Hello Traders

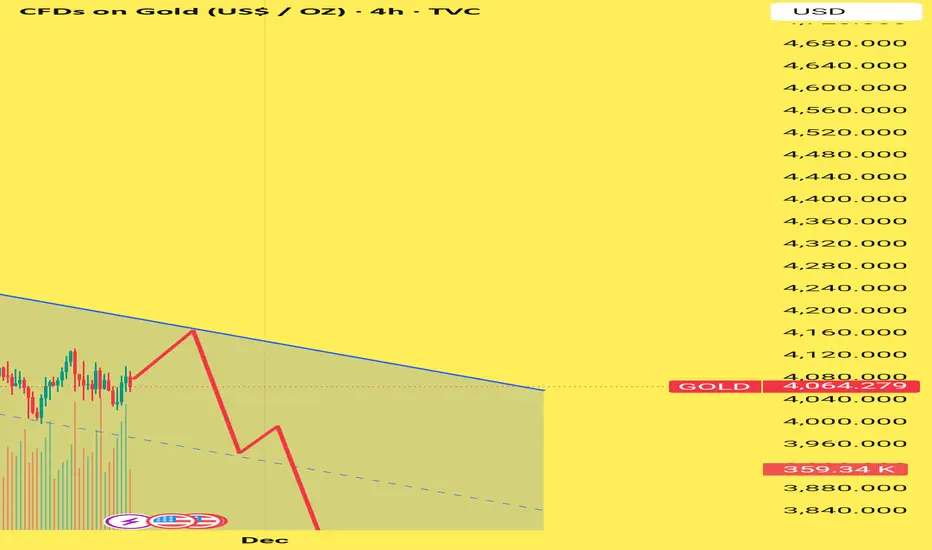

Gold on the 4H timeframe continues to respect a clear descending channel, with price moving steadily between the upper resistance trendline and the lower support boundary.

At the moment, price is trading near the mid-range of the channel, showing limited bullish momentum but still respecting the broader downtrend structure.

Key Highlights:

🔹 Upper Channel Resistance:

Price is approaching a major trendline where sellers have consistently reacted throughout October and November. A rejection from this zone keeps the bearish structure intact.

🔹 Mid-Channel Reaction:

The dashed median line continues to act as a dynamic pivot. Current price movement suggests temporary consolidation before a larger directional move.

🔹 Bearish Scenario (Most aligned with structure):

If price rejects the upper trendline again, a move toward the lower channel support remains possible. This level has historically provided strong reactions.

🔹 Lower Channel Support:

A drop toward this zone would complete the next leg inside the channel, maintaining the overall descending pattern.

Market Structure Insight:

The overall flow remains bearish as long as Gold trades inside this channel. The chart illustrates potential movement but does not represent any financial advice—simply an analysis of market structure based on visible trend behavior.

Gold on the 4H timeframe continues to respect a clear descending channel, with price moving steadily between the upper resistance trendline and the lower support boundary.

At the moment, price is trading near the mid-range of the channel, showing limited bullish momentum but still respecting the broader downtrend structure.

Key Highlights:

🔹 Upper Channel Resistance:

Price is approaching a major trendline where sellers have consistently reacted throughout October and November. A rejection from this zone keeps the bearish structure intact.

🔹 Mid-Channel Reaction:

The dashed median line continues to act as a dynamic pivot. Current price movement suggests temporary consolidation before a larger directional move.

🔹 Bearish Scenario (Most aligned with structure):

If price rejects the upper trendline again, a move toward the lower channel support remains possible. This level has historically provided strong reactions.

🔹 Lower Channel Support:

A drop toward this zone would complete the next leg inside the channel, maintaining the overall descending pattern.

Market Structure Insight:

The overall flow remains bearish as long as Gold trades inside this channel. The chart illustrates potential movement but does not represent any financial advice—simply an analysis of market structure based on visible trend behavior.

⚡ Premium Trader | Forex & Gold Analyst

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

⚡ Premium Trader | Forex & Gold Analyst

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。