__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

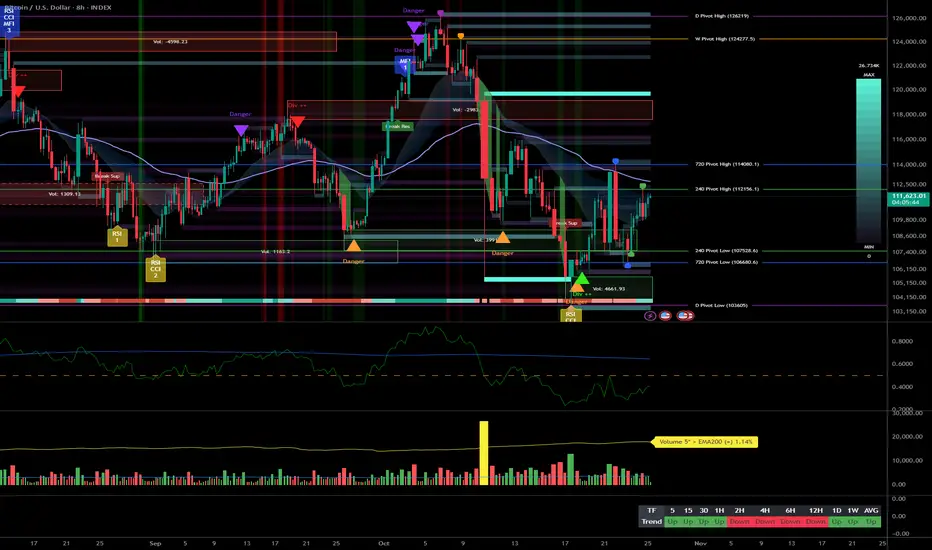

BTC is range-bound below 112,600–114,000, with improving intraday momentum but a firm HTF supply shelf overhead. The broader backdrop stays constructive while supports hold, pending a liquidity catalyst.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Strategically, the dominant trend is neutral below 112,600–114,000; stay opportunistic: buy a clean breakout or tactically sell a clear rejection.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Overall, HTFs stay rangey under a stacked resistance shelf, while LTFs press into the 112,600 pivot.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro/on-chain is mixed: potential risk-on via liquidity, but demand signals remain cautious below resistance.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Range beneath 112,600–114,000 with improving intraday but HTF supply still in control.

- Trend: Neutral, bullish if a clean break above 112,600; key supports at 111,000–110,300 and 108,600.

- Setup: Break & retest > 112,600 toward 114,000/116,000; alternative is disciplined dip-buys on bullish wicks at 110,300–108,600.

- Macro: FOMC + liquidity tone (potential QT end) is the main trigger.

Stay patient: wait for confirmation (close + retest + volume) and let flows lead risk. ⚠️

Market Overview

__________________________________________________________________________________

BTC is range-bound below 112,600–114,000, with improving intraday momentum but a firm HTF supply shelf overhead. The broader backdrop stays constructive while supports hold, pending a liquidity catalyst.

- Momentum: Range with a bullish skew 📈 if 112,600 breaks and holds.

- Key levels:

- Resistances (12H–1D): 112,600–114,000, then 116,000.

- Supports (2H–1D): 111,000–110,300, then 108,600. - Volumes: Normal to moderate (1H–4H), acting as an amplifier on rejections/breakouts.

- Multi-timeframe signals: 1D Up, while 12H/6H/4H remain Down; intraday (2H/1H/30m/15m) Up but capped under 112,600–114,000.

- Risk On / Risk Off Indicator: Mixed read (NEUTRAL SELL vs NEUTRAL BUY) → overall neutral stance, waiting for flow confirmation; this aligns with a range rather than a trend.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Strategically, the dominant trend is neutral below 112,600–114,000; stay opportunistic: buy a clean breakout or tactically sell a clear rejection.

- Global bias: Neutral with buy-on-breakout skew above 112,600; key invalidation if 1D closes below 108,600.

- Opportunities:

- Breakout long: Close + retest above 112,600 targeting 114,000 then 116,000.

- Buy the dip: 111,000–110,300 (or 108,600) on a bullish 2H–1D rejection.

- Tactical short: Rejection at 112,600–114,000 aiming 111,000 then 110,300. - Risk zones / invalidations:

- Below 108,600 on a 1D close: HTF structure weakens → risk of acceleration toward 106,800.

- Above 114,000 on 4H/1D: invalidates range shorts and opens 116,000. - Macro catalysts (Twitter, Perplexity, news):

- FOMC and liquidity tone (potential QT end) as key driver.

- US equities at ATHs: supportive risk backdrop while it lasts.

- BTC spot ETF flows mixed: uneven tailwind, needs confirmation. - Action plan:

- Entry: 112,650–112,900 (clean break/retest on 1H–4H).

- Stop: below 111,900 (breakout play) or below 110,300 (dip play).

- TP1: 114,000; TP2: 116,000; TP3: 118,500 (if extension).

- Approx R/R: 1.8R to 2.5R depending on stop and scaling.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Overall, HTFs stay rangey under a stacked resistance shelf, while LTFs press into the 112,600 pivot.

- 1D: Uptrend but capped beneath 112,600–114,000; a clean reclaim/hold would unlock 116,000.

- 12H/6H/4H: Down/corrective; countertrend bounces likely capped at 112,600–114,000 absent confirmed closes.

- 2H/1H/30m/15m: Rising structure with higher lows; continuation on break & hold of 112,600, otherwise rotation risk toward 111,000–110,300.

- Major divergences: Mixed 1D Up vs 12H Down; raises the bar for confirmation (retest + volume) on any breakout.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro/on-chain is mixed: potential risk-on via liquidity, but demand signals remain cautious below resistance.

- Macro events: Fed QT reportedly nearing an end (near-term), risk supportive; US indices at ATHs; FOMC next → primary liquidity tone driver.

- Bitcoin analysis: Pinned between the 200D (~108.5k) and STH cost basis (~113.1k); a daily close above ~113.1–116.0k unlocks higher; loss of ~108.5k risks 100–101k.

- On-chain data: Below STH cost basis, demand fatigue; elevated LTH distribution; cautious options → need flow impulse to validate a breakout.

- Expected impact: Constructive technical bias contingent on a confirmed break; without liquidity impulse, the range can persist.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Range beneath 112,600–114,000 with improving intraday but HTF supply still in control.

- Trend: Neutral, bullish if a clean break above 112,600; key supports at 111,000–110,300 and 108,600.

- Setup: Break & retest > 112,600 toward 114,000/116,000; alternative is disciplined dip-buys on bullish wicks at 110,300–108,600.

- Macro: FOMC + liquidity tone (potential QT end) is the main trigger.

Stay patient: wait for confirmation (close + retest + volume) and let flows lead risk. ⚠️

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。