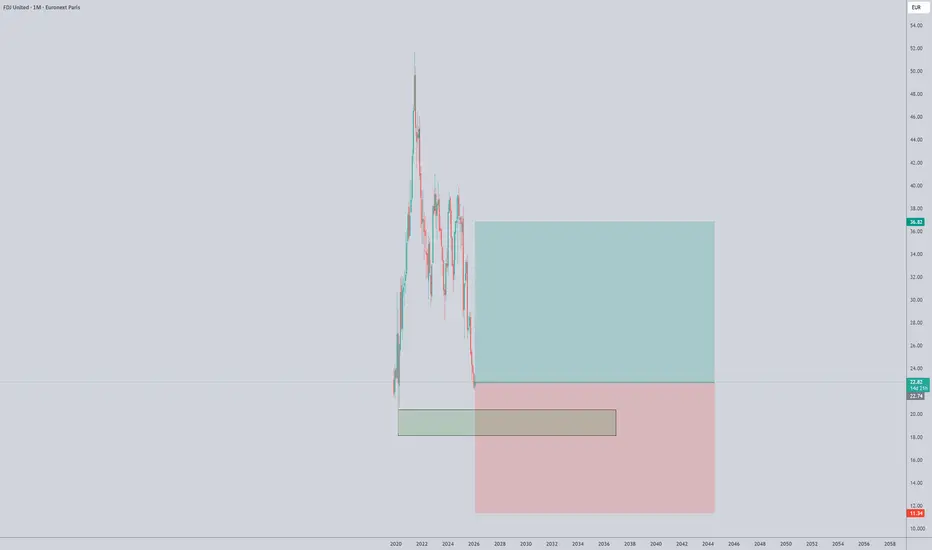

FDJU: High-yield value play (9.0% div) trading at 52-week lows (€22.8) after its pivot to FDJ United. Fails the 'Predator' Gross Margin filter (41.8% vs 80% target), though ROE remains elite at 33.2%. Significant debt (249% D/E) from the Kindred acquisition creates a 57% DCF undervaluation gap, but 118% payout ratio raises dividend sustainability concerns. High government ownership (21%) provides a moat but limits explosive growth. Watch earnings on Feb 19 before entry

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。