Key Zones & Annotations

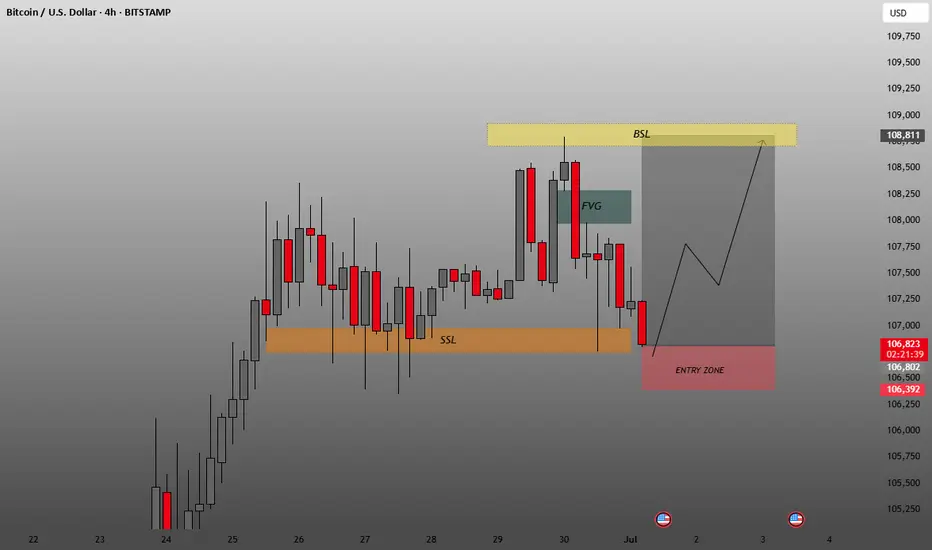

BSL (Buy-Side Liquidity) – Yellow box at the top (~$108,811):

Represents liquidity above recent highs.

Often targeted before potential reversal or continuation moves.

SSL (Sell-Side Liquidity) – Orange box below current price:

Represents liquidity under recent lows.

The market just swept this area, possibly to trigger liquidity grabs or stop hunts.

FVG (Fair Value Gap) – Blue shaded box:

Indicates an imbalance area where price could return for mitigation.

Price might revisit this area before or during a bullish move.

Entry Zone – Red box around current price:

Marks a potential long entry area.

Positioned just after sweeping the SSL.

Projected Move (Gray Box):

Forecasted price trajectory is bullish, aiming for levels above $108,500+, targeting the BSL area.

🧠

Interpretation Based on Smart Money Concepts

Market swept sell-side liquidity (SSL), suggesting weak hands or stops were taken out.

Entry zone aligns with a potential order block or demand zone.

Anticipated move is bullish, likely targeting the imbalance and BSL.

✅

Trading Insight

This is a classic Smart Money reversal setup:

Liquidity sweep below.

Entry near demand zone.

Targeting inefficiencies and liquidity above.

BSL (Buy-Side Liquidity) – Yellow box at the top (~$108,811):

Represents liquidity above recent highs.

Often targeted before potential reversal or continuation moves.

SSL (Sell-Side Liquidity) – Orange box below current price:

Represents liquidity under recent lows.

The market just swept this area, possibly to trigger liquidity grabs or stop hunts.

FVG (Fair Value Gap) – Blue shaded box:

Indicates an imbalance area where price could return for mitigation.

Price might revisit this area before or during a bullish move.

Entry Zone – Red box around current price:

Marks a potential long entry area.

Positioned just after sweeping the SSL.

Projected Move (Gray Box):

Forecasted price trajectory is bullish, aiming for levels above $108,500+, targeting the BSL area.

🧠

Interpretation Based on Smart Money Concepts

Market swept sell-side liquidity (SSL), suggesting weak hands or stops were taken out.

Entry zone aligns with a potential order block or demand zone.

Anticipated move is bullish, likely targeting the imbalance and BSL.

✅

Trading Insight

This is a classic Smart Money reversal setup:

Liquidity sweep below.

Entry near demand zone.

Targeting inefficiencies and liquidity above.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。