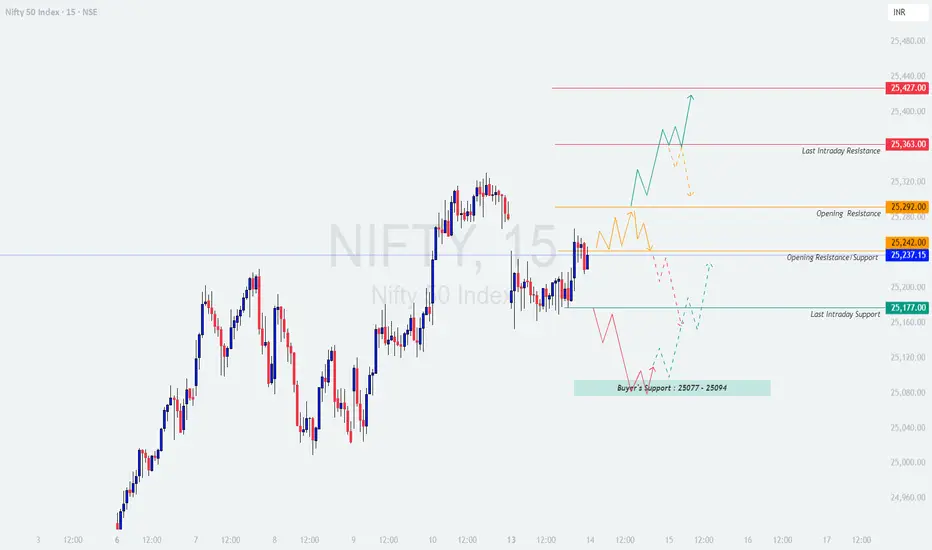

NIFTY TRADING PLAN – 14-Oct-2025

📈 Chart Timeframe: 15-Min | Analysis by LiveTradingBox

🔹 Key Zones:

🟥 Last Intraday Resistance: 25,363 – 25,427

🟧 Opening Resistance: 25,292

🟨 Opening Resistance/Support: 25,242

🟩 Last Intraday Support: 25,177

🟦 Buyer’s Support Zone: 25,077 – 25,094

🚀 Scenario 1: Gap-Up Opening (100+ Points Above Previous Close)

If Nifty opens around or above the 25,292 – 25,363 resistance zone, traders should stay cautious initially. A gap-up above this area without immediate follow-through often attracts profit booking.

🟢 Educational Note: In gap-up scenarios, overextended prices often face supply pressure. Patience during the first retracement gives a safer entry aligned with trend continuation.

⚖️ Scenario 2: Flat Opening Near 25,230 – 25,250

A flat opening around the Opening Resistance/Support Zone (25,242) indicates an indecisive sentiment. This level is a critical pivot that may dictate intraday direction.

🟠 Educational Tip: During flat openings, the market often traps both sides. Let the first direction be confirmed before taking a position, and avoid chasing initial candles.

🔻 Scenario 3: Gap-Down Opening (100+ Points Below Previous Close)

If Nifty opens below 25,120, it enters the Buyer’s Support Zone (25,077 – 25,094). This area is where dip-buyers may become active.

🔴 Educational Note: Gap-downs often trigger panic selling, but experienced traders know that strong support zones are ideal for mean-reversion setups with limited downside exposure.

💡 Risk Management Tips for Options Traders

🧩 Summary & Conclusion

Nifty remains in a neutral-to-bullish tone as long as 25,177 holds. The 25,292–25,363 zone will decide whether the next move extends higher or reverses lower. Any dip toward the 25,077–25,094 area could attract strong buyers if the broader trend stays intact.

Traders should stay disciplined, respect intraday levels, and trade with confirmation rather than anticipation. Remember: Consistency comes from control, not prediction.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making any trading decisions.

📈 Chart Timeframe: 15-Min | Analysis by LiveTradingBox

🔹 Key Zones:

🟥 Last Intraday Resistance: 25,363 – 25,427

🟧 Opening Resistance: 25,292

🟨 Opening Resistance/Support: 25,242

🟩 Last Intraday Support: 25,177

🟦 Buyer’s Support Zone: 25,077 – 25,094

🚀 Scenario 1: Gap-Up Opening (100+ Points Above Previous Close)

If Nifty opens around or above the 25,292 – 25,363 resistance zone, traders should stay cautious initially. A gap-up above this area without immediate follow-through often attracts profit booking.

- []Allow the first 30 minutes for price stability and observe whether the index sustains above 25,363.

[]A strong candle close above 25,363 with rising volume could trigger a momentum move toward 25,427 and possibly 25,480 intraday.

[]However, if the index fails to hold above 25,292, expect a retest towards 25,242 where intraday buying opportunities could emerge again.

[]Aggressive traders can look for quick call scalps only after confirmation above 25,363 with a defined stop loss just below 25,300.

🟢 Educational Note: In gap-up scenarios, overextended prices often face supply pressure. Patience during the first retracement gives a safer entry aligned with trend continuation.

⚖️ Scenario 2: Flat Opening Near 25,230 – 25,250

A flat opening around the Opening Resistance/Support Zone (25,242) indicates an indecisive sentiment. This level is a critical pivot that may dictate intraday direction.

- []If Nifty sustains above 25,242, bulls may gradually push toward 25,292, where resistance might emerge.

[]A clean breakout above 25,292 can open the path to 25,363, followed by 25,427 if momentum persists.

[]Conversely, a break below 25,177 could invite short-term selling toward the Buyer’s Support Zone (25,077 – 25,094).

[]Avoid trading inside the narrow 25,177–25,242 range; instead, wait for breakout confirmation in either direction.

🟠 Educational Tip: During flat openings, the market often traps both sides. Let the first direction be confirmed before taking a position, and avoid chasing initial candles.

🔻 Scenario 3: Gap-Down Opening (100+ Points Below Previous Close)

If Nifty opens below 25,120, it enters the Buyer’s Support Zone (25,077 – 25,094). This area is where dip-buyers may become active.

- []Watch for bullish reversal candles or a higher low structure forming around 25,080 to consider call entries.

[]A rebound from this support could push the index toward 25,177 first, and if sustained, 25,242.

[]However, if the index fails to hold above 25,077, further downside pressure may test 25,020–25,000 zones.

[]Maintain strict stop losses below 25,070 on long positions to manage risk effectively.

🔴 Educational Note: Gap-downs often trigger panic selling, but experienced traders know that strong support zones are ideal for mean-reversion setups with limited downside exposure.

💡 Risk Management Tips for Options Traders

- []Always define your maximum risk per trade (1–2% of capital).

[]Avoid trading both CE & PE simultaneously unless hedging.

[]Prefer trading after initial volatility cools (post 9:45 AM).

[]Use trailing stop losses once in profit to lock gains.

[]Do not average losing positions; focus on quality setups only.

[]Consider weekly options only for momentum confirmation setups.

🧩 Summary & Conclusion

Nifty remains in a neutral-to-bullish tone as long as 25,177 holds. The 25,292–25,363 zone will decide whether the next move extends higher or reverses lower. Any dip toward the 25,077–25,094 area could attract strong buyers if the broader trend stays intact.

Traders should stay disciplined, respect intraday levels, and trade with confirmation rather than anticipation. Remember: Consistency comes from control, not prediction.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making any trading decisions.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。