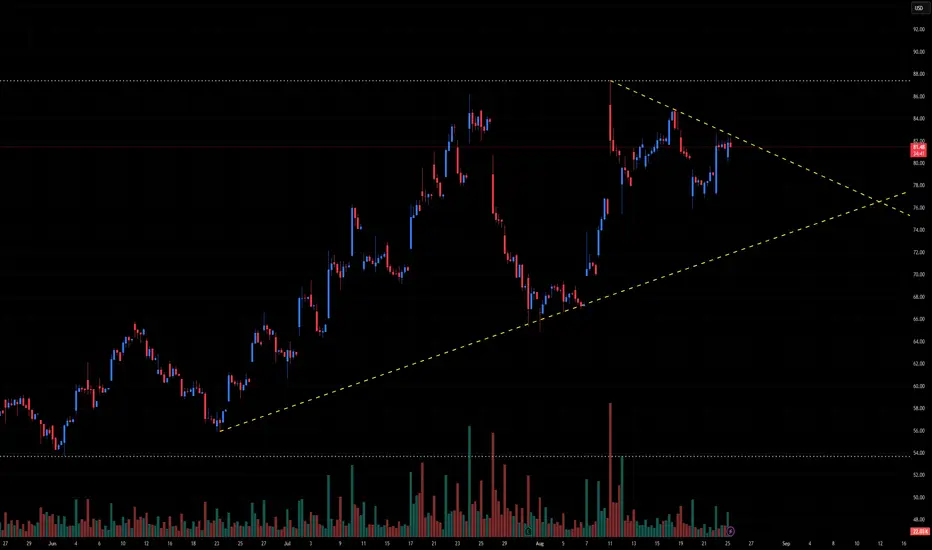

⚡ ALB Technical Outlook – Symmetrical Triangle at Key Inflection

Ticker: ALB (Albemarle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ALB has been in a long-term uptrend, holding an ascending support trendline since late June. After peaking near ~87, price has pulled back and is now consolidating within a symmetrical triangle.

Descending resistance: ~84–85.

Ascending support: ~76–77.

Current price: ~81.40, sitting inside the triangle and nearing the apex.

This structure reflects compression — energy building for a decisive breakout.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 85.

Intermediate Targets:

87–88 → Prior swing high.

90+ → Psychological round number.

Measured Move Target: ~92–94 (triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 77, confirmation under 76.

Intermediate Supports:

74–73 → First demand zone.

70–68 → Stronger support.

Measured Move Target: ~67 (triangle height projection downward).

📈 Volume Analysis

Volume has been declining during the triangle formation — normal for consolidation.

Expect a sharp volume expansion once price escapes the triangle.

⚖️ Probability Bias

The broader trend has been upward, which slightly favors a bullish continuation if resistance at 85 is cleared.

However, a failure below 76–77 would invalidate the bullish structure and trigger a breakdown.

✅ Takeaway

ALB is at a critical decision point within a symmetrical triangle:

Bullish Break > 85: Targets 88 → 90 → 92–94

Bearish Break < 76–77: Targets 74 → 70 → 67

The breakout direction — confirmed by volume — will likely define ALB’s next major move.

Ticker: ALB (Albemarle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ALB has been in a long-term uptrend, holding an ascending support trendline since late June. After peaking near ~87, price has pulled back and is now consolidating within a symmetrical triangle.

Descending resistance: ~84–85.

Ascending support: ~76–77.

Current price: ~81.40, sitting inside the triangle and nearing the apex.

This structure reflects compression — energy building for a decisive breakout.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 85.

Intermediate Targets:

87–88 → Prior swing high.

90+ → Psychological round number.

Measured Move Target: ~92–94 (triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 77, confirmation under 76.

Intermediate Supports:

74–73 → First demand zone.

70–68 → Stronger support.

Measured Move Target: ~67 (triangle height projection downward).

📈 Volume Analysis

Volume has been declining during the triangle formation — normal for consolidation.

Expect a sharp volume expansion once price escapes the triangle.

⚖️ Probability Bias

The broader trend has been upward, which slightly favors a bullish continuation if resistance at 85 is cleared.

However, a failure below 76–77 would invalidate the bullish structure and trigger a breakdown.

✅ Takeaway

ALB is at a critical decision point within a symmetrical triangle:

Bullish Break > 85: Targets 88 → 90 → 92–94

Bearish Break < 76–77: Targets 74 → 70 → 67

The breakout direction — confirmed by volume — will likely define ALB’s next major move.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。