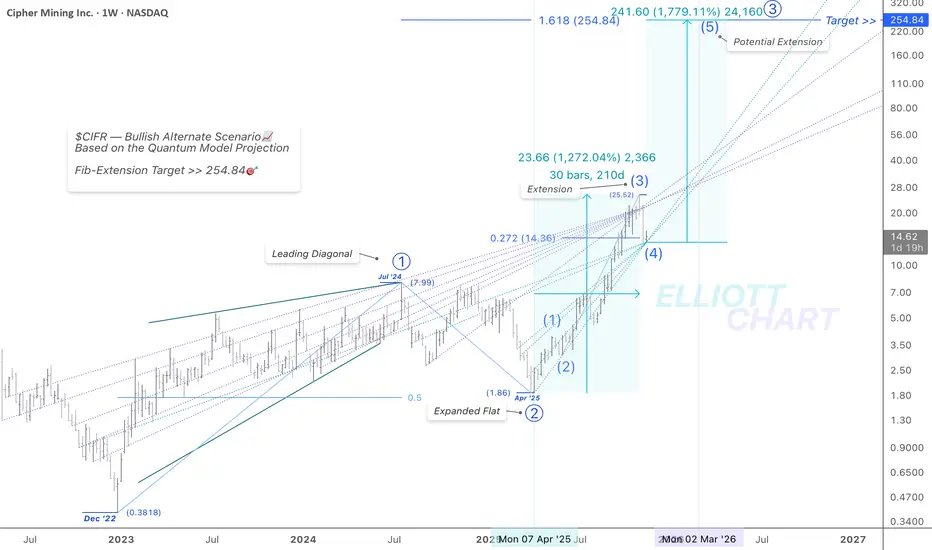

Bullish Alternative — Weekly

As outlined earlier (Nov. 15), Intermediate Wave (4) retraced sharply into the $14.36 target last week and is now resting at the apex of the support equivalence lines.

While there is still room for Intermediate Wave (4) to further evolve into a Flat or Triangle correction, an eventual extension into Intermediate Wave (5) within Primary Wave ⓷ projects toward $254🎯. This aligns with the zone defined by the divergent equivalence lines, marking the 1.618 Fibonacci extension of the Leading Diagonal that formed Primary Wave ⓵ — a structurally bullish formation.

🔖 In my Quantum Models methodology, the equivalence lines function as structural elements, anchoring the model’s internal geometry and framing the progression of alternate paths.

#MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #CIFR #DataCenters #BitcoinMining #HPC #CryptoMining #CipherMining #BTC #Bitcoin #BTCUSD

#HighPerformanceComputing

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。