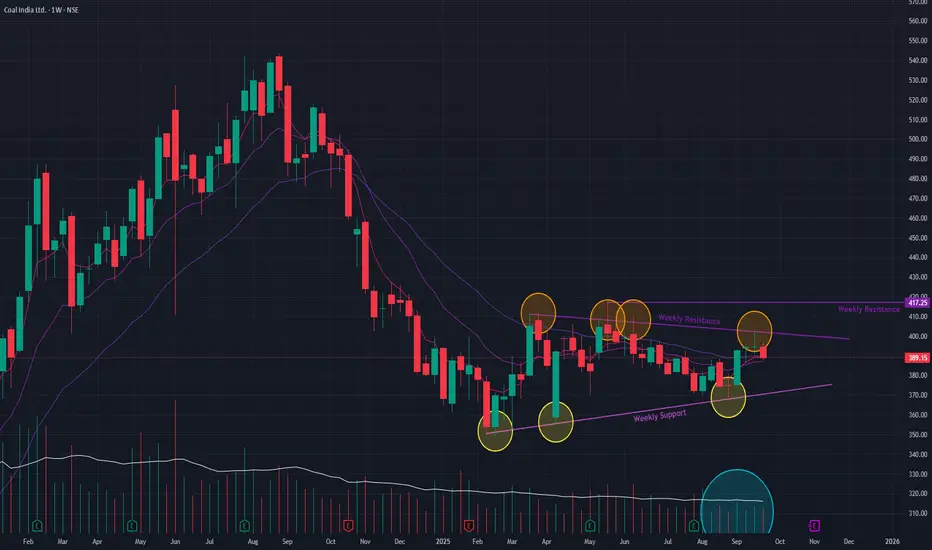

Following a significant downtrend that began in August 2024, Coal India has entered a sideways consolidation phase, which has been in place since December 2024. This prolonged period of consolidation after a downtrend is forming what appears to be a Bear Flag, a classic continuation pattern that typically resolves to the downside.

The stock is currently trading within this pattern, approaching a critical juncture.

Bearish Indicators to Note 📉

The negative outlook is supported by key observations:

- Continuation Pattern: The formation of a Bear Flag itself suggests that the pause is likely a prelude to resuming the prior downtrend.

- Declining Volume: Trading volume has been noticeably drying up during this consolidation phase, which often indicates a lack of buying conviction and can precede a breakdown.

Outlook and Key Levels

The price action in the coming weeks will be crucial.

- Bearish Case: A breakdown below the lower trendline of the flag pattern, especially on a spike in volume, would confirm the continuation of the downtrend.

- Bullish Reversal: To invalidate the bearish pattern, the stock must stage a decisive breakout above the upper resistance trendline of the flag, supported by a massive surge in volume. Until such a breakout occurs, the prevailing technical bias remains bearish.

The stock is currently trading within this pattern, approaching a critical juncture.

Bearish Indicators to Note 📉

The negative outlook is supported by key observations:

- Continuation Pattern: The formation of a Bear Flag itself suggests that the pause is likely a prelude to resuming the prior downtrend.

- Declining Volume: Trading volume has been noticeably drying up during this consolidation phase, which often indicates a lack of buying conviction and can precede a breakdown.

Outlook and Key Levels

The price action in the coming weeks will be crucial.

- Bearish Case: A breakdown below the lower trendline of the flag pattern, especially on a spike in volume, would confirm the continuation of the downtrend.

- Bullish Reversal: To invalidate the bearish pattern, the stock must stage a decisive breakout above the upper resistance trendline of the flag, supported by a massive surge in volume. Until such a breakout occurs, the prevailing technical bias remains bearish.

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。