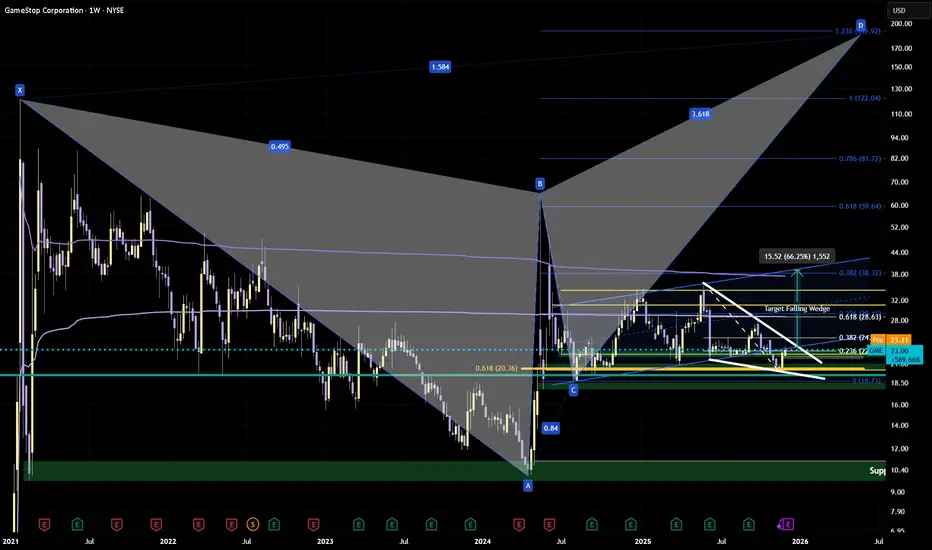

We're sitting at a juicy confluence right now — the 0.618 fib from the 2024 low-to-high AND the 0.236 from the 2025 high-to-low. When fibs stack, they have my attention.

The Falling Wedge

Classic bullish pattern forming since the end of May: price coiling tighter between converging trendlines.

• First target zone: $28–29 (lines up with the VWAP from the 2020 low)

• Next target: $38 (lines up with the 0.382 Fib and the VWAP from the 2021 high)

Now, will we smash through the 0.236 on the first try? Probably not. GME loves its signature rounding loop before committing to a move, so I wouldn’t be surprised to see some chop here first.

The $20–22 zone has been re-accumulation territory again and again: same support, better structure, and improving fundamentals.

The Bigger Picture: Bearish Crab Harmonic

On the harmonic side, the ABC leg of the big Crab is doing its job as a roadmap. When I flip that same ABC into Fib extensions, the 1.236–1.382 FE band drops right into the larger 1.618 XA D-zone of the Bearish Crab. That whole cluster sits roughly in the $200 area, which is where the full pattern would be expected to exhaust if the Crab completes.

The Roadmap:

Current: $22-23

Wedge breakout: $29-30

Next leg: $38

Extended: $59 → $81 → $122

Harmonic D zone: ~$200

The wedge gives us the catalyst. The harmonic gives us the destination. Let's see how it plays out. NFA. DYOR.

The Falling Wedge

Classic bullish pattern forming since the end of May: price coiling tighter between converging trendlines.

• First target zone: $28–29 (lines up with the VWAP from the 2020 low)

• Next target: $38 (lines up with the 0.382 Fib and the VWAP from the 2021 high)

Now, will we smash through the 0.236 on the first try? Probably not. GME loves its signature rounding loop before committing to a move, so I wouldn’t be surprised to see some chop here first.

The $20–22 zone has been re-accumulation territory again and again: same support, better structure, and improving fundamentals.

The Bigger Picture: Bearish Crab Harmonic

On the harmonic side, the ABC leg of the big Crab is doing its job as a roadmap. When I flip that same ABC into Fib extensions, the 1.236–1.382 FE band drops right into the larger 1.618 XA D-zone of the Bearish Crab. That whole cluster sits roughly in the $200 area, which is where the full pattern would be expected to exhaust if the Crab completes.

The Roadmap:

Current: $22-23

Wedge breakout: $29-30

Next leg: $38

Extended: $59 → $81 → $122

Harmonic D zone: ~$200

The wedge gives us the catalyst. The harmonic gives us the destination. Let's see how it plays out. NFA. DYOR.

注释

Quick update to plug into the bigger wedge / Fib / Crab roadmap from the higher timeframes.On the daily chart, price is:

Kissing the SMA20,

Getting support from the middle Bollinger band,

And carving out a potential Inverted Ascending Scallop (only valid if the high of the pattern gets taken out).

On top of that, we’ve just seen the SMA100 cross the SMA50, which for me acts as a “late-cycle confirmation” of the prior move rather than a fresh signal – it often shows the trend is mature and ready either for a proper reversal or for a sharp mean-reversion pop.

What I’d love to see next:

A clean break and daily close above the scallop high, ideally with expanding volume.

That would confirm the pattern and activate the measured move toward the ~$26 area, which sits just above the weekly 0.382 Fib and lines up nicely with the first big resistance band in my larger roadmap.

Until that breakout happens, the scallop is just a potential – the SMA20 + mid-Bollinger zone is the short-term line in the sand I’m watching for continuation vs. failure.

NFA – just an intermediate update on how the daily structure is lining up with the bigger GME plan.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。