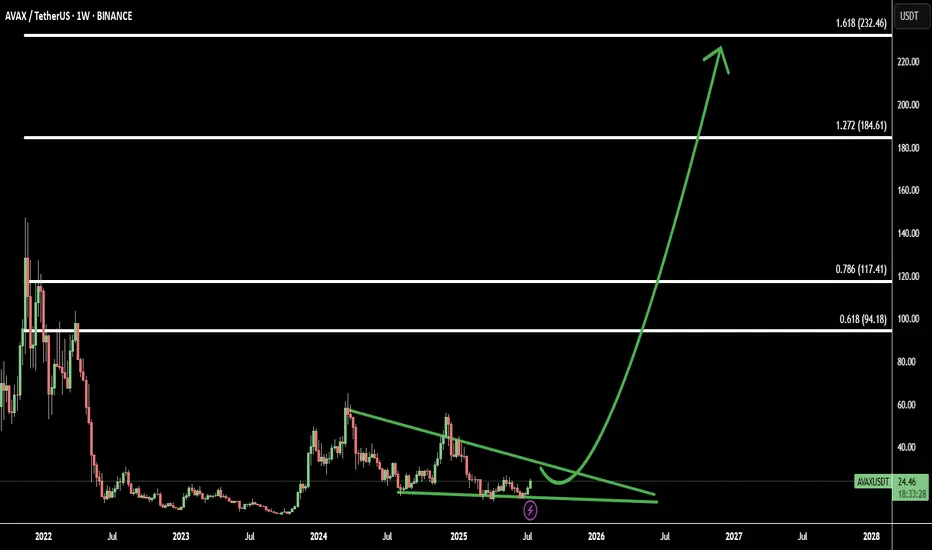

Avalanche (AVAXUSD) has broken out of a falling wedge pattern on the weekly timeframe, signaling a potential shift from bearish consolidation to a bullish continuation phase. The breakout is a strong technical signal often associated with trend reversals.

Using Fibonacci extensions from the breakout base, I’ve mapped out 4 critical target levels:

Target 1: 0.618 Fib – first major resistance after breakout - 94.18

Target 2: 0.786 Fib – deeper retracement and strong reaction zone - 117.41

Target 3: 1.272 Fib – full extension, potential profit-taking point - 184.61

Target 4: 1.618 Fib – aggressive upside target for extended rally - 232.46

These levels align with historical price structure and may act as magnets for bullish momentum if volume confirms the breakout.

Using Fibonacci extensions from the breakout base, I’ve mapped out 4 critical target levels:

Target 1: 0.618 Fib – first major resistance after breakout - 94.18

Target 2: 0.786 Fib – deeper retracement and strong reaction zone - 117.41

Target 3: 1.272 Fib – full extension, potential profit-taking point - 184.61

Target 4: 1.618 Fib – aggressive upside target for extended rally - 232.46

These levels align with historical price structure and may act as magnets for bullish momentum if volume confirms the breakout.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。