PROTECTED SOURCE SCRIPT

RiskMosaic | SandiB V2

Risk On/Off System

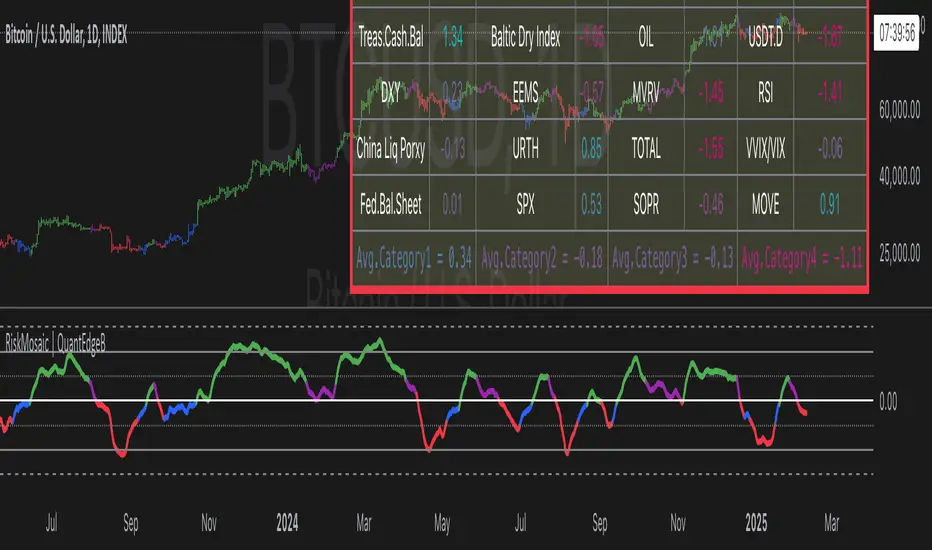

This indicator acts as a comprehensive framework that integrates a diverse range of indicators—spanning liquidity, sentiment, market volatility, and macroeconomic factors—to construct a holistic view of risk.

By blending these varied components, the system identifies shifts in risk-on and risk-off environments, providing a complete and dynamic assessment of global market conditions.

This allows for more informed decision-making by capturing both localized and broad market influences in real time, enabling proactive risk management and the ability to adapt to rapidly changing conditions.

Composition :

4 different categories - each one equal weight

-> Mix of Global & U.S Liquidity

-> Mix of different macro factors

-> Mix of Crypto and Commodities

-> Mix of Volatility & Risk Indicators

Colors description:

- Green = strong = full risk on sentiment/environment

- Red = weak = full risk off sentiment/environment

- Blue = recovery = medium risk on sentiment/environment

- Purple = contraction = medium risk of sentiment/environment

-> Colors are based on oscillator line:

- crossing over 0 or 0.4 = green

- crossing under 0 or -0.5 = red

- crossing over -0.35 = blue

- crossing under 0.35 = purple

This indicator acts as a comprehensive framework that integrates a diverse range of indicators—spanning liquidity, sentiment, market volatility, and macroeconomic factors—to construct a holistic view of risk.

By blending these varied components, the system identifies shifts in risk-on and risk-off environments, providing a complete and dynamic assessment of global market conditions.

This allows for more informed decision-making by capturing both localized and broad market influences in real time, enabling proactive risk management and the ability to adapt to rapidly changing conditions.

Composition :

4 different categories - each one equal weight

-> Mix of Global & U.S Liquidity

-> Mix of different macro factors

-> Mix of Crypto and Commodities

-> Mix of Volatility & Risk Indicators

Colors description:

- Green = strong = full risk on sentiment/environment

- Red = weak = full risk off sentiment/environment

- Blue = recovery = medium risk on sentiment/environment

- Purple = contraction = medium risk of sentiment/environment

-> Colors are based on oscillator line:

- crossing over 0 or 0.4 = green

- crossing under 0 or -0.5 = red

- crossing over -0.35 = blue

- crossing under 0.35 = purple

受保护脚本

该脚本是闭源发布的,您可以自由使用它。您可以收藏它以在图表上使用。您无法查看或修改其源代码。

想在图表上使用此脚本?

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。