Bitcoin – Short-Term Trading Setup Into the Weekend

Technical Analysis

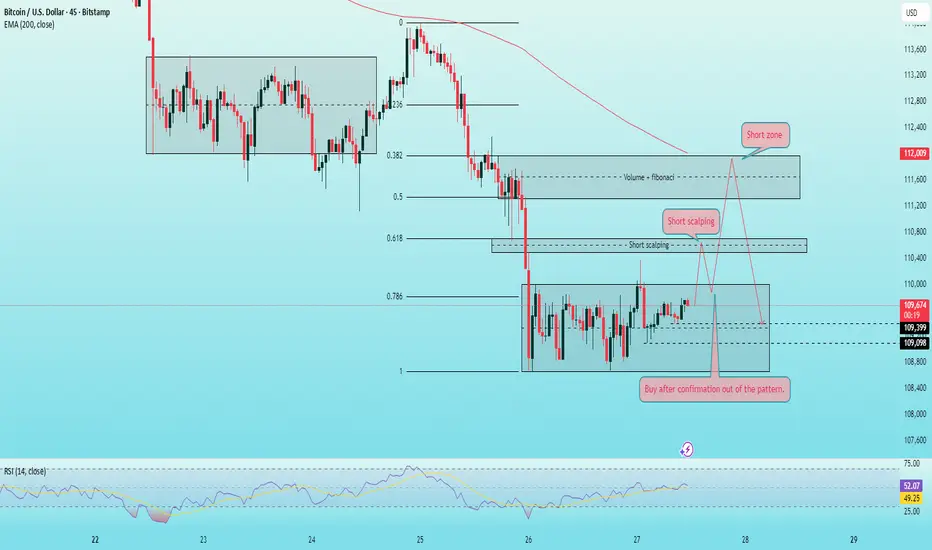

On the 45-minute chart, BTC has been moving sideways inside a rectangular range. This consolidation phase often precedes a strong directional move, and the eventual breakout will provide the confirmation for the next short-term trend.

Recent lows indicate that sellers are struggling to extend pressure, suggesting a higher chance of a relief move upward.

However, there is still the possibility of a fake downside break to sweep liquidity before price resumes higher.

110,000 is the key level to monitor for potential long entries – but only after a clear breakout confirmation.

For short opportunities, the 110,700 and 111,900 zones line up with both Fibonacci retracements and Volume Profile resistance, making them attractive areas for scalping or countertrend plays.

RSI (14) is sitting around 52, reflecting neutral momentum and reinforcing the need for confirmation before committing to a position.

Trade Scenarios

Long: wait for a confirmed breakout, entry near 110,000, SL below the nearest swing low.

Short: scale in around 110,700 and 111,900, SL ~400 points.

📌 I hope this outlook proves useful for your weekend trading. I share real-time signals within my community to help traders follow the market more closely.

Technical Analysis

On the 45-minute chart, BTC has been moving sideways inside a rectangular range. This consolidation phase often precedes a strong directional move, and the eventual breakout will provide the confirmation for the next short-term trend.

Recent lows indicate that sellers are struggling to extend pressure, suggesting a higher chance of a relief move upward.

However, there is still the possibility of a fake downside break to sweep liquidity before price resumes higher.

110,000 is the key level to monitor for potential long entries – but only after a clear breakout confirmation.

For short opportunities, the 110,700 and 111,900 zones line up with both Fibonacci retracements and Volume Profile resistance, making them attractive areas for scalping or countertrend plays.

RSI (14) is sitting around 52, reflecting neutral momentum and reinforcing the need for confirmation before committing to a position.

Trade Scenarios

Long: wait for a confirmed breakout, entry near 110,000, SL below the nearest swing low.

Short: scale in around 110,700 and 111,900, SL ~400 points.

📌 I hope this outlook proves useful for your weekend trading. I share real-time signals within my community to help traders follow the market more closely.

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。