INVITE-ONLY SCRIPT

已更新 MTF Smart Money Concepts

Overview

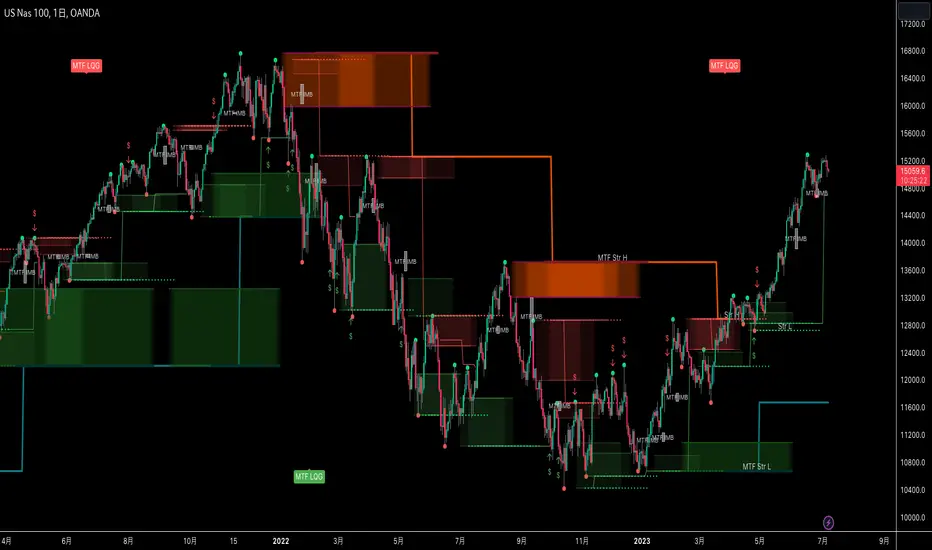

This indicator displays major elements of Smart Money Concepts and price action trading with multi-timeframes(MTF) and layered market structures with color visualization.

What is Smart Money Concepts?

Smart Money Concepts(SMC) is one of the methodologies to interpret how financial market moves and to analyze it and execute trades, focusing on liquidity and order flow of financial institutions.

Smart money means the funds invested by large financial institutions such as banks, institutional traders/investors, market makers, hedge funds etc. contrary to retail traders/investors' money.

It is important to note that there is no proof or evidence that those institutions move the market as described in Smart Money Concepts.

Personally speaking, it is one of the interpretation of the market and another angle to view the market just like other technical analysis methodologies such as Elliott Wave Principle, Gann Theory, Wyckoff Method and even traditional price action trading.

Importance of MTF Analysis

MTF analysis(a.k.a Topdown analysis) is the foundation to technically analyze charts and the most fundamental skill in trading because lower timeframes are always influenced by upper timeframes where large financial institutions operate.

How to use

This indicator is designed to help traders analyze how the market moves in terms of SMC and price action with multi-timeframes and color visualization of the market structures, which makes this indicator unique and different from other indicators.

There is two key settings that you can use based on your trading style.

1.Upper timeframe selection

You have two options to determine upper timeframe; Auto mode and Manual mode.

When Auto mode selected, upper timeframe will be determined based on chart timeframe as follows.

Chart timeframe => Upper timeframe

1M=>15M

5M/15M=>1H

30M/1H=>4H

4H=>D

D=>W

W=>M

If you select Manual mode, you can fix an upper timeframe.

2.High/low settings

This affects all other settings of the indicator and most importantly designs the market structure.

This is the key setting to determine how you view the market as price action trading is all about highs and lows and story of how highs and lows have been created with the market structure.

You can specify left bars and right bars to identify swing highs/lows and these highs/lows become the basis to design the market structure and determine how SMC elements are displayed.

Example:

Left bar&right bar: 10

You can see bigger wave(magenta line) in the market structure(stepped line).

(Magenta line is a drawn object by manual)

Left bar&right bar: 4

With this setting, you can see smaller wave in the market structure.

Since market moves like wave as there is a lot of wave theories in financial investment/trading industry such as Elliott wave, Wolf wave etc., users can define market structure with this setting depending on what degree of wave they aim to trade.

Functions:

MTF Order Block

Concept

Order block is a block of orders where buying orders and selling orders are accumulated. Order blocks are created when the institutions move the market up and down, temporality placing orders in an opposite direction to the way they want to move, in order to match their own orders with counter-orders.

Visualization by the indicator

The indicator displays both chart timeframe's order blocks and upper timeframe's order blocks(MTF).

You can also select from two options how to display order blocks;

1. Show all order blocks

2. Show strong order blocks only

Note: Strong order blocks mean order blocks created at strong highs/lows. See also strong high/low below.

Alerts can be set when prices reach strong order blocks.

MTF Fair Value Gap(FVG)/Imbalance

Concept

Fair Value Gap(FVG)(Imbalance) is a void generated among three consecutive candlesticks.

FVG(s) is created when the market moves so rapidly generating buy side or sell side order imbalances.

FVG(s) is characterized by price action that prices tend to come back to the area where FVG(s) exists, filling in the space among the candlesticks.

Visualization by the indicator

The indicator displays both chart timeframe's FVG and upper timeframe's FVG.

MTF Liquidity Grab

Concept

Liquidity grab is price action to sweep liquidity for the institutions to move the market.

This price action often happens because the size of their orders is so huge and they need a bunch of counter-orders to match their orders. This is why prices sometimes come to areas where liquidity rest and swipe them before the market goes up/down.

Liquidity visualization

Where does liquidity rest?

The answer is above highs(buy side liquidity) and below lows(sell side liquidity).

Among all highs and lows, swing highs and lows are where liquidity is accumulated the most because swing highs and lows can be created only by the institutions, therefore massive liquidity is indicated.

Visualization by the indicator

The indicator displays liquidity dots so that users can easily identify where liquidity rests and liquidity grab of both a chart timeframe and an upper timeframe.

Alerts can be set when liquidity grab happens.

MTF Strong High/Low

Concept

Strong high/low literally means strong highs and lows among all highs and lows including swing highs and lows.

There is a few different definitions of strong high/low in price action trading and the definition in this indicator is as follows.

Strong high

A high that that breaks higher low or lower low

Strong low

A low that breaks lower high or higher high

Visualization by the indicator

The indicator displays strong highs and lows of both a chart timeframe and an upper timeframe.

MTF Market Structure Visualization

Concept

Market structure is a series of price movement with highs and lows which outlines the way the market directs. It is a basis to see trend occurrence, trend reversal and sideways and analyzing the market structures in multi-timeframes is the most fundamental technical skill in trading/investment.

Visualization by the indicator

The indicator displays market structures of both a chart timeframe and an upper timeframe and provide color visualization depending on bullish and bearish market structures.

The definition of bullish and bearish market structure is as follows.

Bullish market structure

When a price breaks a Lower High or Higher High

Bearish market structure

When a price breaks a Higher Low or Lower Low

Settings

All the functions above, colors and line settings are parameterized and can be turned on/off depending on users’ needs.

———————————————————————————

概要

Smart Money Concepts(SMC)およびプライスアクショントレードにおける重要な要素をマルチタイムフレームで表示することのできるインジケーターです。

相場構造(Market structure)をマルチタイムフレームで表示し、相場構造の強弱を色で可視化することができます。

Smart Money Concepts(スマートマネーコンセプト)とは?

Smart Money Concepts(以下SMC) は金融市場がどのように動くかを解釈し、分析し、取引を執行するための相場理論の一つであり、Liquidity(リクイディティ)および機関投資家のオーダーフロー(注文の流れ)に焦点を置いていることが特徴です。

Smart Money(スマートマネー)とは、銀行や機関投資家、マーケットメーカー、ヘッジファンドといった金融機関が動かす資金を意味し、個人投資家の資金と対をなす概念です。

重要な点は、実際に上記の金融機関がSmart Money Conceptsで語られているような相場の動かし方をしているかどうかを証明する明確なエビデンスはないということです。

個人的には、エリオット波動理論やギャン理論、ワイコフ理論、伝統的なプライスアクショントレーディングの方法論と同様に、マーケットの動きを解釈するための一つの方法論であり、マーケットの動きを別の角度から見る枠組みと捉えています。

マルチタイムフレーム(MTF)分析の重要性

MTF分析はチャートをテクニカルに分析する上での基礎であり、トレードにおいて最も重要なスキルです。なぜなら下位のタイムフレームは上記のような金融機関が資金運用を行う上位のタイムフレームの影響を常に受けるためです。

使い方

このインジケーターは、SMCまたはプライスアクショントレードの観点から、トレーダーがマーケットをマルチタイムフレームで分析することを支援するために開発しています。

相場構造(Market structure/マーケットストラクチャー)を方向性に応じて色で可視化することができるため、視覚的に相場の構造を判断できることがこのインジケータのユニークな点であり、他のインジケーターと異なる点です。

ユーザーのトレードスタイルに応じて、以下の二つの設定を行うことができます。

1.上位足の決定方法

ユーザーは上位足のタイムフレームを決定するにあたり、AutoモードとManualモードを選択することができます。

Autoモードを選択した場合、上位足はチャートのタイムフレームに応じて以下のように決定されます。

チャートタイムフレーム => 上位足タイムフレーム

1M=>15M

5M/15M=>1H

30M/1H=>4H

4H=>D

D=>W

W=>M

Manualモードを選択すると上位足のタイムフレームを固定することができます。

2.High/low(高値/安値) 設定

当設定はインジケーターの他の全ての機能に影響し、また最も重要である相場構造の定義に影響します。

当設定はユーザーがマーケットをどのように見るか(=どの程度の粒度)を決定する重要な設定です。なぜならプライスアクショントレードは、高値、安値とそれらが相場構造をどのように構築してきたかの一連の流れを分析することが全てだからです。

ユーザーは相場構造を決定付けるスイングハイ·スイングローを特定するためのバーの本数を設定することができます。ここで設定した内容が、相場構造を定義し、以下で説明するSMCの要素の表示を決定することになります。

例:

Left bar&right bar(左右のバーの数): 10

この場合、ステップラインで示した相場構造の中に大きな波(マゼンタの波)を見ることができます。

(マゼンタのラインは手動で描いたオブジェクト)

Left bar&right bar: 4

この設定では、上記に比べて小さい波を描いていることが確認できます。

相場理論の中にエリオット波動理論やウォルフ波動といった数多くの波動理論があることからわかるように、相場は波として動きます。どの粒度の波を狙うかというトレーダーのスタイルに応じて、設定を変更することができます。

機能

MTFオーダーブロック

コンセプト

オーダーブロックとは買い注文と売り注文が一連となって蓄積されたオーダー(注文)のブロックのことです。

オーダーブロックは機関投資家が相場を動かす際に、本来意図する方向とは一時的に逆に動かすことで、彼ら自身の注文をマッチングさせるための反対注文を発生させることで形成されます。

インジケーターによる表示

インジケーターはチャートタイムフレームのオーダーブロックと上位足のオーダーブロックの両方を表示することができます。

また、オーダーブロックの表示オプションとして、

1.全てのオーダーブロックを表示

2.Strong(ストロング)オーダーブロックのみを表示

を選択することが可能です。

注: StrongオーダーブロックはStrong High/Lowで形成されるオーダーブロックを指します。(下記参照)

また、オーダーブロック到達でのアラート設定も可能です。

MTFフェアーバリューギャップ(FVG)/インバランス

コンセプト

フェアーバリューギャップ(FVG)/インバランスとは連続する3つのローソク足の間に形成される溝(Gap)のことです。

フェアーバリューギャップはマーケットが非常に早く動いたことにより、買いオーダーと売りオーダーの需給バランスが崩れることによって発生します。

フェアーバリューギャップには、価格がフェアーバリューギャップが発生したエリアまで戻ってくる傾向があるという特徴が存在します。

インジケーターによる表示

インジケーターはチャートタイムフレームのフェアーバリューギャップと上位足のフェアーバリューギャップの両方を表示することができます。

MTF Liquidity Grab(リクイディティ·グラブ)

コンセプト

Liquidity(リクイディティ)とはマネー、つまり注文です。

Liquidity Grab(リクイディティ·グラブ)とは、機関投資家がマーケットを動かす際にLiquidityを取得するプライスアクションのことを指します。

このプライスアクションは、機関投資家が処理する注文サイズが非常に大きいため、自身の注文を出す際に大量の反対注文を必要とすることからしばしば発生します。

これが、価格がLiquidity(注文)の集まっているエリアに接近し、それら注文をスワイプ(狩り取る)した後に上昇·下落する理由です。

Liquidityの可視化

一般的にLiquidityは高値の上(buy side liquidity)、安値の下(sell side liquidity)に存在します。

全ての高値·安値の中で、スイングハイ·ローがliquidityが最も蓄積されているエリアということができます。なぜならスイングハイ·ローは機関投資家の注文によってのみ形成されるからです。

インジケーターによる表示

ユーザーがLiquidityポイントを簡単に識別できるようにLiquidityをドット表示することが可能です。またチャートタイムフレームと上位足の両方のLiquidity Grabを表示することができます。

Liquidity Grab発生時にアラートも設定可能です。

MTF Strong High/Low(ストロングハイ·ロー)

コンセプト

Strong high/lowは文字通り、強い高値·安値のことを指します。

トレーダーの間でいくつかの異なる定義が存在しますが、当インジケーターでの定義は以下の通りです。

Strong high

Higher low(ハイアーロー) または Lower low(ロワーロー)をブレイクした高値

Strong low

Lower higher (ロワーハイ) または Higher High(ハイアーハイ)をブレイクした安値

インジケーターによる表示

チャートタイムフレーム、上位足のStrong High/Lowを表示することが可能です。

相場構造可視化

コンセプト

相場構造(Market structure/マーケットストラクチャー)とは、相場の流れを成り立たせる高値と安値を元にした一連の値動きです。建物における骨組みに該当します。

トレンドの発生、転換、レンジを見極めるための基礎であり、マルチタイムフレームで相場構造を分析することは、投資·トレードにおいて最も重要なテクニカルスキルです。

インジケーターによる表示

チャートタイムフレームと上位足タイムフレーム両方の相場構造を表示することができます。

また、相場構造が強気の状態か弱気の状態かを色で可視化するため、上位足含めた相場の流れを視覚的に判断することが可能です。

相場構造の強弱の定義は以下の通りです。

強気の相場構造(Bullish market structure)

価格がLower HighまたはHigher Highをブレイクしたとき

弱気の相場構造(Bearish market structure)

価格がHigher LowまたはLower Lowをブレイクしたとき

設定

上記の全ての機能は色やライン設定含めパラメーターで設定が可能です。またユーザの必要に応じて表示·非表示を切り替えることができます。

This indicator displays major elements of Smart Money Concepts and price action trading with multi-timeframes(MTF) and layered market structures with color visualization.

What is Smart Money Concepts?

Smart Money Concepts(SMC) is one of the methodologies to interpret how financial market moves and to analyze it and execute trades, focusing on liquidity and order flow of financial institutions.

Smart money means the funds invested by large financial institutions such as banks, institutional traders/investors, market makers, hedge funds etc. contrary to retail traders/investors' money.

It is important to note that there is no proof or evidence that those institutions move the market as described in Smart Money Concepts.

Personally speaking, it is one of the interpretation of the market and another angle to view the market just like other technical analysis methodologies such as Elliott Wave Principle, Gann Theory, Wyckoff Method and even traditional price action trading.

Importance of MTF Analysis

MTF analysis(a.k.a Topdown analysis) is the foundation to technically analyze charts and the most fundamental skill in trading because lower timeframes are always influenced by upper timeframes where large financial institutions operate.

How to use

This indicator is designed to help traders analyze how the market moves in terms of SMC and price action with multi-timeframes and color visualization of the market structures, which makes this indicator unique and different from other indicators.

There is two key settings that you can use based on your trading style.

1.Upper timeframe selection

You have two options to determine upper timeframe; Auto mode and Manual mode.

When Auto mode selected, upper timeframe will be determined based on chart timeframe as follows.

Chart timeframe => Upper timeframe

1M=>15M

5M/15M=>1H

30M/1H=>4H

4H=>D

D=>W

W=>M

If you select Manual mode, you can fix an upper timeframe.

2.High/low settings

This affects all other settings of the indicator and most importantly designs the market structure.

This is the key setting to determine how you view the market as price action trading is all about highs and lows and story of how highs and lows have been created with the market structure.

You can specify left bars and right bars to identify swing highs/lows and these highs/lows become the basis to design the market structure and determine how SMC elements are displayed.

Example:

Left bar&right bar: 10

You can see bigger wave(magenta line) in the market structure(stepped line).

(Magenta line is a drawn object by manual)

Left bar&right bar: 4

With this setting, you can see smaller wave in the market structure.

Since market moves like wave as there is a lot of wave theories in financial investment/trading industry such as Elliott wave, Wolf wave etc., users can define market structure with this setting depending on what degree of wave they aim to trade.

Functions:

MTF Order Block

Concept

Order block is a block of orders where buying orders and selling orders are accumulated. Order blocks are created when the institutions move the market up and down, temporality placing orders in an opposite direction to the way they want to move, in order to match their own orders with counter-orders.

Visualization by the indicator

The indicator displays both chart timeframe's order blocks and upper timeframe's order blocks(MTF).

You can also select from two options how to display order blocks;

1. Show all order blocks

2. Show strong order blocks only

Note: Strong order blocks mean order blocks created at strong highs/lows. See also strong high/low below.

Alerts can be set when prices reach strong order blocks.

MTF Fair Value Gap(FVG)/Imbalance

Concept

Fair Value Gap(FVG)(Imbalance) is a void generated among three consecutive candlesticks.

FVG(s) is created when the market moves so rapidly generating buy side or sell side order imbalances.

FVG(s) is characterized by price action that prices tend to come back to the area where FVG(s) exists, filling in the space among the candlesticks.

Visualization by the indicator

The indicator displays both chart timeframe's FVG and upper timeframe's FVG.

MTF Liquidity Grab

Concept

Liquidity grab is price action to sweep liquidity for the institutions to move the market.

This price action often happens because the size of their orders is so huge and they need a bunch of counter-orders to match their orders. This is why prices sometimes come to areas where liquidity rest and swipe them before the market goes up/down.

Liquidity visualization

Where does liquidity rest?

The answer is above highs(buy side liquidity) and below lows(sell side liquidity).

Among all highs and lows, swing highs and lows are where liquidity is accumulated the most because swing highs and lows can be created only by the institutions, therefore massive liquidity is indicated.

Visualization by the indicator

The indicator displays liquidity dots so that users can easily identify where liquidity rests and liquidity grab of both a chart timeframe and an upper timeframe.

Alerts can be set when liquidity grab happens.

MTF Strong High/Low

Concept

Strong high/low literally means strong highs and lows among all highs and lows including swing highs and lows.

There is a few different definitions of strong high/low in price action trading and the definition in this indicator is as follows.

Strong high

A high that that breaks higher low or lower low

Strong low

A low that breaks lower high or higher high

Visualization by the indicator

The indicator displays strong highs and lows of both a chart timeframe and an upper timeframe.

MTF Market Structure Visualization

Concept

Market structure is a series of price movement with highs and lows which outlines the way the market directs. It is a basis to see trend occurrence, trend reversal and sideways and analyzing the market structures in multi-timeframes is the most fundamental technical skill in trading/investment.

Visualization by the indicator

The indicator displays market structures of both a chart timeframe and an upper timeframe and provide color visualization depending on bullish and bearish market structures.

The definition of bullish and bearish market structure is as follows.

Bullish market structure

When a price breaks a Lower High or Higher High

Bearish market structure

When a price breaks a Higher Low or Lower Low

Settings

All the functions above, colors and line settings are parameterized and can be turned on/off depending on users’ needs.

———————————————————————————

概要

Smart Money Concepts(SMC)およびプライスアクショントレードにおける重要な要素をマルチタイムフレームで表示することのできるインジケーターです。

相場構造(Market structure)をマルチタイムフレームで表示し、相場構造の強弱を色で可視化することができます。

Smart Money Concepts(スマートマネーコンセプト)とは?

Smart Money Concepts(以下SMC) は金融市場がどのように動くかを解釈し、分析し、取引を執行するための相場理論の一つであり、Liquidity(リクイディティ)および機関投資家のオーダーフロー(注文の流れ)に焦点を置いていることが特徴です。

Smart Money(スマートマネー)とは、銀行や機関投資家、マーケットメーカー、ヘッジファンドといった金融機関が動かす資金を意味し、個人投資家の資金と対をなす概念です。

重要な点は、実際に上記の金融機関がSmart Money Conceptsで語られているような相場の動かし方をしているかどうかを証明する明確なエビデンスはないということです。

個人的には、エリオット波動理論やギャン理論、ワイコフ理論、伝統的なプライスアクショントレーディングの方法論と同様に、マーケットの動きを解釈するための一つの方法論であり、マーケットの動きを別の角度から見る枠組みと捉えています。

マルチタイムフレーム(MTF)分析の重要性

MTF分析はチャートをテクニカルに分析する上での基礎であり、トレードにおいて最も重要なスキルです。なぜなら下位のタイムフレームは上記のような金融機関が資金運用を行う上位のタイムフレームの影響を常に受けるためです。

使い方

このインジケーターは、SMCまたはプライスアクショントレードの観点から、トレーダーがマーケットをマルチタイムフレームで分析することを支援するために開発しています。

相場構造(Market structure/マーケットストラクチャー)を方向性に応じて色で可視化することができるため、視覚的に相場の構造を判断できることがこのインジケータのユニークな点であり、他のインジケーターと異なる点です。

ユーザーのトレードスタイルに応じて、以下の二つの設定を行うことができます。

1.上位足の決定方法

ユーザーは上位足のタイムフレームを決定するにあたり、AutoモードとManualモードを選択することができます。

Autoモードを選択した場合、上位足はチャートのタイムフレームに応じて以下のように決定されます。

チャートタイムフレーム => 上位足タイムフレーム

1M=>15M

5M/15M=>1H

30M/1H=>4H

4H=>D

D=>W

W=>M

Manualモードを選択すると上位足のタイムフレームを固定することができます。

2.High/low(高値/安値) 設定

当設定はインジケーターの他の全ての機能に影響し、また最も重要である相場構造の定義に影響します。

当設定はユーザーがマーケットをどのように見るか(=どの程度の粒度)を決定する重要な設定です。なぜならプライスアクショントレードは、高値、安値とそれらが相場構造をどのように構築してきたかの一連の流れを分析することが全てだからです。

ユーザーは相場構造を決定付けるスイングハイ·スイングローを特定するためのバーの本数を設定することができます。ここで設定した内容が、相場構造を定義し、以下で説明するSMCの要素の表示を決定することになります。

例:

Left bar&right bar(左右のバーの数): 10

この場合、ステップラインで示した相場構造の中に大きな波(マゼンタの波)を見ることができます。

(マゼンタのラインは手動で描いたオブジェクト)

Left bar&right bar: 4

この設定では、上記に比べて小さい波を描いていることが確認できます。

相場理論の中にエリオット波動理論やウォルフ波動といった数多くの波動理論があることからわかるように、相場は波として動きます。どの粒度の波を狙うかというトレーダーのスタイルに応じて、設定を変更することができます。

機能

MTFオーダーブロック

コンセプト

オーダーブロックとは買い注文と売り注文が一連となって蓄積されたオーダー(注文)のブロックのことです。

オーダーブロックは機関投資家が相場を動かす際に、本来意図する方向とは一時的に逆に動かすことで、彼ら自身の注文をマッチングさせるための反対注文を発生させることで形成されます。

インジケーターによる表示

インジケーターはチャートタイムフレームのオーダーブロックと上位足のオーダーブロックの両方を表示することができます。

また、オーダーブロックの表示オプションとして、

1.全てのオーダーブロックを表示

2.Strong(ストロング)オーダーブロックのみを表示

を選択することが可能です。

注: StrongオーダーブロックはStrong High/Lowで形成されるオーダーブロックを指します。(下記参照)

また、オーダーブロック到達でのアラート設定も可能です。

MTFフェアーバリューギャップ(FVG)/インバランス

コンセプト

フェアーバリューギャップ(FVG)/インバランスとは連続する3つのローソク足の間に形成される溝(Gap)のことです。

フェアーバリューギャップはマーケットが非常に早く動いたことにより、買いオーダーと売りオーダーの需給バランスが崩れることによって発生します。

フェアーバリューギャップには、価格がフェアーバリューギャップが発生したエリアまで戻ってくる傾向があるという特徴が存在します。

インジケーターによる表示

インジケーターはチャートタイムフレームのフェアーバリューギャップと上位足のフェアーバリューギャップの両方を表示することができます。

MTF Liquidity Grab(リクイディティ·グラブ)

コンセプト

Liquidity(リクイディティ)とはマネー、つまり注文です。

Liquidity Grab(リクイディティ·グラブ)とは、機関投資家がマーケットを動かす際にLiquidityを取得するプライスアクションのことを指します。

このプライスアクションは、機関投資家が処理する注文サイズが非常に大きいため、自身の注文を出す際に大量の反対注文を必要とすることからしばしば発生します。

これが、価格がLiquidity(注文)の集まっているエリアに接近し、それら注文をスワイプ(狩り取る)した後に上昇·下落する理由です。

Liquidityの可視化

一般的にLiquidityは高値の上(buy side liquidity)、安値の下(sell side liquidity)に存在します。

全ての高値·安値の中で、スイングハイ·ローがliquidityが最も蓄積されているエリアということができます。なぜならスイングハイ·ローは機関投資家の注文によってのみ形成されるからです。

インジケーターによる表示

ユーザーがLiquidityポイントを簡単に識別できるようにLiquidityをドット表示することが可能です。またチャートタイムフレームと上位足の両方のLiquidity Grabを表示することができます。

Liquidity Grab発生時にアラートも設定可能です。

MTF Strong High/Low(ストロングハイ·ロー)

コンセプト

Strong high/lowは文字通り、強い高値·安値のことを指します。

トレーダーの間でいくつかの異なる定義が存在しますが、当インジケーターでの定義は以下の通りです。

Strong high

Higher low(ハイアーロー) または Lower low(ロワーロー)をブレイクした高値

Strong low

Lower higher (ロワーハイ) または Higher High(ハイアーハイ)をブレイクした安値

インジケーターによる表示

チャートタイムフレーム、上位足のStrong High/Lowを表示することが可能です。

相場構造可視化

コンセプト

相場構造(Market structure/マーケットストラクチャー)とは、相場の流れを成り立たせる高値と安値を元にした一連の値動きです。建物における骨組みに該当します。

トレンドの発生、転換、レンジを見極めるための基礎であり、マルチタイムフレームで相場構造を分析することは、投資·トレードにおいて最も重要なテクニカルスキルです。

インジケーターによる表示

チャートタイムフレームと上位足タイムフレーム両方の相場構造を表示することができます。

また、相場構造が強気の状態か弱気の状態かを色で可視化するため、上位足含めた相場の流れを視覚的に判断することが可能です。

相場構造の強弱の定義は以下の通りです。

強気の相場構造(Bullish market structure)

価格がLower HighまたはHigher Highをブレイクしたとき

弱気の相場構造(Bearish market structure)

価格がHigher LowまたはLower Lowをブレイクしたとき

設定

上記の全ての機能は色やライン設定含めパラメーターで設定が可能です。またユーザの必要に応じて表示·非表示を切り替えることができます。

版本注释

Added signals and alert conditions for market structure changes.Alert condition name;

Please select conditions below on alert setting menu.

Bullish market structure: Market structure shifted from bearish structure to bullish structure

Bearish market structure: Market structure shifted from bullish structure to bearish structure

Triangles are signals for market structure changes

--------------------------------------------------------------

マーケットストラクチャー変更時にシグナル表示とアラート設定が可能になりました。

アラート条件名称;

アラート設定画面から以下の条件を選択してください。

Bullish market structure: マーケットストラクチャーが弱気から強気に変化した時

Bearish market structure: マーケットストラクチャーが強気から弱気に変化した時

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系FX365_Thailand。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This is an invite-only and paid indicator. To get access, please sing up the link below.

https://shorturl.at/lMPW4

■”なぜ”がわかる相場分析

・チャートの動きというファクトを元に

・客観的かつロジカルに

・初心者でもわかるように

相場展望を解説

Followすると投稿の度に通知が届きます。

bit.ly/3s888QI

■Editor's Pick

bit.ly/3pkLCEl

■Blog

bit.ly/2VPAMJk

■Indicator

bit.ly/3lmWYFk

■Membership

bit.ly/3zvLkPG

・チャートの動きというファクトを元に

・客観的かつロジカルに

・初心者でもわかるように

相場展望を解説

Followすると投稿の度に通知が届きます。

bit.ly/3s888QI

■Editor's Pick

bit.ly/3pkLCEl

■Blog

bit.ly/2VPAMJk

■Indicator

bit.ly/3lmWYFk

■Membership

bit.ly/3zvLkPG

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系FX365_Thailand。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This is an invite-only and paid indicator. To get access, please sing up the link below.

https://shorturl.at/lMPW4

■”なぜ”がわかる相場分析

・チャートの動きというファクトを元に

・客観的かつロジカルに

・初心者でもわかるように

相場展望を解説

Followすると投稿の度に通知が届きます。

bit.ly/3s888QI

■Editor's Pick

bit.ly/3pkLCEl

■Blog

bit.ly/2VPAMJk

■Indicator

bit.ly/3lmWYFk

■Membership

bit.ly/3zvLkPG

・チャートの動きというファクトを元に

・客観的かつロジカルに

・初心者でもわかるように

相場展望を解説

Followすると投稿の度に通知が届きます。

bit.ly/3s888QI

■Editor's Pick

bit.ly/3pkLCEl

■Blog

bit.ly/2VPAMJk

■Indicator

bit.ly/3lmWYFk

■Membership

bit.ly/3zvLkPG

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。