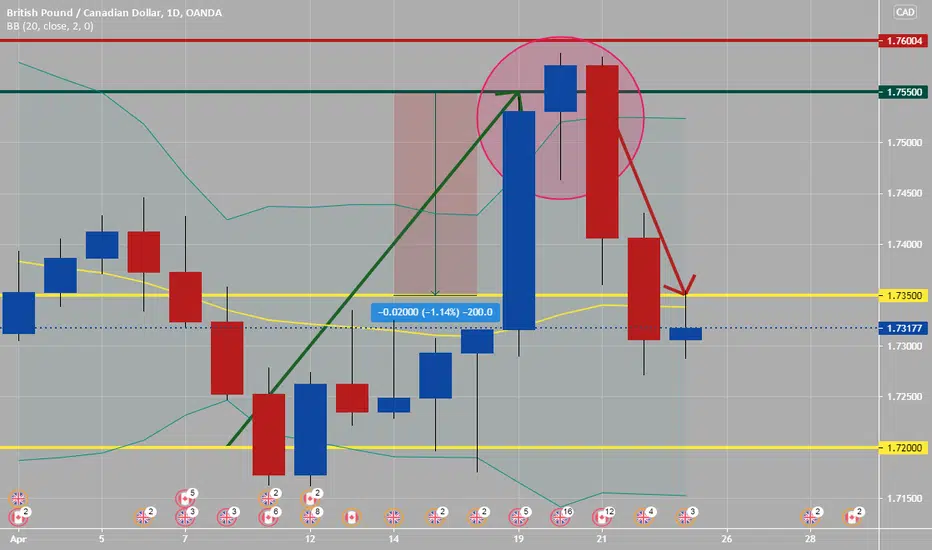

The hangman candle, so named because it looks like a person who has been executed with legs swinging beneath, always occurs after an extended uptrend. The hangman occurs because traders, seeing a sell-off in the shares, rush in to grab the stock a bargain price.

In order for the Hanging Man signal to be valid, the following conditions must exist:

• The Forex pair must have been in a definite uptrend before this signal occurs. This can be visually seen on the chart.

• The lower shadow must be at least twice the size of the body.

• The day after the Hanging Man is formed, one should witness continued selling.

• There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a red body would be more positive than a blue or green body.

In order for the Hanging Man signal to be valid, the following conditions must exist:

• The Forex pair must have been in a definite uptrend before this signal occurs. This can be visually seen on the chart.

• The lower shadow must be at least twice the size of the body.

• The day after the Hanging Man is formed, one should witness continued selling.

• There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a red body would be more positive than a blue or green body.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。