📌 Sector: Capital Goods (Pumps)

📌 Market Cap: ₹14,804 Cr

📌 P/E Ratio: ~40.8×

📊 Fundamentals

The company has consistently reduced debt over the past 5 years, strengthening its balance sheet.

Profit Growth: From ₹312 Cr (Jun 2024) → ₹363 Cr (Jun 2025).

Shareholding Pattern: FIIs have trimmed their stake, while DIIs have increased holdings – a sign of domestic institutional confidence.

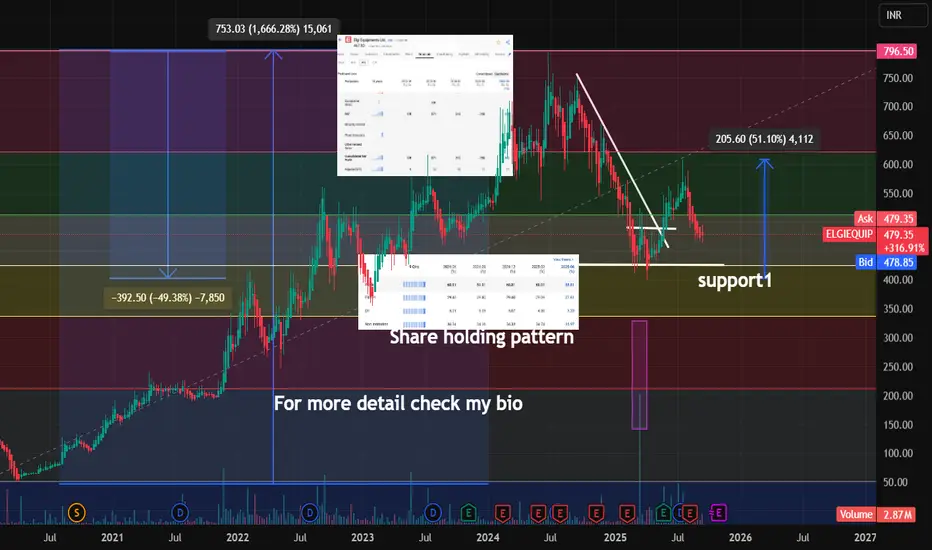

📈 Technical Outlook

All-Time High: ~₹797

Corrected nearly 50% down to ₹400 zone, followed by a 51% recovery towards ₹600.

Key Supports:

₹425 – immediate support zone

₹336 – strong support at 0.60 Fibonacci retracement

🎯 Conclusion

Elgi Equipments remains a fundamentally solid player with consistent profit growth and a healthier balance sheet. However, valuations are on the higher side (P/E ~40×), making entry levels crucial. Technically, the ₹425 and ₹336 zones are major support areas to watch for long-term accumulation.

⚡ Stock is in a recovery phase after a deep correction – patience and levels matter more than chasing momentum.

FOR more query dm me

📌 Market Cap: ₹14,804 Cr

📌 P/E Ratio: ~40.8×

📊 Fundamentals

The company has consistently reduced debt over the past 5 years, strengthening its balance sheet.

Profit Growth: From ₹312 Cr (Jun 2024) → ₹363 Cr (Jun 2025).

Shareholding Pattern: FIIs have trimmed their stake, while DIIs have increased holdings – a sign of domestic institutional confidence.

📈 Technical Outlook

All-Time High: ~₹797

Corrected nearly 50% down to ₹400 zone, followed by a 51% recovery towards ₹600.

Key Supports:

₹425 – immediate support zone

₹336 – strong support at 0.60 Fibonacci retracement

🎯 Conclusion

Elgi Equipments remains a fundamentally solid player with consistent profit growth and a healthier balance sheet. However, valuations are on the higher side (P/E ~40×), making entry levels crucial. Technically, the ₹425 and ₹336 zones are major support areas to watch for long-term accumulation.

⚡ Stock is in a recovery phase after a deep correction – patience and levels matter more than chasing momentum.

FOR more query dm me

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。