📣 Southwind | FCPO Weekly Roundup

🗓 Week ending: Aug 29, 2025

📰 Policy driver

- 🇮🇩 Indonesia sets Sept CPO reference at USD 954.71/MT → export tax ~USD 124/MT; with 10% levy, total burden ~USD 219/MT vs ~USD 165 in Aug (+USD 54).

- Implication: higher Indonesian costs can shift some demand toward Malaysia and support FCPO spreads in Sept.

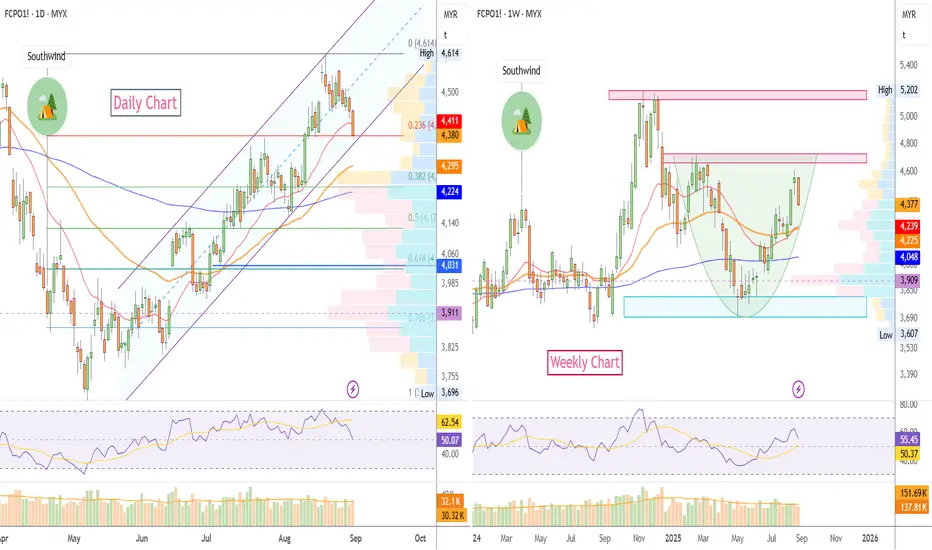

📈 Technicals (Daily)

- 🔺 Price at rising‑channel support; reclaiming short DMAs often reopens upside toward prior swing highs in trends.

- 🔎 Watch a clean close back above fast MAs for momentum confirmation.

🗂 Technicals (Weekly)

- 🥄 Rounded base still intact; resistance stacked 4,600–4,800, with higher lows keeping structure constructive into Q4.

- 📊 Break-and-close above the band would validate a base break and extend upside potential.

🎯 Levels

- 🛡 Supports: channel lower rail/MA cluster; a decisive break risks deeper mean‑reversion to prior range supports.

- 🚧 Resistances: 4,450 first, then 4,600–4,800 on weekly supply.

🌍 Fundamentals to watch

- 🛢 Indonesia’s monthly tax/levy grid and spread impact.

- 🚢 Malaysia exports vs inventories; stocks elevated but outlook seen steady-to-firm on demand momentum.

✅ Bias

- Overall: cautiously **bullish** while the daily channel holds and weekly higher lows persist; aiming for retests into the 4,600s on a strong MA reclaim.

🗓 Week ending: Aug 29, 2025

📰 Policy driver

- 🇮🇩 Indonesia sets Sept CPO reference at USD 954.71/MT → export tax ~USD 124/MT; with 10% levy, total burden ~USD 219/MT vs ~USD 165 in Aug (+USD 54).

- Implication: higher Indonesian costs can shift some demand toward Malaysia and support FCPO spreads in Sept.

📈 Technicals (Daily)

- 🔺 Price at rising‑channel support; reclaiming short DMAs often reopens upside toward prior swing highs in trends.

- 🔎 Watch a clean close back above fast MAs for momentum confirmation.

🗂 Technicals (Weekly)

- 🥄 Rounded base still intact; resistance stacked 4,600–4,800, with higher lows keeping structure constructive into Q4.

- 📊 Break-and-close above the band would validate a base break and extend upside potential.

🎯 Levels

- 🛡 Supports: channel lower rail/MA cluster; a decisive break risks deeper mean‑reversion to prior range supports.

- 🚧 Resistances: 4,450 first, then 4,600–4,800 on weekly supply.

🌍 Fundamentals to watch

- 🛢 Indonesia’s monthly tax/levy grid and spread impact.

- 🚢 Malaysia exports vs inventories; stocks elevated but outlook seen steady-to-firm on demand momentum.

✅ Bias

- Overall: cautiously **bullish** while the daily channel holds and weekly higher lows persist; aiming for retests into the 4,600s on a strong MA reclaim.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。