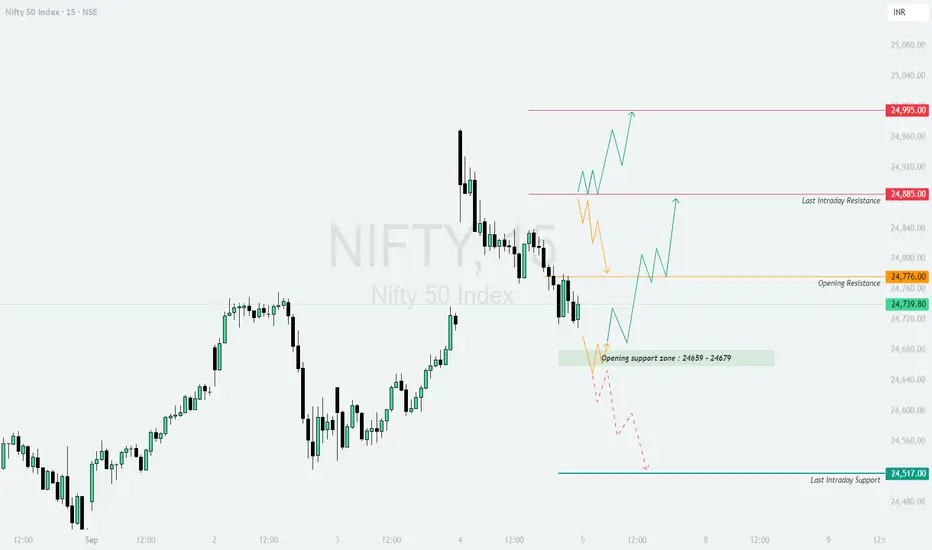

NIFTY TRADING PLAN – 05-Sep-2025

📌 Key Levels to Watch:

Opening Resistance: 24,776

Last Intraday Resistance: 24,885

Major Resistance: 24,995

Opening Support Zone: 24,659 – 24,679

Last Intraday Support: 24,517

The price action shows that Nifty is consolidating between strong support and resistance zones. The reaction around these levels will determine the day’s trend.

🔼 1. Gap-Up Opening (100+ points above 24,840)

If Nifty opens with a strong gap-up above 24,840, it will directly challenge the resistance zones.

📌 Plan of Action:

👉 Educational Note: Gap-ups near resistance require patience. Wait for confirmation candles before entering, as false breakouts are common at these levels.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near the opening resistance indicates indecision and may lead to range-bound action initially.

📌 Plan of Action:

👉 Educational Note: Flat openings often provide the best opportunities as they allow traders to position based on the first 30 minutes of price action clarity.

🔽 3. Gap-Down Opening (100+ points below 24,620)

If Nifty opens below the support zone, sellers gain the upper hand.

📌 Plan of Action:

👉 Educational Note: Gap-downs usually trigger fear-driven moves. Avoid chasing the fall; instead, look for a retest of levels to confirm direction.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 24,885 → Bullish bias towards 24,995 and beyond.

🟧 Flat Opening (24,720 – 24,780) → Wait for a breakout above 24,776 for directional clarity.

🔴 Below 24,620 → Weakness towards 24,517 with risk of further downside.

⚠️ Critical Zone: 24,659 – 24,679 (Opening Support). Watch this level closely for intraday cues.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely educational and should not be considered financial advice. Please consult your financial advisor before making any trading decisions.

📌 Key Levels to Watch:

Opening Resistance: 24,776

Last Intraday Resistance: 24,885

Major Resistance: 24,995

Opening Support Zone: 24,659 – 24,679

Last Intraday Support: 24,517

The price action shows that Nifty is consolidating between strong support and resistance zones. The reaction around these levels will determine the day’s trend.

🔼 1. Gap-Up Opening (100+ points above 24,840)

If Nifty opens with a strong gap-up above 24,840, it will directly challenge the resistance zones.

📌 Plan of Action:

- [] Sustaining above 24,885 (last intraday resistance) will indicate strength.

[] First upside target is 24,995, where profit booking could emerge. - If momentum sustains beyond 24,995, expect a breakout rally with strong bullish sentiment.

👉 Educational Note: Gap-ups near resistance require patience. Wait for confirmation candles before entering, as false breakouts are common at these levels.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near the opening resistance indicates indecision and may lead to range-bound action initially.

📌 Plan of Action:

- [] If Nifty sustains above 24,776, it can attempt to test 24,885.

[] A breakout above 24,885 strengthens the bullish trend towards 24,995. - Failure to hold above 24,720 can pull the index back into the support zone (24,659–24,679).

👉 Educational Note: Flat openings often provide the best opportunities as they allow traders to position based on the first 30 minutes of price action clarity.

🔽 3. Gap-Down Opening (100+ points below 24,620)

If Nifty opens below the support zone, sellers gain the upper hand.

📌 Plan of Action:

- [] A gap-down below 24,620 will likely drag Nifty to retest 24,517 (last intraday support).

[] Sustaining below 24,517 may invite further downside pressure with intraday weakness. - Quick rebounds can occur, but unless Nifty reclaims 24,659, the trend remains bearish.

👉 Educational Note: Gap-downs usually trigger fear-driven moves. Avoid chasing the fall; instead, look for a retest of levels to confirm direction.

🛡️ Risk Management Tips for Options Traders

- [] Always use stop losses on an hourly close basis to avoid false moves.

[] Limit exposure to 1–2% of capital per trade.

[] For uncertain days, consider deploying neutral strategies like straddles or strangles.

[] Scale out profits gradually instead of waiting for final targets. - Avoid over-leveraging; keep cash ready for adjustments.

📌 Summary & Conclusion

🟢 Above 24,885 → Bullish bias towards 24,995 and beyond.

🟧 Flat Opening (24,720 – 24,780) → Wait for a breakout above 24,776 for directional clarity.

🔴 Below 24,620 → Weakness towards 24,517 with risk of further downside.

⚠️ Critical Zone: 24,659 – 24,679 (Opening Support). Watch this level closely for intraday cues.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely educational and should not be considered financial advice. Please consult your financial advisor before making any trading decisions.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。