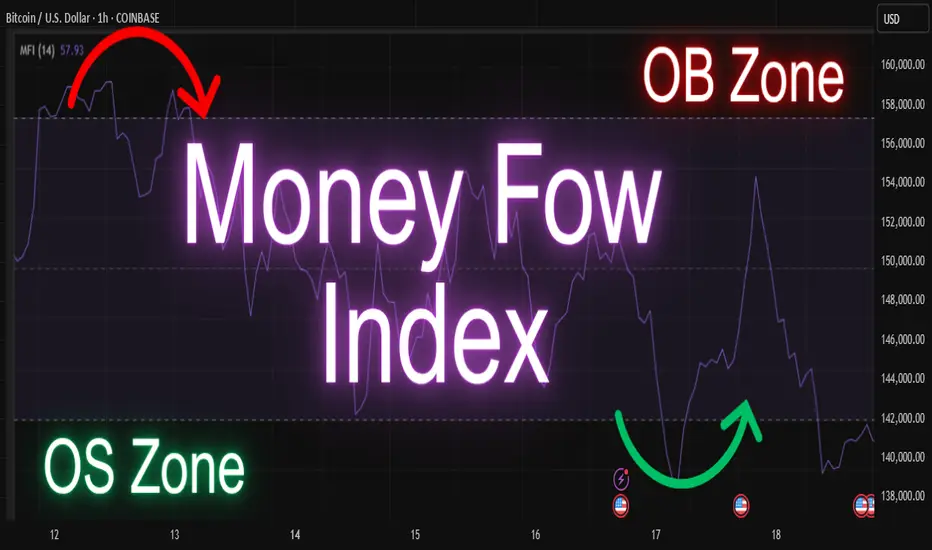

the money flow index (mfi) is a momentum indicator that uses both price and volume to measure buying and selling pressure

🧠 unlike rsi, which only considers price, mfi gives deeper insights by combining volume into the calculation

mfi values range from 0 to 100

1)above 80 = overbought zone

2)below 20 = oversold zone

🔍 traders use mfi to spot potential reversals, divergences, and to confirm trends

🛠️ you can combine mfi with other indicators like moving averages or support/resistance for better decision-making

🧪 test it on different timeframes to understand how it behaves with your strategy

Disclaimer :

This idea post is not financial advice, it's for educational purposes only, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

🧠 unlike rsi, which only considers price, mfi gives deeper insights by combining volume into the calculation

mfi values range from 0 to 100

1)above 80 = overbought zone

2)below 20 = oversold zone

🔍 traders use mfi to spot potential reversals, divergences, and to confirm trends

🛠️ you can combine mfi with other indicators like moving averages or support/resistance for better decision-making

🧪 test it on different timeframes to understand how it behaves with your strategy

Disclaimer :

This idea post is not financial advice, it's for educational purposes only, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Shivam mandai

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Shivam mandai

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。