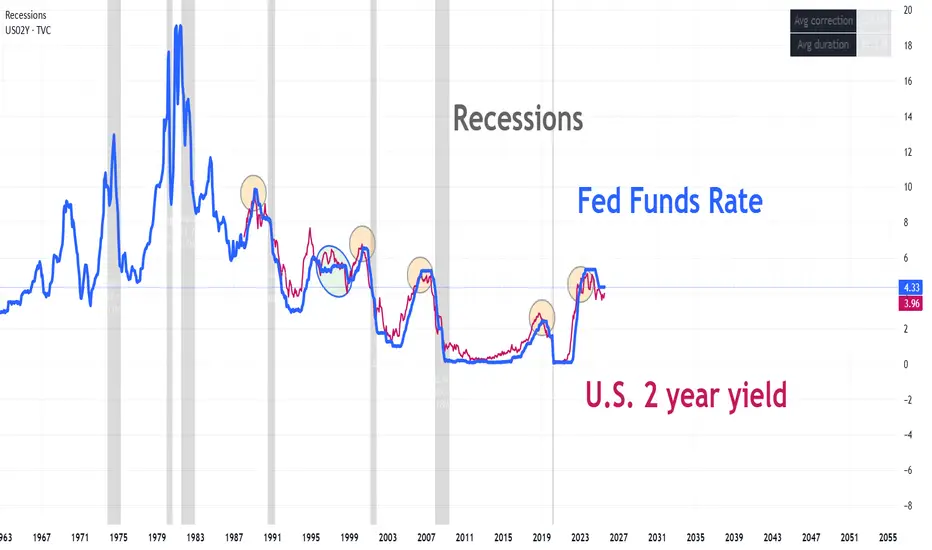

On August 4, we published a report analyzing the relationship between the 2-year yield and the Fed rate. At first glance, it looks like a technical oscillator, except in this case it represents market expectations for the 2-year rate. It embeds the expected real rate, expected inflation, and the term premium. Every time it gave a short signal, a recession followed shortly after. It generated one false signal and correctly anticipated the last four recessions. Two weeks after the report, Jackson Hole brought the pseudo-confirmation of the rate cut.

@intermarketflow

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

@intermarketflow

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。