JUBLFOOD — Multi-Timeframe Technical Analysis

Monthly Timeframe:

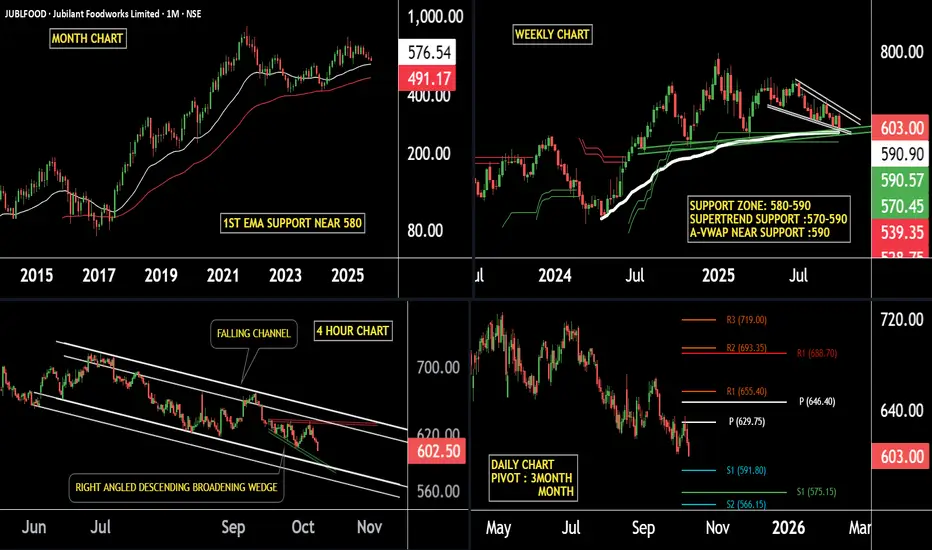

JUBLFOOD is showing strong support on the EMA, with the first key support area positioned near the 580 level. This zone has historically acted as a major demand area, suggesting potential accumulation.

Weekly Timeframe:

The stock is currently trading near the 570–590 support zone, where the Supertrend indicator is also providing confirmation of support. Sustaining above this zone could trigger a potential reversal or upward momentum.

Daily Timeframe:

Both the quarterly and monthly pivot levels indicate strong support between 575–591, reinforcing this area as a crucial price base from a pivot-point perspective.

4-Hour Timeframe:

On the lower timeframe, JUBLFOOD is moving within a falling channel and forming a descending broadening wedge pattern near the 580 support zone. This structure suggests a possible bullish reversal if the price holds and breaks above the upper trendline.

if this level is sustain then we may see higher prices in stock.

thank you!!

Monthly Timeframe:

JUBLFOOD is showing strong support on the EMA, with the first key support area positioned near the 580 level. This zone has historically acted as a major demand area, suggesting potential accumulation.

Weekly Timeframe:

The stock is currently trading near the 570–590 support zone, where the Supertrend indicator is also providing confirmation of support. Sustaining above this zone could trigger a potential reversal or upward momentum.

Daily Timeframe:

Both the quarterly and monthly pivot levels indicate strong support between 575–591, reinforcing this area as a crucial price base from a pivot-point perspective.

4-Hour Timeframe:

On the lower timeframe, JUBLFOOD is moving within a falling channel and forming a descending broadening wedge pattern near the 580 support zone. This structure suggests a possible bullish reversal if the price holds and breaks above the upper trendline.

if this level is sustain then we may see higher prices in stock.

thank you!!

@RahulSaraoge

Connect us at t.me/stridesadvisory

Connect us at t.me/stridesadvisory

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

@RahulSaraoge

Connect us at t.me/stridesadvisory

Connect us at t.me/stridesadvisory

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。