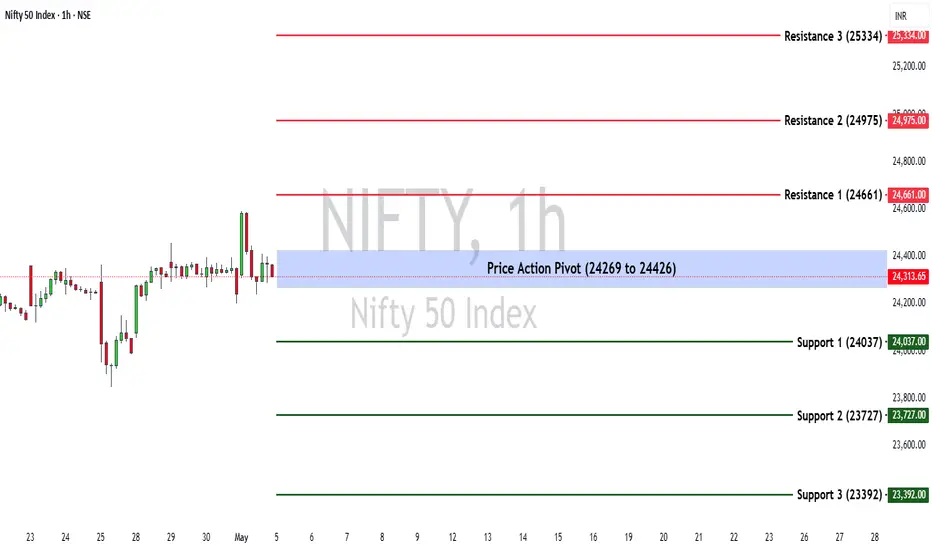

The Nifty 50 opened with a gap-up of 30.95 points (0.13%) and ended the week at 24,346.70 with a gain of (1.28%)

If Nifty sustains below 24,369, selling pressure may increase. However, a move above 24,426, could restore bullish momentum.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The crucial range to watch for potential trend reversals or continuation is 24,369 -24,426.

🔹 Support & Resistance Levels:

Support:

Resistance:

Market Outlook

✅ Bullish Scenario: A sustained breakout above 24,426 could attract buying momentum, driving Nifty towards R1 (24,661) and beyond.

❌ Bearish Scenario: A drop below 24,369 may trigger selling pressure, pushing Nifty towards S1 (24.037) or lower.

If Nifty sustains below 24,369, selling pressure may increase. However, a move above 24,426, could restore bullish momentum.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The crucial range to watch for potential trend reversals or continuation is 24,369 -24,426.

🔹 Support & Resistance Levels:

Support:

- S1: 24,037

- S2: 23,427

- S3: 23,144

Resistance:

- R1: 24,661

- R2: 24,975

- R3: 25,334

Market Outlook

✅ Bullish Scenario: A sustained breakout above 24,426 could attract buying momentum, driving Nifty towards R1 (24,661) and beyond.

❌ Bearish Scenario: A drop below 24,369 may trigger selling pressure, pushing Nifty towards S1 (24.037) or lower.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。