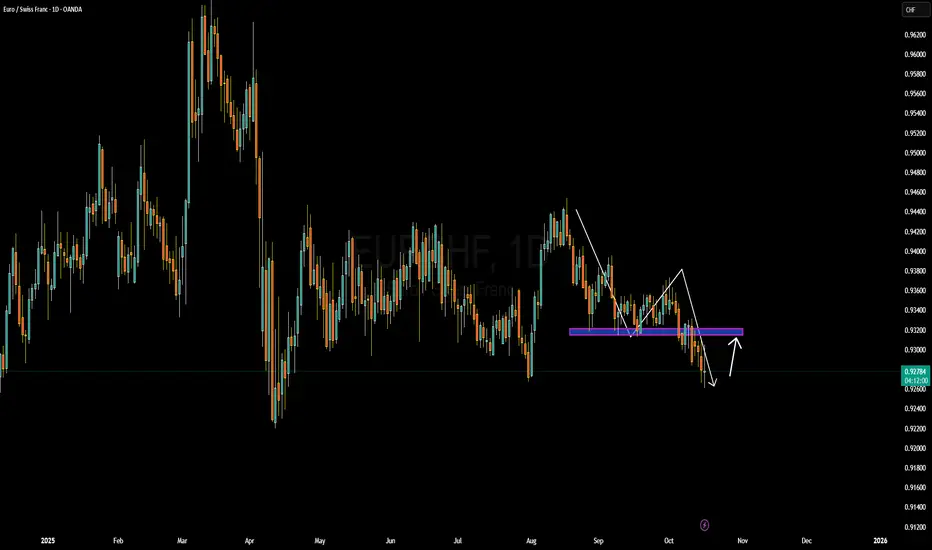

EURCHF is currently trading at a key demand zone where price has reacted multiple times in the past. After a steady decline from the September swing high, price is now retesting the horizontal support range around 0.9280–0.9300, which has previously acted as a strong decision point for buyers. If this zone holds again, I expect a corrective bounce back into the 0.9340–0.9360 supply area before the market decides its next leg. However, if price fails to reclaim that resistance, sellers may use it as a fresh distribution point for continuation to the downside.

From a fundamental perspective, the euro remains under pressure as the European Central Bank leans toward prolonged rate cuts amid weak manufacturing data, while the Swiss franc continues to attract safe-haven flows due to lingering geopolitical tensions and persistent risk-off sentiment across global markets. This macro landscape keeps EURCHF naturally tilted to the bearish side unless there is a notable shift in inflation or growth dynamics in the eurozone.

My approach here is straightforward: I am watching for a bullish reaction from this demand zone for a short-term corrective play, but I won’t ignore the possibility of a breakdown. A clean 4H close below 0.9260 would confirm bearish continuation toward 0.9200, while a reclaim of 0.9340 would open the door for a broader recovery swing. Patience and reaction over prediction — price will reveal the direction soon.

From a fundamental perspective, the euro remains under pressure as the European Central Bank leans toward prolonged rate cuts amid weak manufacturing data, while the Swiss franc continues to attract safe-haven flows due to lingering geopolitical tensions and persistent risk-off sentiment across global markets. This macro landscape keeps EURCHF naturally tilted to the bearish side unless there is a notable shift in inflation or growth dynamics in the eurozone.

My approach here is straightforward: I am watching for a bullish reaction from this demand zone for a short-term corrective play, but I won’t ignore the possibility of a breakdown. A clean 4H close below 0.9260 would confirm bearish continuation toward 0.9200, while a reclaim of 0.9340 would open the door for a broader recovery swing. Patience and reaction over prediction — price will reveal the direction soon.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。