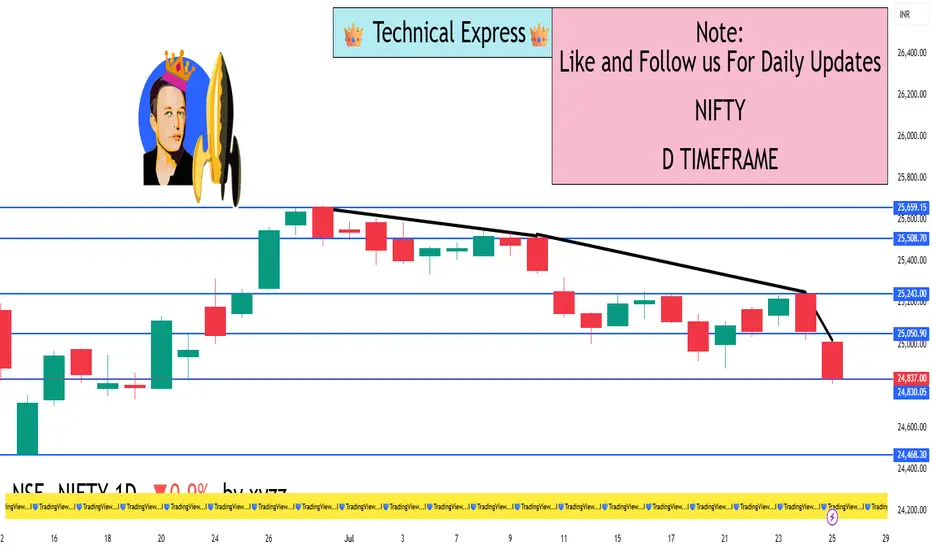

Closing Price: 24,837.00

Net Change: −225.10 points (−0.90%)

Opening: 24,981.35

High: 25,008.90

Low: 24,770.85

Trend: Bearish

📊 Technical Overview

✅ Candle Type:

Bearish candle formed with a long body and small wicks.

Indicates strong selling pressure throughout the day.

🔻 Support Zones:

24,750 – Immediate support (tested on 25 July)

24,600 – Stronger support zone

24,400 – Medium-term support from early July

🔺 Resistance Zones:

24,900 – Immediate resistance

25,000 – Psychological resistance

25,150–25,300 – Strong resistance zone

📈 Indicators Summary:

RSI: Likely near 45 – showing weakening momentum

MACD: Bearish crossover continues – indicating downward trend

Volume: Slightly higher than average – confirms active selling

🧠 Market Sentiment:

Sentiment remains cautious and bearish.

Selling seen in major sectors like Auto, Energy, FMCG, and Banking.

Only Pharma showed relative strength.

Global cues and foreign investor selling weighed on market sentiment.

This marks the fourth straight weekly loss for the Nifty index.

✅ Conclusion:

Nifty is in a short-term downtrend, unable to sustain above 25,000.

If 24,750 is broken decisively, the next target could be 24,600 or lower.

Bulls must reclaim and hold above 25,000–25,150 to reverse the sentiment.

Net Change: −225.10 points (−0.90%)

Opening: 24,981.35

High: 25,008.90

Low: 24,770.85

Trend: Bearish

📊 Technical Overview

✅ Candle Type:

Bearish candle formed with a long body and small wicks.

Indicates strong selling pressure throughout the day.

🔻 Support Zones:

24,750 – Immediate support (tested on 25 July)

24,600 – Stronger support zone

24,400 – Medium-term support from early July

🔺 Resistance Zones:

24,900 – Immediate resistance

25,000 – Psychological resistance

25,150–25,300 – Strong resistance zone

📈 Indicators Summary:

RSI: Likely near 45 – showing weakening momentum

MACD: Bearish crossover continues – indicating downward trend

Volume: Slightly higher than average – confirms active selling

🧠 Market Sentiment:

Sentiment remains cautious and bearish.

Selling seen in major sectors like Auto, Energy, FMCG, and Banking.

Only Pharma showed relative strength.

Global cues and foreign investor selling weighed on market sentiment.

This marks the fourth straight weekly loss for the Nifty index.

✅ Conclusion:

Nifty is in a short-term downtrend, unable to sustain above 25,000.

If 24,750 is broken decisively, the next target could be 24,600 or lower.

Bulls must reclaim and hold above 25,000–25,150 to reverse the sentiment.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

相关出版物

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

相关出版物

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。