OPEN-SOURCE SCRIPT

Symbols Correlation, built for pair trading

Overview:

This script is designed for pairs trading. If you are not familiar with pairs trading, I suggest learning about it, as it can be a profitable strategy in neutral markets (or neutral trends between two assets). The correlation between two assets is the foundation of pairs trading, and without it, the chances of making a profit are low.

Correlation can be described in two opposite ways:

Any value between 1 and -1 indicates some degree of correlation, but generally, values higher than 0.7 or lower than -0.7 are considered significant.

Features:

Typically, correlation is measured using the closing prices. This script adds three more correlation studies based on open, high, and low prices. By using all four lines, we can get a better understanding of the pair's correlation.

How to Read This Indicator:

To use this indicator effectively, you need to input your pair as a ratio. For example, if your pair is TSN and ZBH, enter it in the symbol search as: TSN/ZBH

Example Interpretations:

Application in Pairs Trading:

In pairs trading, aim for the highest possible correlation, and it is important to have a sustained correlation over a long period. Pairs that correlate only part of the year but not consistently are less reliable for pairs trading.

This is an example for good correlation for pairs trading:

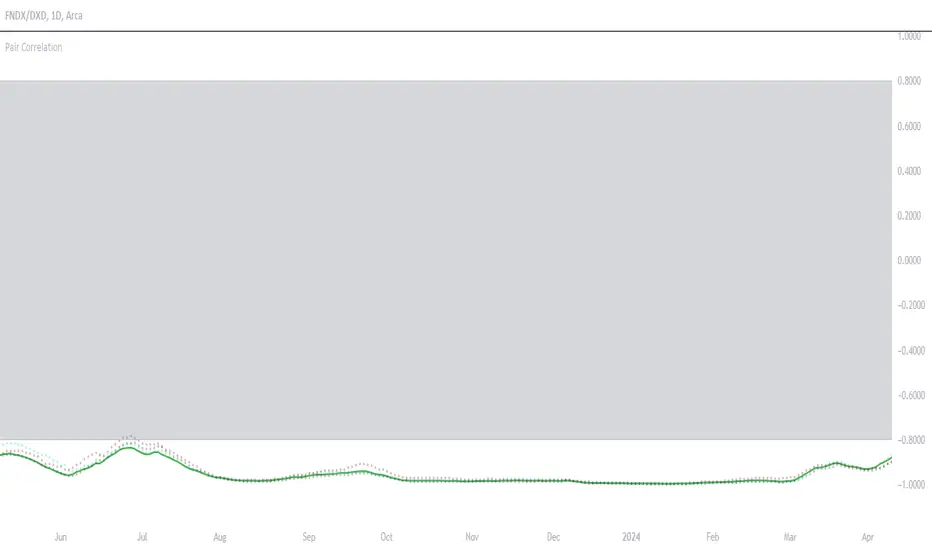

This is an example for bad correlation for pairs trading:

Here is a view of my full indicators when doing pairs trading:

This script is designed for pairs trading. If you are not familiar with pairs trading, I suggest learning about it, as it can be a profitable strategy in neutral markets (or neutral trends between two assets). The correlation between two assets is the foundation of pairs trading, and without it, the chances of making a profit are low.

Correlation can be described in two opposite ways:

- 1: Absolute positive correlation (meaning the asset prices move together).

- -1: Absolute negative correlation (meaning the asset prices move in opposite directions).

Any value between 1 and -1 indicates some degree of correlation, but generally, values higher than 0.7 or lower than -0.7 are considered significant.

Features:

Typically, correlation is measured using the closing prices. This script adds three more correlation studies based on open, high, and low prices. By using all four lines, we can get a better understanding of the pair's correlation.

How to Read This Indicator:

To use this indicator effectively, you need to input your pair as a ratio. For example, if your pair is TSN and ZBH, enter it in the symbol search as: TSN/ZBH

- Gray Area: This area indicates "no high correlation" (default is between -0.8 and 0.8, adjustable in the settings).

- Gray Line: This represents the close correlation within the "no high correlation" range.

- Green Line: This represents the close correlation within the "high correlation" range.

- Dot Lines: These represent the open, high, and low correlations.

Example Interpretations:

- A: All four lines are close together & the line is green – very good correlation!

- B: The line is gray, and the dot lines are apart – not a strong correlation.

- C: When the close correlation remains green for a long time, it signals a strong correlation.

Application in Pairs Trading:

In pairs trading, aim for the highest possible correlation, and it is important to have a sustained correlation over a long period. Pairs that correlate only part of the year but not consistently are less reliable for pairs trading.

This is an example for good correlation for pairs trading:

This is an example for bad correlation for pairs trading:

Here is a view of my full indicators when doing pairs trading:

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。