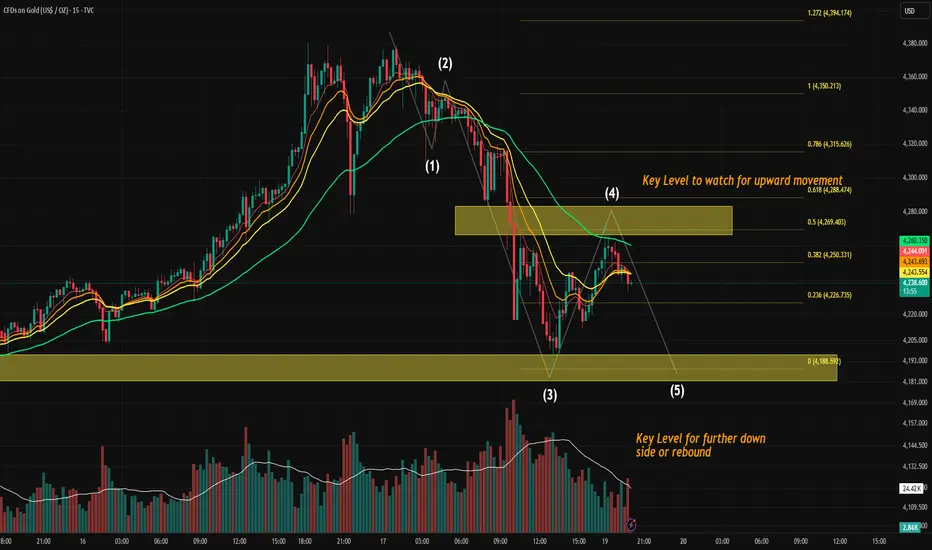

Gold Price Action Analysis - Potential Wave 5 Setup (sub waves within Wave A going down)

Wave Structure Overview

The current structure on the 15-minute chart appears to be unfolding in a classic 5-wave impulsive sequence:

Wave (1) — Initial sell-off following local top formation.

Wave (2) — Sharp retracement, testing previous supply, rejected at previous premarket range high (Friday US Stocks premarket high)

Wave (3) — Strong impulsive move down with expanding volume, typical of a wave 3 extension.

It respected one of our previous opening range high (lower yellow level).

Wave (4) — Counter-trend rally into a prior supply block / zone, showing hesitation and rejection. (we are likely done, since it had retraced to 0.5 Fib of Wave 3), i am not ruling out where we may have one more small wave up before we get into the real wave (5).

Wave (5) — Still developing, assuming wave (4) is done, we are likely to push into the lower yellow demand zone, where either continuation or a significant rebound may occur.

One scenario that can happen is that we double bottom where wave 5 meet end of wave 3, and we start a corrective wave up which is a potential Wave B going up.

🟧 Key Levels to Watch

Upper Zone (around 4271–4290)

This zone aligns with the ORH level and prior Wave (4) rejection area.

➝ If broken with strong momentum, it can invalidate the immediate bearish Wave 5 scenario and hint at a deeper retracement or new bullish structure.

Lower Zone (around 4198–4181)

This is a strong demand zone, confluence with Wave (3) extension targets and potential end of Wave (5).

➝ Price reaction here is crucial: either we see a clean 5-wave completion and rebound, or further downside acceleration.

📊 Momentum Confirmation (MACD)

The MACD shows a decelerating bearish momentum going into Wave (5), which fits the classic pattern where Wave 3 has the strongest momentum and Wave 5 often shows divergence or a weaker push.

If MACD prints a higher low while price makes a lower low, that would confirm bullish divergence, a common reversal signal after an impulse.

📝 Trading Implications

Scenario A — Bounce at Demand Zone:

Look for reversal signals or bullish divergence near 4180–4198 to confirm the end of Wave (5). Potential short-covering rally could take us close to 4300

Scenario B — Breakdown Below Demand Zone:

A clean break and close below 4180 may open the door to extended bearish continuation — likely a larger degree correction or Wave C structure.

Invalidation:

A move and acceptance above the upper ORH zone would invalidate this short-term bearish count.

Final Thoughts

This setup is technically clean:

Clear Elliott structure

Key liquidity zones mapped

Momentum oscillator in sync with price action

⚠️ But remember, Wave 5s can truncate or extend, so flexibility is key. Watch how price behaves at the lower yellow zone — that’s where the next big move could be born.

Wave Structure Overview

The current structure on the 15-minute chart appears to be unfolding in a classic 5-wave impulsive sequence:

Wave (1) — Initial sell-off following local top formation.

Wave (2) — Sharp retracement, testing previous supply, rejected at previous premarket range high (Friday US Stocks premarket high)

Wave (3) — Strong impulsive move down with expanding volume, typical of a wave 3 extension.

It respected one of our previous opening range high (lower yellow level).

Wave (4) — Counter-trend rally into a prior supply block / zone, showing hesitation and rejection. (we are likely done, since it had retraced to 0.5 Fib of Wave 3), i am not ruling out where we may have one more small wave up before we get into the real wave (5).

Wave (5) — Still developing, assuming wave (4) is done, we are likely to push into the lower yellow demand zone, where either continuation or a significant rebound may occur.

One scenario that can happen is that we double bottom where wave 5 meet end of wave 3, and we start a corrective wave up which is a potential Wave B going up.

🟧 Key Levels to Watch

Upper Zone (around 4271–4290)

This zone aligns with the ORH level and prior Wave (4) rejection area.

➝ If broken with strong momentum, it can invalidate the immediate bearish Wave 5 scenario and hint at a deeper retracement or new bullish structure.

Lower Zone (around 4198–4181)

This is a strong demand zone, confluence with Wave (3) extension targets and potential end of Wave (5).

➝ Price reaction here is crucial: either we see a clean 5-wave completion and rebound, or further downside acceleration.

📊 Momentum Confirmation (MACD)

The MACD shows a decelerating bearish momentum going into Wave (5), which fits the classic pattern where Wave 3 has the strongest momentum and Wave 5 often shows divergence or a weaker push.

If MACD prints a higher low while price makes a lower low, that would confirm bullish divergence, a common reversal signal after an impulse.

📝 Trading Implications

Scenario A — Bounce at Demand Zone:

Look for reversal signals or bullish divergence near 4180–4198 to confirm the end of Wave (5). Potential short-covering rally could take us close to 4300

Scenario B — Breakdown Below Demand Zone:

A clean break and close below 4180 may open the door to extended bearish continuation — likely a larger degree correction or Wave C structure.

Invalidation:

A move and acceptance above the upper ORH zone would invalidate this short-term bearish count.

Final Thoughts

This setup is technically clean:

Clear Elliott structure

Key liquidity zones mapped

Momentum oscillator in sync with price action

⚠️ But remember, Wave 5s can truncate or extend, so flexibility is key. Watch how price behaves at the lower yellow zone — that’s where the next big move could be born.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。