TBT Zones - Preferably used on the 4H chart. You should combine this script with other technical indicators as well. In general the script helps find buy and sell opportunities early enough so as to make better decisions before taking a trade. Basically, it uses the rsi indicator, the long lower and long upper shadow candle sticks to create buy and sell zones....

"Relative Daily Change%" Indicator (RDC) The "Relative Daily Change%" indicator compares a stock's average daily price change percentage over the last 200 days with a chosen index. It plots a colored curve. If the stock's change% is higher than the index, the curve is green, indicating it's doing better. Red means the stock is under-performing. This...

RedK Relative Strength Ribbon (RedK RS_Ribbon) is TA tool that plots the Relative Strength of the current chart symbol against another symbol, or an index of choice. It enables us to see when a stock is gaining strength (or weakness) relative to (an index that represents) the market, and when it hits new highs or lows of that relative strength, which may lead to...

Introducing the "RSI Supreme Multi-Method" indicator, a powerful tool that combines the Relative Strength Index (RSI) with selectable manipulation methods to identify overbought and oversold conditions in the market, along with the ability to detect divergences for enhanced trading insights. The indicator features four distinct manipulation methods for the RSI,...

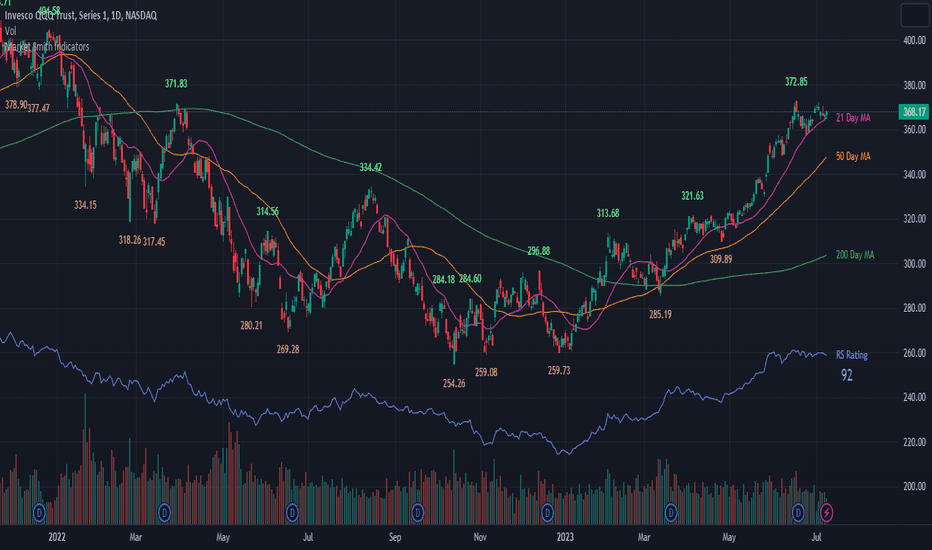

Market Smith has a collection of tools that are useful for identifying stocks. On their charts they have a 21/50/200 day moving averages, high and low pivot points, a relative strength line, and a relative strength rating. This script contains indicators for the following: 21/50/200 Day Moving Averages High and Low pivot points A Relative Strength line A...

This screener tracks the following for up to 20 assets: -All selected tickers will be screened in same timeframes (as in the chart). -Values in table indicate that how many days passed after the last Bullish or Bearish of RSI Divergence. For example, when BTCUSDT appears Bullish-Days Ago (15) , Bitcoin has switched to a Bullish Divergence signal 15 days...

█ OVERVIEW This script is an indicator that helps traders to identify the RSI Levels for multiple fractals wherever the current timeframe is. This script was based on RSI Levels, 20-30 & 70-80 by abdomi indicator, that calculates the Relative Strenght Index levels based on the asset's price and plots it into the chart, creating a "wave" style indicator. The...

The Rough Average indicator is a unique technical tool that calculates a modified average to provide insights into market conditions. It incorporates a combination of mathematical operations and existing indicators to offer traders a different perspective on price movements. The Rough Average indicator aims to capture market dynamics through a specific...

The "RSI Momentum Trend" indicator is a valuable tool for traders seeking to identify momentum trends. By utilizing the Relative Strength Index (RSI) and customizable momentum thresholds, this indicator helps traders spot potential bullish and bearish signals. you can adjust input parameters such as the RSI period, positive and negative momentum thresholds, and...

█ Overview The Relative Trend Index (RTI) developed by Zeiierman is an innovative technical analysis tool designed to measure the strength and direction of the market trend. Unlike some traditional indicators, the RTI boasts a distinctive ability to adapt and respond to market volatility, while still minimizing the effects of minor, short-term market...

The RS Momentum single Symbol indicator is a custom indicator that compares the performance of a specific symbol to a base symbol and calculates the relative strength (RS) and relative momentum (RM) between them. The indicator is designed to help traders identify the current market phase of the symbol and make informed trading decisions based on the relative...

🧾 Description: A nexus is a connection, link, or neuronal junction where signals and information are transmitted between different elements. The MTF Smoothable RSI Nexus indicator serves as a nexus between smoothable, MTF RSIs by facilitating the visualization and interaction of up to six multi-timeframe RSIs, each with its own customizable timeframe, period,...

The name RAM originated because of three popular technical indicators Relative Strength Index (RSI), Average True Range (ATR), and Moving average convergence/divergence were used all together to create three conditions individually first and once all three conditions meet at once then we considered a potential opportunity either for buy or sell and produce...

Here is a fun new way to view the RSI. A new TradingView Indicator for you RSI enthusiasts. This is the Honey Chai RSI Indicator. This indicator combines the RSI oscillator with additional features to enhance its functionality and visual study. The purpose of this indicator is to provide a more comprehensive view of the RSI and aid in identifying trends, potential...

This is an RSI dashboard, which allows you to see the current RSI value for five timeframes across up to 8 tickers of your choice. This is a useful tool to gauge momentum across multiple timeframes, where you would look to enter a buy with high RSI values across the timeframes (and vice versa for sell positions). Conversely, some traders use RSI to identify...

It is an indicator combining the RSI indicator and KDJ indicator. Buy signal will triggers when: RSI signal positioning below 25 J value crosses below 0 Sell signal will triggers when: RSI signal positioning above 85 J value crosses above 100 *********** Please take note that this indicator may be not accurate for every chart in the crypto market, but it is...

█ Background information The Relative Strength Index (RSI) and the Exponential Moving Average (EMA) are two popular indicators. Traders use these indicators to understand market trends and predict future price changes. However, traders often wonder which indicator is better: RSI or EMA. What if these indicators give similar results? To find out, we...

Hello, This software is a technical analysis script written in the TradingView Pine language. The script creates a trading indicator based on Fibonacci retracement levels and the RSI indicator, providing information about price movements and asset volatility by using Bollinger Bands. There are many different scripts in the market that draw RSI and Fibonacci...

![RSI Supreme Multi-Method [MyTradingCoder] BTCUSDT: RSI Supreme Multi-Method [MyTradingCoder]](https://s3.tradingview.com/3/3KGDKTfs_mid.png)

![MTF Smoothable RSI Nexus [DarkWaveAlgo] ETHUSDT: MTF Smoothable RSI Nexus [DarkWaveAlgo]](https://s3.tradingview.com/b/BqStWAnl_mid.png)