OPEN-SOURCE SCRIPT

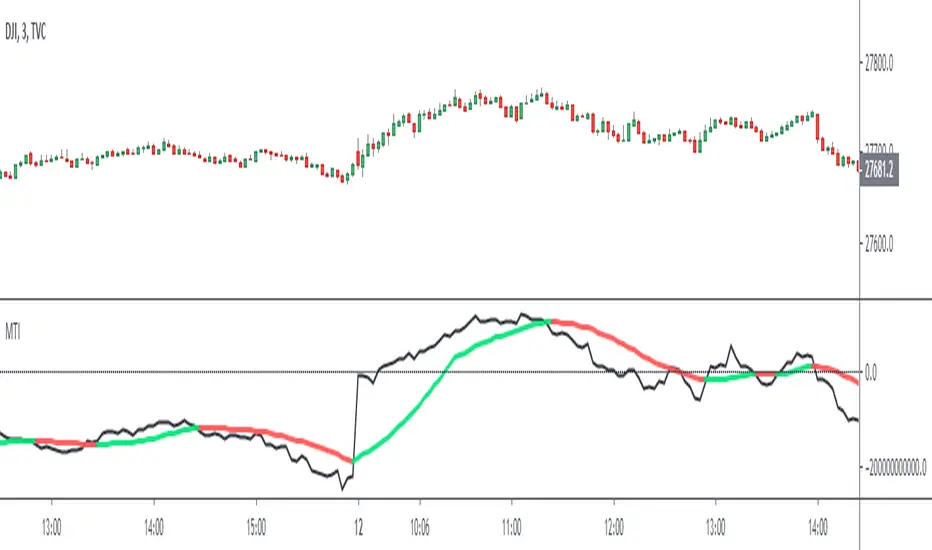

Market Thrust Indicator

The Market Thrust indicator is a powerful measure of the stock market's internal strength or weakness. There are four components to this indicator:

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。