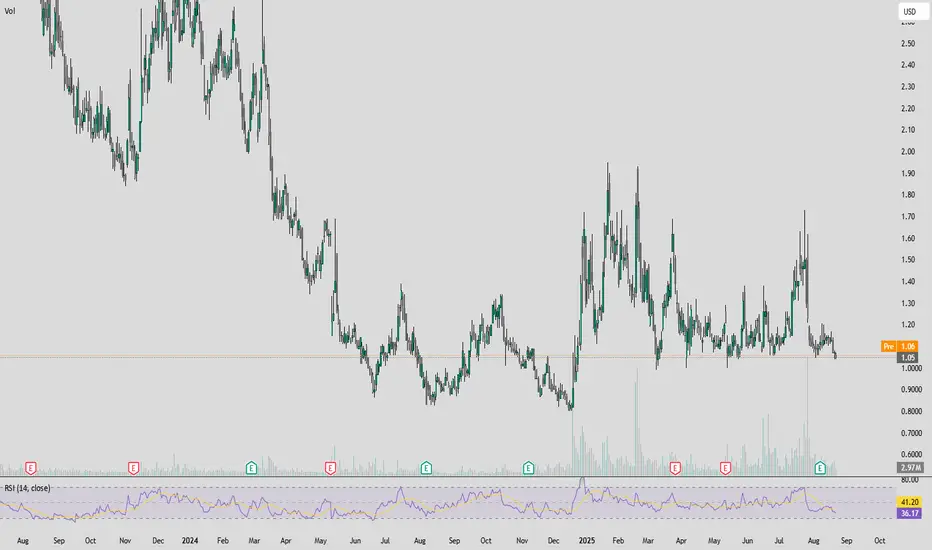

In recent weeks, MicroVision (MVIS) has been gaining attention again. The company specializes in advanced laser and sensor technologies, focusing on autonomous vehicle solutions – combining both hardware and software to give cars "smart eyes" to understand the road.

Leading analysts currently rate the stock as a Buy, with a price target of around $3 per share. This outlook is supported by the company’s strong technology platform and an experienced management team capable of executing in highly competitive markets.

MicroVision’s applications go beyond autonomous driving – they can extend into security, monitoring systems, and other innovative uses that may open the door to large-scale markets in the near future.

Disclaimer: This is not a personal recommendation to buy or sell securities. Investing in stocks carries risks, and every investor should conduct independent research and seek professional advice before making decisions.

Leading analysts currently rate the stock as a Buy, with a price target of around $3 per share. This outlook is supported by the company’s strong technology platform and an experienced management team capable of executing in highly competitive markets.

MicroVision’s applications go beyond autonomous driving – they can extend into security, monitoring systems, and other innovative uses that may open the door to large-scale markets in the near future.

Disclaimer: This is not a personal recommendation to buy or sell securities. Investing in stocks carries risks, and every investor should conduct independent research and seek professional advice before making decisions.

meitar Fadida Israel

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

meitar Fadida Israel

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。