The Nifty 50 ended the week at 24,870.10, gaining +0.97%.

🔹 Key Levels for the Upcoming Week

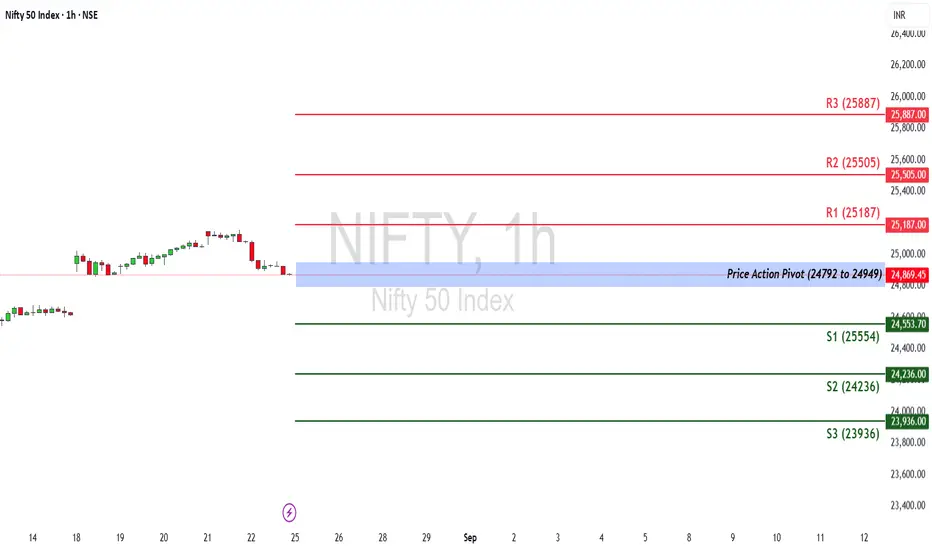

📌 Price Action Pivot Zone:

24,792 to 24,949 – This is the critical zone to watch. A decisive move beyond either side may dictate next week’s trend.

🔻 Support Levels

S1: 24,553

S2: 24,236

S3: 23,936

🔺 Resistance Levels

R1: 25,187

R2: 25,505

R3: 25,887

📊 Candle Observation:

The last weekly candle formed a red body with a long lower shadow, showing that although bears dominated early in the week, strong buying support emerged near the lows. This wick-based recovery signals demand at lower levels, keeping the support zones (24,553–24,236) important for the coming sessions.

📰 Sentiment Check (Last Week):

The Nifty opened the week with a gap-up, supported by global cues and positive sentiment around the Trump–Putin meeting, which was seen as a potential step toward easing geopolitical tensions.

However, mid-week profit booking dragged the index down, before buyers stepped back in from lower supports, leaving a long lower wick on the weekly candle.

This shows underlying resilience, though the market remains sensitive to global political developments.

📈 Market Outlook

✅ Bullish Scenario:

If Nifty sustains above 24,949, buying momentum could build, aiming for R1 (25,187). A strong breakout above this may push prices towards R2 (25,505) and R3 (25,887).

❌ Bearish Scenario:

If the index breaks below 24,792, selling pressure may return. This could drag Nifty towards S1 (24,553), and further down to S2 (24,236) and S3 (23,936).

📌 Sentiment Outlook:

Nifty is showing resilience with support at lower levels, but for a strong bullish confirmation, it needs to sustain above the 24,949 pivot zone. Global cues, especially political events, may continue to influence short-term moves.

Disclaimer: lnkd.in/gJJDnvn2

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

24,792 to 24,949 – This is the critical zone to watch. A decisive move beyond either side may dictate next week’s trend.

🔻 Support Levels

S1: 24,553

S2: 24,236

S3: 23,936

🔺 Resistance Levels

R1: 25,187

R2: 25,505

R3: 25,887

📊 Candle Observation:

The last weekly candle formed a red body with a long lower shadow, showing that although bears dominated early in the week, strong buying support emerged near the lows. This wick-based recovery signals demand at lower levels, keeping the support zones (24,553–24,236) important for the coming sessions.

📰 Sentiment Check (Last Week):

The Nifty opened the week with a gap-up, supported by global cues and positive sentiment around the Trump–Putin meeting, which was seen as a potential step toward easing geopolitical tensions.

However, mid-week profit booking dragged the index down, before buyers stepped back in from lower supports, leaving a long lower wick on the weekly candle.

This shows underlying resilience, though the market remains sensitive to global political developments.

📈 Market Outlook

✅ Bullish Scenario:

If Nifty sustains above 24,949, buying momentum could build, aiming for R1 (25,187). A strong breakout above this may push prices towards R2 (25,505) and R3 (25,887).

❌ Bearish Scenario:

If the index breaks below 24,792, selling pressure may return. This could drag Nifty towards S1 (24,553), and further down to S2 (24,236) and S3 (23,936).

📌 Sentiment Outlook:

Nifty is showing resilience with support at lower levels, but for a strong bullish confirmation, it needs to sustain above the 24,949 pivot zone. Global cues, especially political events, may continue to influence short-term moves.

Disclaimer: lnkd.in/gJJDnvn2

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。