🧠 COPPER — The Sleeping Giant Ready for a Supercycle 🌍⚡

Copper, the “metal of electrification,” is setting up for one of the biggest macro-bull markets we’ve ever seen. From EVs to renewable grids to AI data-center power demand, copper is literally the blood of the new industrial era. Let’s break it down step-by-step 👇

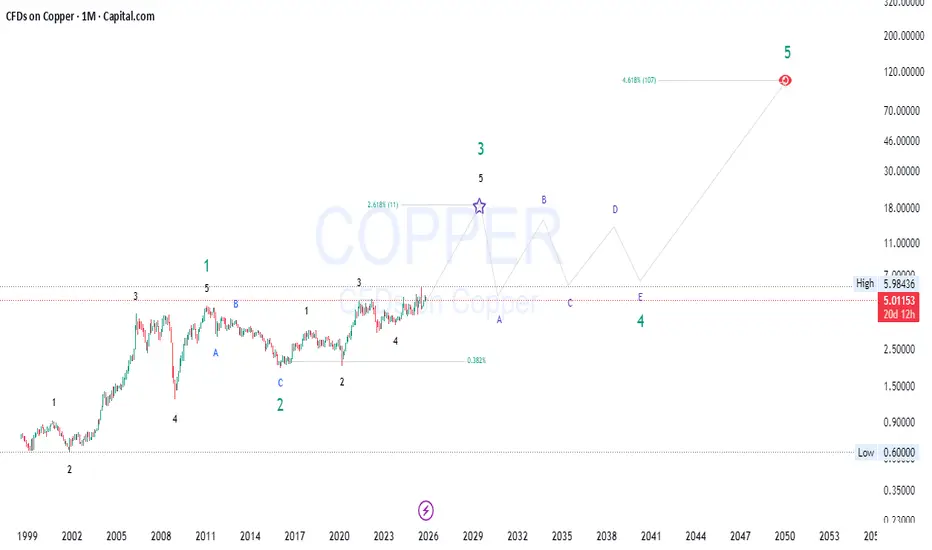

🔮 Wave Theory Confluence (Elliott + Fibonacci Extensions)

Zooming out to the monthly timeframe, we can clearly see Copper finishing its Wave 3 within a long-term 5-wave impulsive supercycle.

This aligns perfectly with historical commodity supercycles—massive runs followed by decades of consolidation before exponential growth again.

🧩 Smart Money Concepts (SMC) – Liquidity & Institutional Order Flow

Smart Money has been quietly accumulating since 2016 👀

Expect Wyckoff-style reaccumulation as price coils between $4–$6 before the breakout into the next expansion leg 🚀

🧭 Price Action & Market Structure

This PA structure mirrors textbook “smart accumulation > markup > distribution > reaccumulation” phases seen in previous copper supercycles.

💹 Fundamentals: The Perfect Storm

All fundamentals point to structural deficits by 2026-2030, aligning perfectly with Wave 3’s macro push.

🧮 Fibonacci Confluence & Cycle Timing

The time cycle between major waves (≈10–12 years) also aligns with commodity supercycles, putting Wave 5’s blow-off top around 2045-2050.

🔔 Conclusion: The Long Game

Copper isn’t just a trade — it’s a multi-decade macro opportunity.

While short-term volatility (Wave 4) will shake weak hands, the structural setup screams “supercycle incoming.”

🟢 Bias: Long-term bullish

🕰 Accumulation Zone: $4–$5

🎯 Targets:

⚡ “Commodities move slow… until they don’t.”

The smart money has already positioned. The rest will chase the breakout. Don’t be the last one in.

#Copper #ElliottWave #SmartMoneyConcepts #Commodities #MacroCycle #PriceAction #Fibonacci #TradingView #Investing #Metals

Copper, the “metal of electrification,” is setting up for one of the biggest macro-bull markets we’ve ever seen. From EVs to renewable grids to AI data-center power demand, copper is literally the blood of the new industrial era. Let’s break it down step-by-step 👇

🔮 Wave Theory Confluence (Elliott + Fibonacci Extensions)

Zooming out to the monthly timeframe, we can clearly see Copper finishing its Wave 3 within a long-term 5-wave impulsive supercycle.

- ✅ Wave 1 (2001-2008) fueled by China’s infrastructure boom.

- ✅ Wave 2 (2008-2016) a deep corrective phase, classic ABC zigzag.

- ⚡ Wave 3 (2016-2026) now unfolding with a 2.618 Fibonacci extension, targeting around $10–11 levels per pound by the late 2020s.

- 📉 After that, expect a macro Wave 4 correction—likely a complex ABCDE structure—before the final parabolic Wave 5 projection toward $100+ in the 2040s according to long-term fib confluence (4.618x extension).

This aligns perfectly with historical commodity supercycles—massive runs followed by decades of consolidation before exponential growth again.

🧩 Smart Money Concepts (SMC) – Liquidity & Institutional Order Flow

Smart Money has been quietly accumulating since 2016 👀

- Liquidity grab below the 2020 lows cleaned out retail longs, allowing institutions to build heavy long positions.

- The current structure shows higher highs (HHs) and higher lows (HLs) — the signature of a bullish market structure shift.

- Premium/Discount zones show Copper still trading in the discount range of the macro leg (below the 50% equilibrium), suggesting Smart Money accumulation continues.

Expect Wyckoff-style reaccumulation as price coils between $4–$6 before the breakout into the next expansion leg 🚀

🧭 Price Action & Market Structure

- Monthly BOS (Break of Structure) confirmed above $5, flipping long-term market structure bullish.

- Demand zones at $4.0–$4.5 act as strong re-entry levels.

- Liquidity pools above the $6 level (previous highs) likely to be taken out as price seeks expansion to the Wave 3 target zone.

- Look for a final shakeout into Wave 4 later in the decade before the next true parabolic move.

This PA structure mirrors textbook “smart accumulation > markup > distribution > reaccumulation” phases seen in previous copper supercycles.

💹 Fundamentals: The Perfect Storm

- ⚙️ Electrification Boom – Copper is the backbone of EVs, renewable grids, AI data centers, and defense manufacturing.

- 🔋 Supply Constraints – Global mine production growth slowing while demand from green tech surges.

- 🌎 Geopolitical Tensions – Supply concentration in Chile, Peru, and DRC adds a geopolitical risk premium.

- 💰 Inflation Hedge – Commodities entering a reflation cycle as central banks pivot back to stimulus.

All fundamentals point to structural deficits by 2026-2030, aligning perfectly with Wave 3’s macro push.

🧮 Fibonacci Confluence & Cycle Timing

- Wave 3 projection: 2.618 × Wave 1 = ~$10.7

- Wave 4 retracement: likely 0.382 fib (~$6–$7 zone)

- Wave 5 extension: 4.618 × Wave 1 = $100+

The time cycle between major waves (≈10–12 years) also aligns with commodity supercycles, putting Wave 5’s blow-off top around 2045-2050.

🔔 Conclusion: The Long Game

Copper isn’t just a trade — it’s a multi-decade macro opportunity.

While short-term volatility (Wave 4) will shake weak hands, the structural setup screams “supercycle incoming.”

🟢 Bias: Long-term bullish

🕰 Accumulation Zone: $4–$5

🎯 Targets:

- Mid-term (2026-2028): $10–11

- Long-term (2040s): $100+

⚡ “Commodities move slow… until they don’t.”

The smart money has already positioned. The rest will chase the breakout. Don’t be the last one in.

#Copper #ElliottWave #SmartMoneyConcepts #Commodities #MacroCycle #PriceAction #Fibonacci #TradingView #Investing #Metals

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。