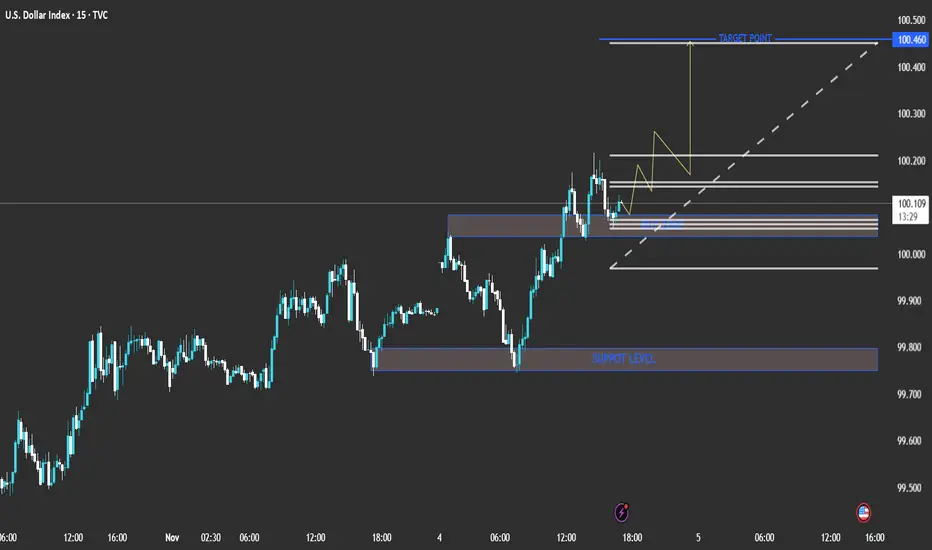

Current Price: 100.112

Bias: Bullish short-term

Timeframe: 15-min

The chart shows a clear bullish structure with higher highs and higher lows forming. The price recently bounced from a minor support zone around the 100.00 level and is showing momentum to the upside.

📊 Key Levels

Support Level: 99.750 – 99.850 (major zone from previous lows)

Buy Zone: 100.000 – 100.050 (minor support/entry zone)

Target Point: 100.460

⚙️ Analysis Summary

Price has broken above short-term resistance and is now retesting the buy zone, suggesting a possible continuation higher.

The ascending trendline (dotted white line) supports this bullish bias.

The yellow zigzag projection indicates expected consolidation before a push upward.

🎯 Trading Plan (Based on Chart Setup)

Entry Zone: Around 100.000 – 100.050

Stop Loss: Below 99.900 (below structure support)

Take Profit: 100.460 (target zone)

Risk/Reward Ratio: Approximately 1:3

🔍 Conclusion

The chart suggests a short-term bullish scenario for DXY (U.S. Dollar Index). A successful bounce from the 100.00 zone could lead to a move toward the 100.46 target point. However, a break below 99.90 would invalidate the setup and shift bias to neutral or bearish. UKX

UKX  UKX

UKX  MCX

MCX  FBMKLCI

FBMKLCI  AIM1

AIM1  ASX

ASX  NMX

NMX  AW01

AW01  JAPAN

JAPAN  GEISAC

GEISAC  FBM100

FBM100  AIM5

AIM5  BUK100P

BUK100P  XIN0

XIN0  AXX

AXX  XIN0U

XIN0U

Bias: Bullish short-term

Timeframe: 15-min

The chart shows a clear bullish structure with higher highs and higher lows forming. The price recently bounced from a minor support zone around the 100.00 level and is showing momentum to the upside.

📊 Key Levels

Support Level: 99.750 – 99.850 (major zone from previous lows)

Buy Zone: 100.000 – 100.050 (minor support/entry zone)

Target Point: 100.460

⚙️ Analysis Summary

Price has broken above short-term resistance and is now retesting the buy zone, suggesting a possible continuation higher.

The ascending trendline (dotted white line) supports this bullish bias.

The yellow zigzag projection indicates expected consolidation before a push upward.

🎯 Trading Plan (Based on Chart Setup)

Entry Zone: Around 100.000 – 100.050

Stop Loss: Below 99.900 (below structure support)

Take Profit: 100.460 (target zone)

Risk/Reward Ratio: Approximately 1:3

🔍 Conclusion

The chart suggests a short-term bullish scenario for DXY (U.S. Dollar Index). A successful bounce from the 100.00 zone could lead to a move toward the 100.46 target point. However, a break below 99.90 would invalidate the setup and shift bias to neutral or bearish.

JOIN MY TELEGRAM

t.me/MR_NRACOS_ANALYSIS

t.me/MR_NRACOS_ANALYSIS

SERVICES AVAILABLE FOR CHANNEL

✓FOREX TRADING ANALYSIS

✓FOREX TRADING IDEA 💡

✓FOREX TRADING SIGNALS XAU USD BTC SUD

✓ PREMIUM CHANNEL

t.me/MR_NRACOS_ANALYSIS

t.me/MR_NRACOS_ANALYSIS

SERVICES AVAILABLE FOR CHANNEL

✓FOREX TRADING ANALYSIS

✓FOREX TRADING IDEA 💡

✓FOREX TRADING SIGNALS XAU USD BTC SUD

✓ PREMIUM CHANNEL

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

JOIN MY TELEGRAM

t.me/MR_NRACOS_ANALYSIS

t.me/MR_NRACOS_ANALYSIS

SERVICES AVAILABLE FOR CHANNEL

✓FOREX TRADING ANALYSIS

✓FOREX TRADING IDEA 💡

✓FOREX TRADING SIGNALS XAU USD BTC SUD

✓ PREMIUM CHANNEL

t.me/MR_NRACOS_ANALYSIS

t.me/MR_NRACOS_ANALYSIS

SERVICES AVAILABLE FOR CHANNEL

✓FOREX TRADING ANALYSIS

✓FOREX TRADING IDEA 💡

✓FOREX TRADING SIGNALS XAU USD BTC SUD

✓ PREMIUM CHANNEL

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。