OPEN-SOURCE SCRIPT

Indicator: Krivo Index [Forex]

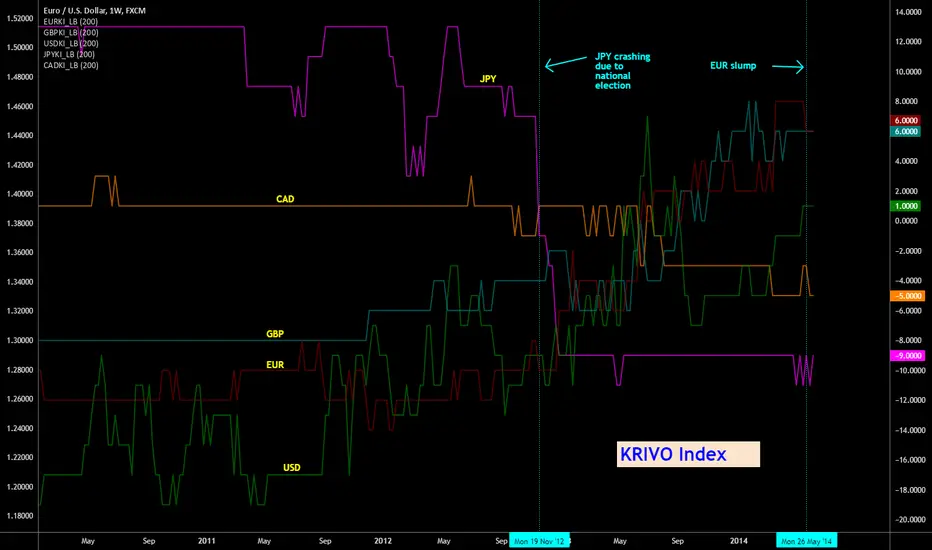

Krivo index, suggested by Richard Krivo, tries to quantify the "strength" of a currency by checking how many of its pairs are trading strongly (close above 200sma). As you can see from the chart, KI gives an excellent overview of their strength. Note how it correctly points out the JPY crash (Nov 2012).

I decided to implement KI for each currency separately to be compliant with Pine requirements. Also, this enables to add only the needed currency KI scripts (for ex., just CAD_KI and USD_KI). You can add the needed currency KI scripts and merge them all together to form a chart like this. Make sure you "right click" on all and select "Scale Right" (or "Scale Left". Thing to note is all KIs shd be aligned to the same scale).

I have published KI for only 5 currencies now, but can add more on request. BTW, this index is usable on all time frames.

More info on KrivoIndex:

-----------------------------

dailyfx.com/forex/education/trading_tips/post_of_the_day/2011/06/15/How_to_Create_a_Trading_Edge_Know_the_Strong_and_the_Weak_Currencies.html

JPY crashing:

-----------------------------

webcache.googleusercontent.com/search?q=cache:Q4NcRl6oSgQJ:www.madhedgefundtrader.com/surprise-japanese-election-sends-yen-crashing/+&cd=4&hl=en&ct=clnk&gl=us

Euro Slump:

-----------------------------

bloomberg.com/news/2014-05-22/euro-set-for-3-week-slide-before-german-sentiment-eu-elections.html

Please see the comment below for the complete list of currency pairs I used for deriving these indexes.

I decided to implement KI for each currency separately to be compliant with Pine requirements. Also, this enables to add only the needed currency KI scripts (for ex., just CAD_KI and USD_KI). You can add the needed currency KI scripts and merge them all together to form a chart like this. Make sure you "right click" on all and select "Scale Right" (or "Scale Left". Thing to note is all KIs shd be aligned to the same scale).

I have published KI for only 5 currencies now, but can add more on request. BTW, this index is usable on all time frames.

More info on KrivoIndex:

-----------------------------

dailyfx.com/forex/education/trading_tips/post_of_the_day/2011/06/15/How_to_Create_a_Trading_Edge_Know_the_Strong_and_the_Weak_Currencies.html

JPY crashing:

-----------------------------

webcache.googleusercontent.com/search?q=cache:Q4NcRl6oSgQJ:www.madhedgefundtrader.com/surprise-japanese-election-sends-yen-crashing/+&cd=4&hl=en&ct=clnk&gl=us

Euro Slump:

-----------------------------

bloomberg.com/news/2014-05-22/euro-set-for-3-week-slide-before-german-sentiment-eu-elections.html

Please see the comment below for the complete list of currency pairs I used for deriving these indexes.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

List of my free indicators: bit.ly/1LQaPK8

List of my indicators at Appstore: blog.tradingview.com/?p=970

List of my indicators at Appstore: blog.tradingview.com/?p=970

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

List of my free indicators: bit.ly/1LQaPK8

List of my indicators at Appstore: blog.tradingview.com/?p=970

List of my indicators at Appstore: blog.tradingview.com/?p=970

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。