Bank Nifty Technical Analysis for May 26–30, 2025

# Current Market Context

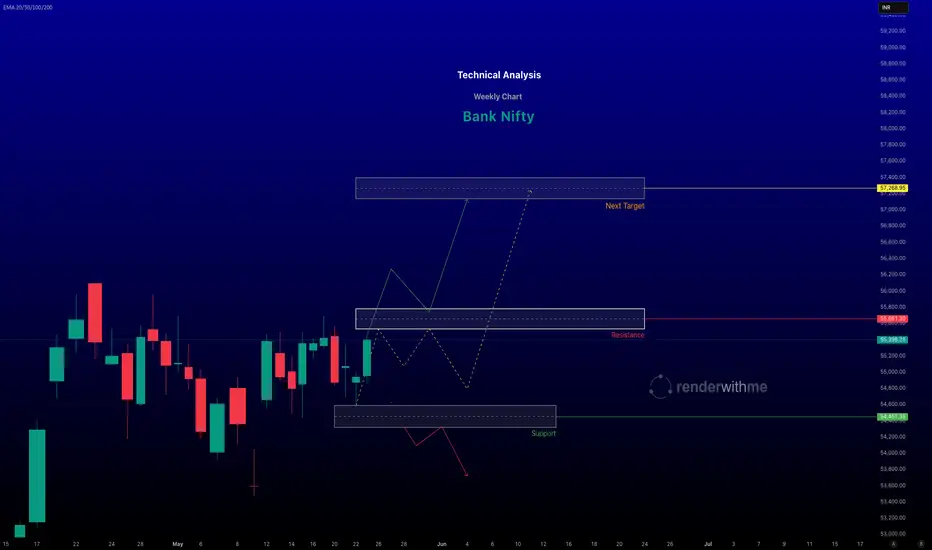

Recent Performance: As of May 23, 2025, the Bank Nifty index closed at approximately 55,389, up 456.94 points in the prior session, reflecting bullish momentum. The index is trading within a broken descending channel, indicating potential for further upside if key levels are sustained.

Market Sentiment: I suggest a neutral to bullish bias, with some analysts expecting a breakout above 55,900 or a move toward 56,500–57,500 in the near term. However, signs of distribution and weak open interest (OI) build-up indicate caution, as momentum may stall if support levels break.

#Key Technical Levels

- Support Levels:

Immediate support lies at 54,800–54,850, coinciding with the 20-day EMA zone. A break below 54,850 could trigger selling pressure, with further support at 54,700, 54,450, and 54,250.

Weekly pivot support is noted at 54,600, with a stronger support at 54,300 if a deeper correction occurs.

- Resistance Levels:

Immediate resistance is at 55,520 - 55,700 . A sustained break above this could lead to short covering and targets of 56,000 - 57,500

## Disclaimer

- This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

# Current Market Context

Recent Performance: As of May 23, 2025, the Bank Nifty index closed at approximately 55,389, up 456.94 points in the prior session, reflecting bullish momentum. The index is trading within a broken descending channel, indicating potential for further upside if key levels are sustained.

Market Sentiment: I suggest a neutral to bullish bias, with some analysts expecting a breakout above 55,900 or a move toward 56,500–57,500 in the near term. However, signs of distribution and weak open interest (OI) build-up indicate caution, as momentum may stall if support levels break.

#Key Technical Levels

- Support Levels:

Immediate support lies at 54,800–54,850, coinciding with the 20-day EMA zone. A break below 54,850 could trigger selling pressure, with further support at 54,700, 54,450, and 54,250.

Weekly pivot support is noted at 54,600, with a stronger support at 54,300 if a deeper correction occurs.

- Resistance Levels:

Immediate resistance is at 55,520 - 55,700 . A sustained break above this could lead to short covering and targets of 56,000 - 57,500

## Disclaimer

- This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

renderwithme

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。