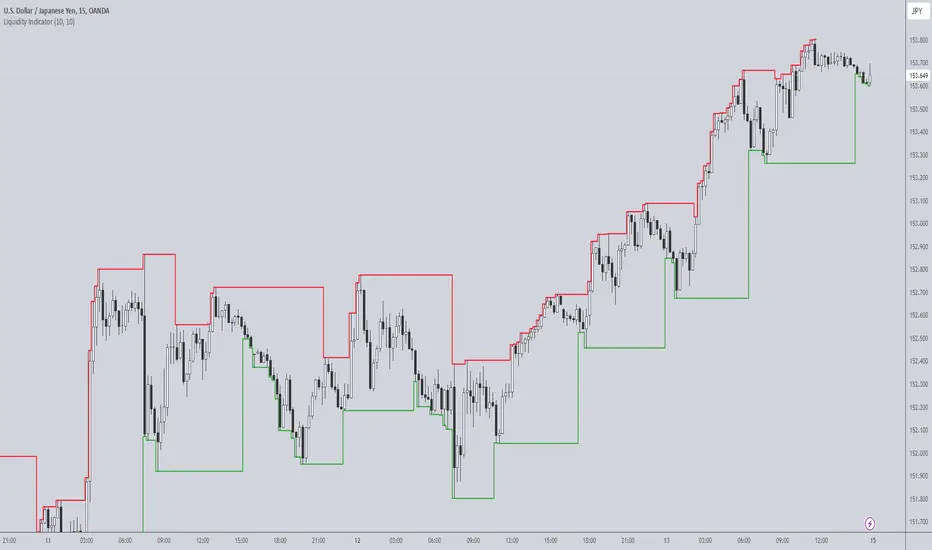

The Liquidity Indicator helps identify key price levels where liquidity may be concentrated by highlighting local highs and local lows on the chart. These levels are calculated using a lookback period to determine the highest and lowest points in the recent price action.

Local Highs: Displayed as red lines, these indicate recent peaks where price has experienced rejection or a possible reversal point.

Local Lows: Displayed as green lines, these represent recent troughs where price may find support or experience a bounce.

This indicator is useful for spotting potential areas of interest for price reversal or continuation, as high liquidity zones may lead to more significant price movements.

Key Features:

Adjustable lookback period to define the scope for identifying local highs and lows.

Continuous plotting without any time restrictions, providing real-time insights into liquidity conditions.

Alerts available for when a local high or local low is detected, enabling timely market analysis.

Use Case:

This indicator can be used in conjunction with other technical analysis tools or strategies to help identify significant price levels where liquidity could impact price action. It is suitable for both intraday and swing traders looking for key price zones where potential reversals or continuations might occur.

Local Highs: Displayed as red lines, these indicate recent peaks where price has experienced rejection or a possible reversal point.

Local Lows: Displayed as green lines, these represent recent troughs where price may find support or experience a bounce.

This indicator is useful for spotting potential areas of interest for price reversal or continuation, as high liquidity zones may lead to more significant price movements.

Key Features:

Adjustable lookback period to define the scope for identifying local highs and lows.

Continuous plotting without any time restrictions, providing real-time insights into liquidity conditions.

Alerts available for when a local high or local low is detected, enabling timely market analysis.

Use Case:

This indicator can be used in conjunction with other technical analysis tools or strategies to help identify significant price levels where liquidity could impact price action. It is suitable for both intraday and swing traders looking for key price zones where potential reversals or continuations might occur.

版本注释

The ability to create separate lookback periods for the upper and lower liquidity lines has been added.版本注释

The ability to create separate lookback periods for the upper and lower liquidity lines has been added.开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。