📌 Current Data (as of early afternoon):

Current Price: Around 25,060

Opening Price: Approx. 25,200

Day’s High: ~25,246

Day’s Low: ~25,018

Previous Close: 25,216

Net Change: Down by ~155 points (–0.62%)

🔍 Intraday Price Action Analysis

Opening Weakness: Nifty opened lower than yesterday’s close due to weak global cues and selling in major sectors.

Bearish Pressure: Sellers dominated early in the day, dragging the index below 25,100.

Support Level Tested: Nifty hovered near 25,050, which acted as a short-term support.

Limited Bounce: Despite attempts to recover, resistance near 25,200–25,250 is capping upside movement.

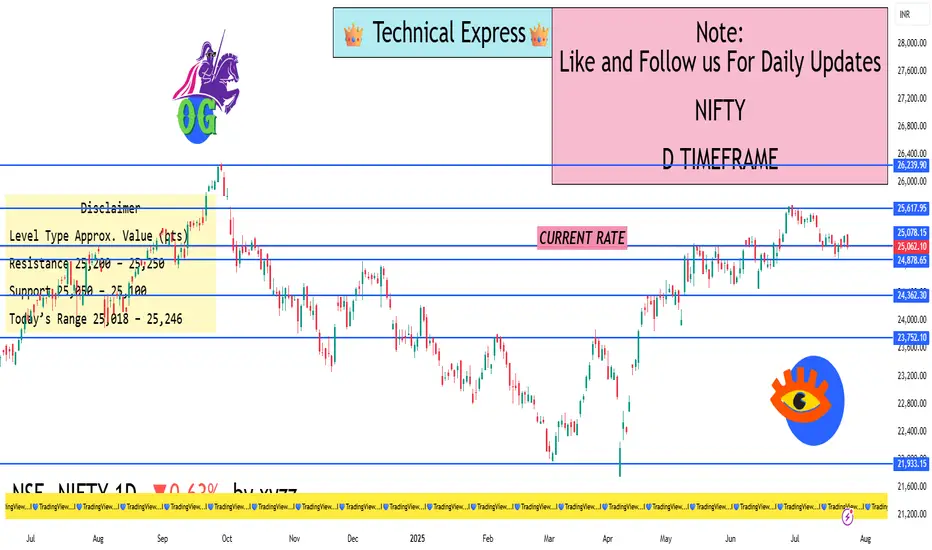

📊 Technical Summary – 1D Timeframe

Type Range / Value

Support Levels 25,050 / 25,000

Resistance Levels 25,200 / 25,250

Trend Bias Slightly Bearish

Momentum Weak, with mild recovery attempts

Volatility Moderate

If Nifty holds above 25,050, it could try to reclaim 25,200–25,250.

A break below 25,018–25,000 may trigger further downside toward 24,950.

🧠 Why Nifty Is Down Today

IT Sector Weakness: Poor performance in tech stocks after recent earnings reports is dragging the index.

Banking Stocks Pressure: Major private and PSU banks are showing weakness due to profit booking.

Profit Booking: Traders are cashing out after last week's rally near all-time highs.

Global Market Impact: Uncertainty in international markets and trade concerns are weighing on sentiment.

🎯 What Traders Should Watch Next

Key Intraday Level: 25,050 — If Nifty stays above this level, short-term stability is possible.

Breakout Point: 25,250 — A close above this may indicate fresh bullish momentum.

Breakdown Point: Below 25,000 — Could lead to deeper correction toward 24,950–24,900.

Volatility Spike?: Stay alert around closing hours—FII/DII data and global market opening will affect the closing trend.

✅ Conclusion

Nifty 50 is under pressure today due to sectoral weakness and lack of strong domestic triggers. The index is currently range-bound between 25,000–25,250. Traders should monitor these levels closely for the next directional move.

Current Price: Around 25,060

Opening Price: Approx. 25,200

Day’s High: ~25,246

Day’s Low: ~25,018

Previous Close: 25,216

Net Change: Down by ~155 points (–0.62%)

🔍 Intraday Price Action Analysis

Opening Weakness: Nifty opened lower than yesterday’s close due to weak global cues and selling in major sectors.

Bearish Pressure: Sellers dominated early in the day, dragging the index below 25,100.

Support Level Tested: Nifty hovered near 25,050, which acted as a short-term support.

Limited Bounce: Despite attempts to recover, resistance near 25,200–25,250 is capping upside movement.

📊 Technical Summary – 1D Timeframe

Type Range / Value

Support Levels 25,050 / 25,000

Resistance Levels 25,200 / 25,250

Trend Bias Slightly Bearish

Momentum Weak, with mild recovery attempts

Volatility Moderate

If Nifty holds above 25,050, it could try to reclaim 25,200–25,250.

A break below 25,018–25,000 may trigger further downside toward 24,950.

🧠 Why Nifty Is Down Today

IT Sector Weakness: Poor performance in tech stocks after recent earnings reports is dragging the index.

Banking Stocks Pressure: Major private and PSU banks are showing weakness due to profit booking.

Profit Booking: Traders are cashing out after last week's rally near all-time highs.

Global Market Impact: Uncertainty in international markets and trade concerns are weighing on sentiment.

🎯 What Traders Should Watch Next

Key Intraday Level: 25,050 — If Nifty stays above this level, short-term stability is possible.

Breakout Point: 25,250 — A close above this may indicate fresh bullish momentum.

Breakdown Point: Below 25,000 — Could lead to deeper correction toward 24,950–24,900.

Volatility Spike?: Stay alert around closing hours—FII/DII data and global market opening will affect the closing trend.

✅ Conclusion

Nifty 50 is under pressure today due to sectoral weakness and lack of strong domestic triggers. The index is currently range-bound between 25,000–25,250. Traders should monitor these levels closely for the next directional move.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。