OPEN-SOURCE SCRIPT

已更新 SMI Ergodic Indicator/Oscillator of Money Flow Index

▮ Introduction

The Stochastic Momentum Index Ergodic (SMII) indicator is a technical analysis tool designed to predict trend reversals in the price of an asset.

It functions as a momentum oscillator, measuring the ratio of the smoothed price change to the smoothed absolute price change over a given number of previous periods.

The Ergodic SMI is based on the True Strength Index (TSI) and integrates a signal line, which is an exponential moving average (EMA) of the SMI indicator itself.

The Ergodic SMI oscillator provides a clearer picture of market trends than the traditional stochastic oscillator by incorporating the concept of 'ergodicity', which helps remove market noise.

On ther other hand, MFI (Money Flow Index) is a technical analysis indicator used to measure the inflow of money into an asset and thus help identify buying and selling pressure in a given financial instrument.

When these two indicators are combined, they can provide a more comprehensive view of price direction and market strength.

▮ Motivation: why another indicator?

By combining SMII with MFI, we can gain even more insights into the market.

One way to do this is to use the MFI as an input to the SMII, rather than just using price.

This means we are measuring momentum based on buying and selling pressure rather than just price.

Furthermore, there is the possibility of making several fine adjustments to both the calculation and visualization parameters that are not present in other indicators.

▮ What to look for

When using the SMII MFI indicator, there are a few things to look out for.

First, look at the SMII signal line.

When the line crosses above -40, it is considered a buy signal, while the crossing below +40 is considered a sell signal.

Also, pay attention to divergences between the SMII and the price.

If price is rising but the SMII is showing negative divergence, it could indicate that momentum is waning and a reversal could be in the offing.

Likewise, if price is falling but the SMII is showing positive divergence, this could indicate that momentum is building and a reversal could also be in the offing.

Divergences can be considered in both indicator and/or histogram.

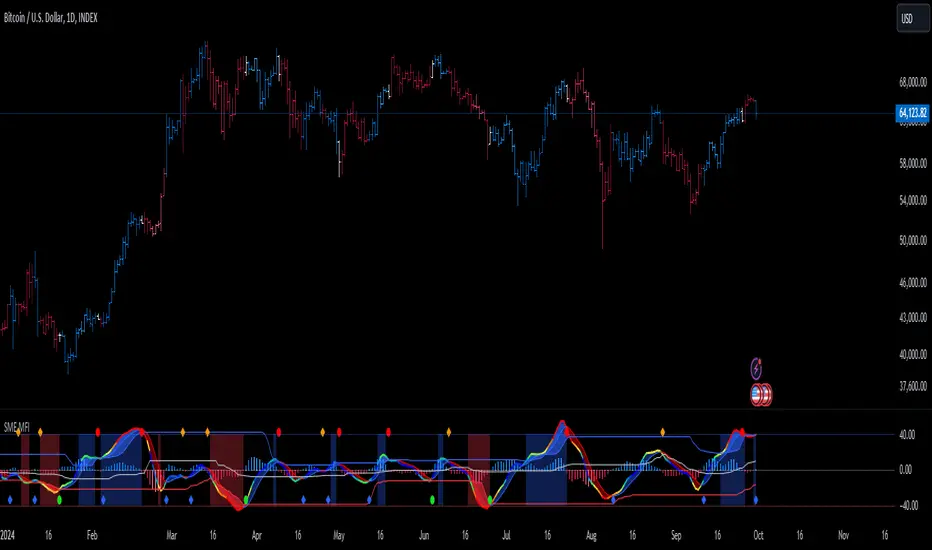

Examples:

▮ Notes

The indicator presented here offers both the 'SMII' and the 'SMIO', that is, the 'Stochastic Momentum Index Ergodic Indicator' together with the 'Stochastic Momentum Index Ergodic Oscillator' (histogram), as per the documentation described in reference links.

So it is important to highlight the differences in relation to my other indicator, the 'Stochastic Momentum Index (SMI) of Money Flow Index (MFI)':

This last one is purely based on the SMI, which is implemented using SMA smoothing for the relative range and the high/low range.

Although they may seem the same in some situations, the calculation is actually different. The TSI tends to be more responsive at the expense of being noisier, while the SMI tends to be smoother. Which of these two indicators is best depends on the situation, the context, and the analyst's personal preference.

Please refer to reference links to more info.

▮ References

SMI documentation

SMII documentation

SMIO documentation

MFI documentation

The Stochastic Momentum Index Ergodic (SMII) indicator is a technical analysis tool designed to predict trend reversals in the price of an asset.

It functions as a momentum oscillator, measuring the ratio of the smoothed price change to the smoothed absolute price change over a given number of previous periods.

The Ergodic SMI is based on the True Strength Index (TSI) and integrates a signal line, which is an exponential moving average (EMA) of the SMI indicator itself.

The Ergodic SMI oscillator provides a clearer picture of market trends than the traditional stochastic oscillator by incorporating the concept of 'ergodicity', which helps remove market noise.

On ther other hand, MFI (Money Flow Index) is a technical analysis indicator used to measure the inflow of money into an asset and thus help identify buying and selling pressure in a given financial instrument.

When these two indicators are combined, they can provide a more comprehensive view of price direction and market strength.

▮ Motivation: why another indicator?

By combining SMII with MFI, we can gain even more insights into the market.

One way to do this is to use the MFI as an input to the SMII, rather than just using price.

This means we are measuring momentum based on buying and selling pressure rather than just price.

Furthermore, there is the possibility of making several fine adjustments to both the calculation and visualization parameters that are not present in other indicators.

▮ What to look for

When using the SMII MFI indicator, there are a few things to look out for.

First, look at the SMII signal line.

When the line crosses above -40, it is considered a buy signal, while the crossing below +40 is considered a sell signal.

Also, pay attention to divergences between the SMII and the price.

If price is rising but the SMII is showing negative divergence, it could indicate that momentum is waning and a reversal could be in the offing.

Likewise, if price is falling but the SMII is showing positive divergence, this could indicate that momentum is building and a reversal could also be in the offing.

Divergences can be considered in both indicator and/or histogram.

Examples:

▮ Notes

The indicator presented here offers both the 'SMII' and the 'SMIO', that is, the 'Stochastic Momentum Index Ergodic Indicator' together with the 'Stochastic Momentum Index Ergodic Oscillator' (histogram), as per the documentation described in reference links.

So it is important to highlight the differences in relation to my other indicator, the 'Stochastic Momentum Index (SMI) of Money Flow Index (MFI)':

This last one is purely based on the SMI, which is implemented using SMA smoothing for the relative range and the high/low range.

Although they may seem the same in some situations, the calculation is actually different. The TSI tends to be more responsive at the expense of being noisier, while the SMI tends to be smoother. Which of these two indicators is best depends on the situation, the context, and the analyst's personal preference.

Please refer to reference links to more info.

▮ References

SMI documentation

SMII documentation

SMIO documentation

MFI documentation

版本注释

Minor fixes and default parameters changed.版本注释

Default parameters changed.开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

To contribute to my work:

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

To contribute to my work:

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。