Confluent Inc. (NASDAQ: CFLT) surged nearly 28% in premarket trading after reports from The Wall Street Journal indicated that IBM is in advanced talks to acquire the real-time data-streaming company for approximately $11 billion. The move would represent one of IBM’s largest strategic pushes into cloud infrastructure and artificial intelligence, reinforcing the company’s ambition to strengthen its enterprise-grade data capabilities.

Confluent, valued around $8.1 billion prior to the report, plays a critical role in enterprise data modernization. Its platform powers real-time data pipelines at massive scale—technology increasingly essential for companies deploying generative AI and high-speed analytics workflows. IBM, with a market cap of roughly $288 billion, sees real-time event streaming as a foundational layer for AI, hybrid cloud, and automation growth segments.

Sources noted that a formal announcement could come as early as Monday, though negotiations remain fluid and deal terms are not finalized. Neither company has issued public comments. Analysts highlight that enterprise-software consolidation has accelerated in 2025 as competition intensifies around AI infrastructure, with large technology firms increasingly seeking to acquire mission-critical data-handling platforms.

The report follows earlier coverage from Reuters, revealing that Confluent began exploring strategic alternatives in October and retained financial advisers to assess options. Investors will now focus on whether IBM’s offer materializes and whether final pricing reflects Confluent’s strong growth trajectory and essential role in AI-driven data ecosystems.

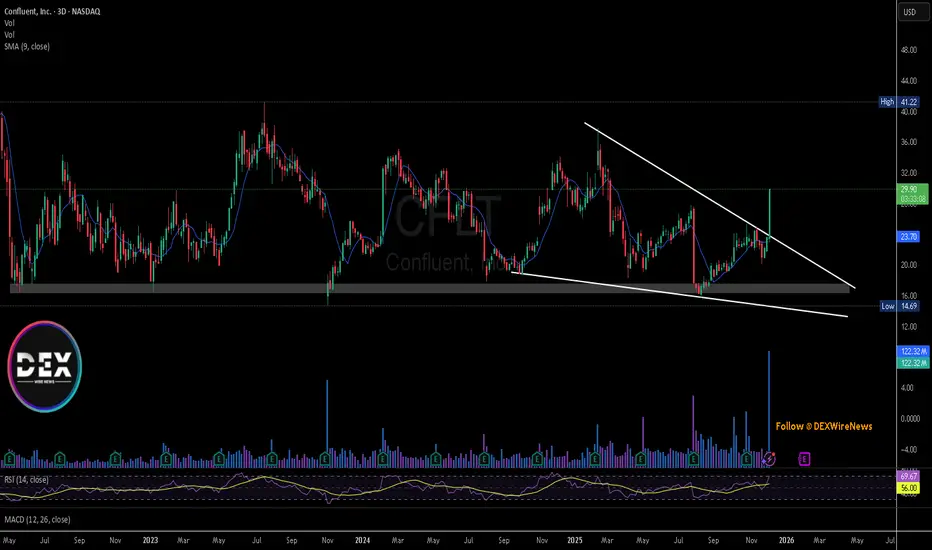

Technical Analysis

The chart shows CFLT breaking out strongly from a long-term descending wedge pattern, fueled by a surge in volume—the highest in several months. Price has cleanly reclaimed the key $23–$24 resistance level and surged toward $30. RSI pushes toward overbought territory, reflecting aggressive momentum.

If the breakout sustains, the next major target sits near $41, the high of 2023. However, failure to hold above former resistance may lead to a pullback toward the breakout zone around $23. The structure supports a bullish continuation as long as price stays above the wedge.

Confluent, valued around $8.1 billion prior to the report, plays a critical role in enterprise data modernization. Its platform powers real-time data pipelines at massive scale—technology increasingly essential for companies deploying generative AI and high-speed analytics workflows. IBM, with a market cap of roughly $288 billion, sees real-time event streaming as a foundational layer for AI, hybrid cloud, and automation growth segments.

Sources noted that a formal announcement could come as early as Monday, though negotiations remain fluid and deal terms are not finalized. Neither company has issued public comments. Analysts highlight that enterprise-software consolidation has accelerated in 2025 as competition intensifies around AI infrastructure, with large technology firms increasingly seeking to acquire mission-critical data-handling platforms.

The report follows earlier coverage from Reuters, revealing that Confluent began exploring strategic alternatives in October and retained financial advisers to assess options. Investors will now focus on whether IBM’s offer materializes and whether final pricing reflects Confluent’s strong growth trajectory and essential role in AI-driven data ecosystems.

Technical Analysis

The chart shows CFLT breaking out strongly from a long-term descending wedge pattern, fueled by a surge in volume—the highest in several months. Price has cleanly reclaimed the key $23–$24 resistance level and surged toward $30. RSI pushes toward overbought territory, reflecting aggressive momentum.

If the breakout sustains, the next major target sits near $41, the high of 2023. However, failure to hold above former resistance may lead to a pullback toward the breakout zone around $23. The structure supports a bullish continuation as long as price stays above the wedge.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。