We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Bitcoin Analysis

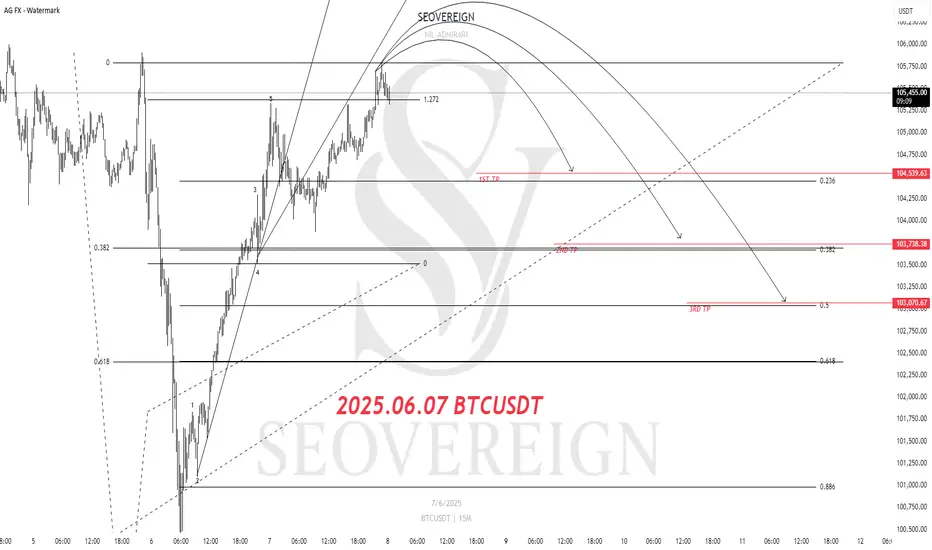

After a prolonged downtrend, Bitcoin is attempting a temporary rebound in the form of a dead cat bounce. This current upward move appears to be more of a technical rebound within the broader downtrend rather than a strong trend reversal.

From an Elliott Wave structure perspective, the current rebound is being captured as an impulsive wave, which suggests it could either be the final leg of a 5-wave move or the movement just before a corrective phase begins. Based on this view, I am considering entering a short position by targeting the point at which the upward momentum starts to exhaust.

Wave Ratio:

The length of the current 5th wave is approaching 1.618 times the length of the 1st wave, a ratio often observed in overextended wave patterns.

Target Price:

The initial target is set at 104,500, which coincides with the retracement zone of the previous decline and the prior support level.

The current area is considered favorable for a short entry in terms of risk-reward ratio. However, it is crucial to confirm whether the upward wave has truly concluded.

With overbought signals from oscillators and the appearance of a trend-reversal candlestick pattern, a short entry can be considered upon confirmation.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Bitcoin Analysis

After a prolonged downtrend, Bitcoin is attempting a temporary rebound in the form of a dead cat bounce. This current upward move appears to be more of a technical rebound within the broader downtrend rather than a strong trend reversal.

From an Elliott Wave structure perspective, the current rebound is being captured as an impulsive wave, which suggests it could either be the final leg of a 5-wave move or the movement just before a corrective phase begins. Based on this view, I am considering entering a short position by targeting the point at which the upward momentum starts to exhaust.

Wave Ratio:

The length of the current 5th wave is approaching 1.618 times the length of the 1st wave, a ratio often observed in overextended wave patterns.

Target Price:

The initial target is set at 104,500, which coincides with the retracement zone of the previous decline and the prior support level.

The current area is considered favorable for a short entry in terms of risk-reward ratio. However, it is crucial to confirm whether the upward wave has truly concluded.

With overbought signals from oscillators and the appearance of a trend-reversal candlestick pattern, a short entry can be considered upon confirmation.

🔴유튜브

🔗youtube.com/@seovereign

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📌FIFTH(전자책) 무료 배포-분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

⚠️경고: 무근의 명예훼손·욕설·비방은 형사·민사 대응합니다. 계정추적·고소·손배 청구를 진행할 수 있으며, 모든 관련 자료(스크린샷·로그)를 수집하고 있습니다.

🔗youtube.com/@seovereign

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📌FIFTH(전자책) 무료 배포-분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

⚠️경고: 무근의 명예훼손·욕설·비방은 형사·민사 대응합니다. 계정추적·고소·손배 청구를 진행할 수 있으며, 모든 관련 자료(스크린샷·로그)를 수집하고 있습니다.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

🔴유튜브

🔗youtube.com/@seovereign

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📌FIFTH(전자책) 무료 배포-분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

⚠️경고: 무근의 명예훼손·욕설·비방은 형사·민사 대응합니다. 계정추적·고소·손배 청구를 진행할 수 있으며, 모든 관련 자료(스크린샷·로그)를 수집하고 있습니다.

🔗youtube.com/@seovereign

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📌FIFTH(전자책) 무료 배포-분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

⚠️경고: 무근의 명예훼손·욕설·비방은 형사·민사 대응합니다. 계정추적·고소·손배 청구를 진행할 수 있으며, 모든 관련 자료(스크린샷·로그)를 수집하고 있습니다.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。